Retirees WA suing to recover millions from companies linked to husband of ex-CEO Margaret Thomas

By

ABC News

- Replies 1

Millions of dollars belonging to retirees who have prepaid funerals through a charity could be in jeopardy amid an investigation from WA's consumer watchdog.

Retirees WA (RWA) has thousands of mostly senior members and operates retirement villages and aged care facilities across Western Australia, social programs for seniors, and a scheme for discounted funerals.

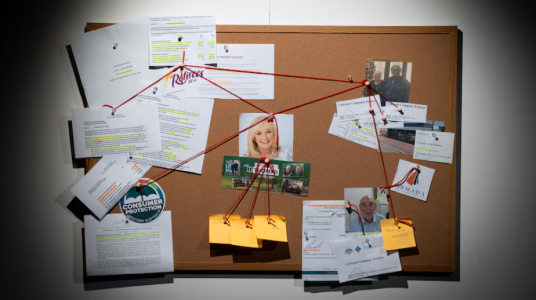

But money from the charity's prepaid funeral fund has been tied up in a maze of loans and investments into companies linked to Frank Pinner, the husband of RWA's former chief executive officer Margaret Thomas.

The charity is now pursuing legal action against Mr Pinner and his companies to try to recoup millions of dollars. Mr Pinner has filed a defence denying that any monies are owed.

Millions flow from funeral fund

Margaret Thomas is the Mayor of Kalamunda, and ran unsuccessfully for the Liberals in the 2005 state election.

A few months after the election loss, she became Retirees WA's chief financial officer, and was also appointed its chief executive officer in 2007.

Millions of dollars started flowing from the charity into loans and investments, with the approval of the boards at the time.

Ms Thomas's husband, Frank Pinner, was a director of the company which received the investments, ASIC records show.

The money for all the investments and loans came from Retirees WA's funeral fund, where millions of dollars are held in trust on behalf of members who have prepaid their funerals.

As of the last financial year, the charity had $6.6 million worth of prepaid funerals. Its most expensive funeral package is $4,279 — or about 1,500 prepaid funerals.

The charity's financial reports show it invested $1.6 million in 2005 into Mr Pinner's building company, Over 55 Lifestyle Villages Pty Ltd, and another $2.8 million the following year.

The charity also loaned $1.8 million to Mr Pinner's company in 2006, which the company used to buy a property.

Retirees WA then paid $4,315 per month, growing to $9,200 per month by 2015, to lease part of the property back as office space.

Mr Pinner's company sold the property for $3 million in 2016, and paid the $1.8 million loan back to the charity.

RWA's financial reports do not state the charity received the $1.2 million profit from the sale of the property.

Charity sues

Ms Thomas stepped away from her dual roles at Retirees WA early last year.

She and Mr Pinner both declined requests for interviews and did not answer written questions about Mr Pinner's financial links to the charity.

"Those questions are based on numerous factual inaccuracies, and imply a number of imputations which are false," a letter from their lawyer said.

But the lawyer refused to clarify the "inaccuracies" and said it would be inappropriate to respond to questions relating to ongoing legal proceedings.

None of the transactions detailed above are part of ongoing legal proceedings and the ABC is not suggesting any wrongdoing by Ms Thomas or Mr Pinner in relation to any of them.

Retirees WA is suing Mr Pinner and his companies over what it claims is a default on a $1.5 million loan made to his company in May 2017, and another $1.5 million loan made in November 2020.

Mr Pinner denies the allegations.

Throughout Margaret Thomas's tenure at RWA, building contracts for the charity's retirement villages and aged care facilities were approved by the boards to be given to companies operated by Mr Pinner.

Links to former auditor

The charity's financial web stretches beyond husband and wife.

Past financial reports show Graeme Wovodich was RWA's external auditor in charge of scrutinising the charity's finances for a decade during Ms Thomas's tenure, when he worked as a director with Armada Accountants & Advisors.

The ABC understands Mr Wovodich left his firm in 2018, which resulted in him losing Retirees WA as a client.

A year later, a $4.8 million investment from the funeral fund in one of Mr Pinner's companies was transferred to Retirement Village Developments Pty Ltd, a company directed by Mr Wovodich.

However, the investment in Mr Wovodich's company has been "fully impaired" in the charity's latest financial report, which means the $4.8 million has been deemed irrecoverable and the investment revalued at $0.

Graeme Wovodich also declined a request for an interview, and did not respond to written questions.

