Rising scams trigger surge in financial complaints

By

Seia Ibanez

- Replies 6

Australians are facing an unprecedented wave of fraudulent activities and sophisticated scams that are not only affecting individuals but also putting a strain on the systems designed to protect them.

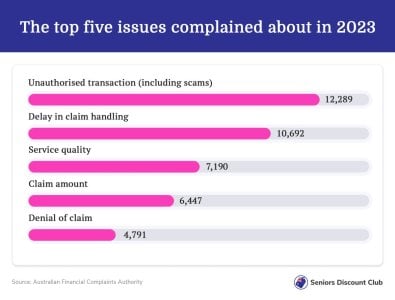

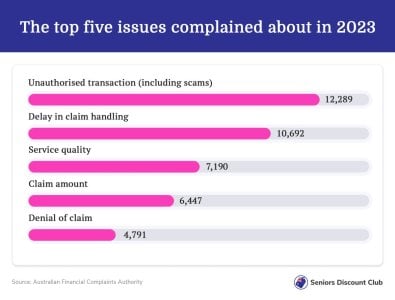

The Australian Financial Complaints Authority (AFCA) has reported a staggering increase in complaints, many related to scams that are becoming more complex and convincing.

The latest figures from AFCA showed that it received over 100,000 complaints—the highest in its five-year history—with a staggering 8,987 related to scams.

This is a significant jump from the 4,611 scam-related complaints reported in 2022.

AFCA CEO David Locke has expressed ‘great concern’ over the number of people affected by scams and the unsustainable rate at which complaints are growing.

‘As we head into the new year our hope for 2024 is that this will be the year that anti-scam initiatives by industry and government finally disrupt this serious and organised crime,’ Locke said.

Locke also mentioned that the volume of complaints escalated to AFCA was increasing at an ‘unsustainable rate’ and that the industry needed to improve.

‘We believe many financial firms could be doing a better job of handling complaints within their own internal complaints processes, so only the most complex cases reach AFCA–which is the role we are meant to play,’ he said.

‘Instead, the volume of complaints reaching us is putting unnecessary pressure on the external dispute resolution system and inevitably causing further delays for consumers.’

The impact of these scams is not just a statistic; it's felt deeply by many individuals, such asVictorian pensioner Charles Houen.

At 89, Houen lost $14,000 to scammers posing as online security experts who gained access to his Bendigo Bank account in July last year.

This money was not just his savings; it was his financial safety net for medical expenses, including cataract surgery.

He reported the scam to his local branch, to which the manager helped him report his case to the authorities.

‘The local branch manager was very helpful, and she actually encouraged me to make the complaint to [AFCA and police],’ Houen said.

However, in September, he was told by the bank that his money could not be reimbursed, prompting him to take his case to AFCA.

Houen wanted a full reimbursement of his funds, which included thousands of dollars the scammers stole from his credit card.

‘At the very minimum, [the bank] should not require me to repay the $4,500 cash advance, and subsequent interest and fees, that the scammers transacted on my MasterCard account,’ he said in his AFCA complaint.

AFCA sent an email to Houen on November 15 stating that they were experiencing delays due to a ‘significant increase in complaints’.

He, like many others, is still waiting for a resolution.

'They have updated me to the extent of saying that they are under a really heavy load of complaints at the moment and that I'm in the queue to be assigned to someone in the team for investigation and analysis,’ Houen said.

In response to the alarming increase in scams, the federal government announced a series of anti-scam measures, including a national task force and an SMS sender ID registry.

A consultation paper on a proposed framework for tackling scams across different industries, which could require businesses across banking, telecommunications, and digital platforms to implement stronger preventative measures or to ‘lift the bar’, was also published.

The Australian Banking Association (ABA) has emphasised that scam prevention will be a significant focus in 2024, acknowledging that ‘all sectors have a role to play in ramping up the fight against scammers, including government, banks, telcos, social media, law enforcement, crypto platforms and individuals’.

The Scam-Safe Accord was introduced by ABA and the Community Owned Banking Association (COBA) last year. They believe this technology will be a game-changer in the fight against scams to protect Australians’ money.

The Accord also makes the banking industry committed to introducing a new confirmation of payee system and additional identification checks for new accounts.

Consumer advocates, however, argue that more robust action is needed.

The report of the Australian Competition and Consumer Commission (ACCC) revealed that there was a staggering loss of over $3 billion to scams in Australia in 2022 alone. This was higher by 80 per cent from 2021, with losses projected to grow.

The Consumer Action Law Centre's Stephanie Tonkin has urged the government to adopt measures similar to those in the United Kingdom, where banks are mandated to reimburse scam victims.

‘The whole idea is that that drives the investment in the systems to prevent and disrupt scams,’ Tonkin said.