Red flags

Members of Retirees WA have been raising questions about the charity's financial management for years.

"What absolutely amazes me, I find it utterly bewildering … they were allowed to do this for years," member Susan Burns said.

"How can you run a charity like that?"

"There was a resident in here who unfortunately has since died ... he was really concerned about the funeral fund. A lot of people got told, 'don't leave your money in the funeral fund'."

Letters from Ms Burns show she alerted WA's consumer watchdog about the charity's financial management as early as 2016 and also complained to the Australian Charities and Not-for-profit Commission.

"We were just ignored," she said.

In mid-2021, Consumer Protection formally started investigating the governance of Retirees WA.

Retirees WA changes

The consumer watchdog says its ongoing investigation is "highly complex", and it will provide information to families once it is finished.

Retirees WA's new CEO Henrietta de Sa was the charity's funeral fund manager when some of the loans and investments were approved using money from the fund, but said she was not involved in the decisions.

She said changes had been made in the organisation's management structure since Ms Thomas left to ensure the board "has more insight over all our financial decisions and over the organisation as a whole."

New rules will mean one person can't hold both CEO and CFO positions — as Margaret Thomas did — and the charity is implementing a "liquidity management strategy" to ensure it can meet its financial obligations.

"We realised there were a lot of things, that our policies and procedures need to be changed, because they were not up to date," Ms de Sa said.

"Retirees WA does have a plan … I think Retirees WA is very solvent, and there's no worry."

Governance failings

University of Western Australia charity governance expert Ian Murray warns of the potential dangers of charities transacting with private companies where the transaction involves people with pre-existing connections, such as family members or business partners.

"When you're talking about red flags, yes we would worry a bit about for-profits and non-profits entering into related party transactions," Professor Murray said.

He said it could be difficult for the federal regulator — the Australian Charities and Not-for-profits Commission (ACNC) — to have a clear picture of whether a related party transaction might be a cause for concern.

"The reporting is all about 'have you got related parties?' … but in a charity setting, that's not the worry. It's a secondary question about 'have we got private benefit flowing to someone?'," he said.

Professor Murray said a recent Productivity Commission inquiry into regulation of the charity sector recommended giving more enforcement powers to the federal regulator, including against individuals.

"Charities exist for the public benefit," Professor Murray said.

"It's going to be people in need, or others who charities are meant to be serving, who are the ones that suffer when we have governance failures in the charity sector."

Written by Cason Ho, ABC News.

Retirees WA (RWA) has thousands of mostly senior members and operates retirement villages and aged care facilities across Western Australia, social programs for seniors, and a scheme for discounted funerals.

But money from the charity's prepaid funeral fund has been tied up in a maze of loans and investments into companies linked to Frank Pinner, the husband of RWA's former chief executive officer Margaret Thomas.

The charity is now pursuing legal action against Mr Pinner and his companies to try to recoup millions of dollars. Mr Pinner has filed a defence denying that any monies are owed.

Millions flow from funeral fund

Margaret Thomas is the Mayor of Kalamunda, and ran unsuccessfully for the Liberals in the 2005 state election.

A few months after the election loss, she became Retirees WA's chief financial officer, and was also appointed its chief executive officer in 2007.

Millions of dollars started flowing from the charity into loans and investments, with the approval of the boards at the time.

Ms Thomas's husband, Frank Pinner, was a director of the company which received the investments, ASIC records show.

The money for all the investments and loans came from Retirees WA's funeral fund, where millions of dollars are held in trust on behalf of members who have prepaid their funerals.

As of the last financial year, the charity had $6.6 million worth of prepaid funerals. Its most expensive funeral package is $4,279 — or about 1,500 prepaid funerals.

A web of moneyThe charity's financial reports show it invested $1.6 million in 2005 into Mr Pinner's building company, Over 55 Lifestyle Villages Pty Ltd, and another $2.8 million the following year.

The charity also loaned $1.8 million to Mr Pinner's company in 2006, which the company used to buy a property.

Retirees WA then paid $4,315 per month, growing to $9,200 per month by 2015, to lease part of the property back as office space.

Mr Pinner's company sold the property for $3 million in 2016, and paid the $1.8 million loan back to the charity.

RWA's financial reports do not state the charity received the $1.2 million profit from the sale of the property.

Charity sues

Ms Thomas stepped away from her dual roles at Retirees WA early last year.

She and Mr Pinner both declined requests for interviews and did not answer written questions about Mr Pinner's financial links to the charity.