‘Also, if you've got a clear law and framework around when a bank is responsible for reimbursing their customers, that can be dealt with at that bank customer level [and] it doesn't have to escalate…and then have to overload AFCA.’

Have you noticed the surge of scam reports recently? What do you do to protect yourself from these scams? Let us know in the comments below!

The Australian Financial Complaints Authority (AFCA) has reported a staggering increase in complaints, many related to scams that are becoming more complex and convincing.

The latest figures from AFCA showed that it received over 100,000 complaints—the highest in its five-year history—with a staggering 8,987 related to scams.

This is a significant jump from the 4,611 scam-related complaints reported in 2022.

AFCA CEO David Locke has expressed ‘great concern’ over the number of people affected by scams and the unsustainable rate at which complaints are growing.

‘As we head into the new year our hope for 2024 is that this will be the year that anti-scam initiatives by industry and government finally disrupt this serious and organised crime,’ Locke said.

Locke also mentioned that the volume of complaints escalated to AFCA was increasing at an ‘unsustainable rate’ and that the industry needed to improve.

‘We believe many financial firms could be doing a better job of handling complaints within their own internal complaints processes, so only the most complex cases reach AFCA–which is the role we are meant to play,’ he said.

‘Instead, the volume of complaints reaching us is putting unnecessary pressure on the external dispute resolution system and inevitably causing further delays for consumers.’

The impact of these scams is not just a statistic; it's felt deeply by many individuals, such asVictorian pensioner Charles Houen.

At 89, Houen lost $14,000 to scammers posing as online security experts who gained access to his Bendigo Bank account in July last year.

This money was not just his savings; it was his financial safety net for medical expenses, including cataract surgery.

He reported the scam to his local branch, to which the manager helped him report his case to the authorities.

‘The local branch manager was very helpful, and she actually encouraged me to make the complaint to [AFCA and police],’ Houen said.

However, in September, he was told by the bank that his money could not be reimbursed, prompting him to take his case to AFCA.

Houen wanted a full reimbursement of his funds, which included thousands of dollars the scammers stole from his credit card.

‘At the very minimum, [the bank] should not require me to repay the $4,500 cash advance, and subsequent interest and fees, that the scammers transacted on my MasterCard account,’ he said in his AFCA complaint.

AFCA sent an email to Houen on November 15 stating that they were experiencing delays due to a ‘significant increase in complaints’.

He, like many others, is still waiting for a resolution.

'They have updated me to the extent of saying that they are under a really heavy load of complaints at the moment and that I'm in the queue to be assigned to someone in the team for investigation and analysis,’ Houen said.

In response to the alarming increase in scams, the federal government announced a series of anti-scam measures, including a national task force and an SMS sender ID registry.

A consultation paper on a proposed framework for tackling scams across different industries, which could require businesses across banking, telecommunications, and digital platforms to implement stronger preventative measures or to ‘lift the bar’, was also published.

The Australian Banking Association (ABA) has emphasised that scam prevention will be a significant focus in 2024, acknowledging that ‘all sectors have a role to play in ramping up the fight against scammers, including government, banks, telcos, social media, law enforcement, crypto platforms and individuals’.

The Scam-Safe Accord was introduced by ABA and the Community Owned Banking Association (COBA) last year. They believe this technology will be a game-changer in the fight against scams to protect Australians’ money.

The Accord also makes the banking industry committed to introducing a new confirmation of payee system and additional identification checks for new accounts.

Consumer advocates, however, argue that more robust action is needed.

The report of the Australian Competition and Consumer Commission (ACCC) revealed that there was a staggering loss of over $3 billion to scams in Australia in 2022 alone. This was higher by 80 per cent from 2021, with losses projected to grow.

The Consumer Action Law Centre's Stephanie Tonkin has urged the government to adopt measures similar to those in the United Kingdom, where banks are mandated to reimburse scam victims.

‘The whole idea is that that drives the investment in the systems to prevent and disrupt scams,’ Tonkin said.

‘Also, if you've got a clear law and framework around when a bank is responsible for reimbursing their customers, that can be dealt with at that bank customer level [and] it doesn't have to escalate…and then have to overload AFCA.’

Key Takeaways

- Complaints about scams to the Australian Financial Complaints Authority (AFCA) nearly doubled in the past year, with significant concerns about the impact on consumers and the dispute resolution process.

- AFCA's CEO, David Locke, has expressed that the increasing volume of complaints is unsustainable and causing delays, urging financial firms to improve their internal complaint handling.

- A government national task force and other anti-scam measures have been announced to combat the growing issue, with industry commitments to enhance scam prevention strategies in 2024.

- Consumer advocates are pressing for stronger measures, similar to those in the UK, where banks will be obligated to reimburse scam victims, potentially reducing the burden on AFCA and speeding up resolution processes.