"Those questions are based on numerous factual inaccuracies, and imply a number of imputations which are false," a letter from their lawyer said.

But the lawyer refused to clarify the "inaccuracies" and said it would be inappropriate to respond to questions relating to ongoing legal proceedings.

None of the transactions detailed above are part of ongoing legal proceedings and the ABC is not suggesting any wrongdoing by Ms Thomas or Mr Pinner in relation to any of them.

Retirees WA is suing Mr Pinner and his companies over what it claims is a default on a $1.5 million loan made to his company in May 2017, and another $1.5 million loan made in November 2020.

Mr Pinner denies the allegations.

Throughout Margaret Thomas's tenure at RWA, building contracts for the charity's retirement villages and aged care facilities were approved by the boards to be given to companies operated by Mr Pinner.

Links to former auditor

The charity's financial web stretches beyond husband and wife.

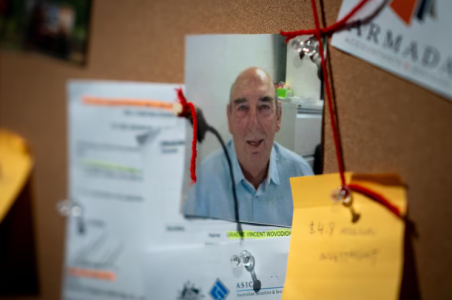

Past financial reports show Graeme Wovodich was RWA's external auditor in charge of scrutinising the charity's finances for a decade during Ms Thomas's tenure, when he worked as a director with Armada Accountants & Advisors.

The ABC understands Mr Wovodich left his firm in 2018, which resulted in him losing Retirees WA as a client.

A year later, a $4.8 million investment from the funeral fund in one of Mr Pinner's companies was transferred to Retirement Village Developments Pty Ltd, a company directed by Mr Wovodich.

However, the investment in Mr Wovodich's company has been "fully impaired" in the charity's latest financial report, which means the $4.8 million has been deemed irrecoverable and the investment revalued at $0.

Graeme Wovodich also declined a request for an interview, and did not respond to written questions.

Red flags

Members of Retirees WA have been raising questions about the charity's financial management for years.

"What absolutely amazes me, I find it utterly bewildering … they were allowed to do this for years," member Susan Burns said.

"How can you run a charity like that?"

"There was a resident in here who unfortunately has since died ... he was really concerned about the funeral fund. A lot of people got told, 'don't leave your money in the funeral fund'."

Letters from Ms Burns show she alerted WA's consumer watchdog about the charity's financial management as early as 2016 and also complained to the Australian Charities and Not-for-profit Commission.

"We were just ignored," she said.

In mid-2021, Consumer Protection formally started investigating the governance of Retirees WA.

Retirees WA changes

The consumer watchdog says its ongoing investigation is "highly complex", and it will provide information to families once it is finished.

Retirees WA's new CEO Henrietta de Sa was the charity's funeral fund manager when some of the loans and investments were approved using money from the fund, but said she was not involved in the decisions.

She said changes had been made in the organisation's management structure since Ms Thomas left to ensure the board "has more insight over all our financial decisions and over the organisation as a whole."

New rules will mean one person can't hold both CEO and CFO positions — as Margaret Thomas did — and the charity is implementing a "liquidity management strategy" to ensure it can meet its financial obligations.

"We realised there were a lot of things, that our policies and procedures need to be changed, because they were not up to date," Ms de Sa said.

"Retirees WA does have a plan … I think Retirees WA is very solvent, and there's no worry."

Governance failings

University of Western Australia charity governance expert Ian Murray warns of the potential dangers of charities transacting with private companies where the transaction involves people with pre-existing connections, such as family members or business partners.

"When you're talking about red flags, yes we would worry a bit about for-profits and non-profits entering into related party transactions," Professor Murray said.

He said it could be difficult for the federal regulator — the Australian Charities and Not-for-profits Commission (ACNC) — to have a clear picture of whether a related party transaction might be a cause for concern.

"The reporting is all about 'have you got related parties?' … but in a charity setting, that's not the worry. It's a secondary question about 'have we got private benefit flowing to someone?'," he said.

Professor Murray said a recent Productivity Commission inquiry into regulation of the charity sector recommended giving more enforcement powers to the federal regulator, including against individuals.

"Charities exist for the public benefit," Professor Murray said.

"It's going to be people in need, or others who charities are meant to be serving, who are the ones that suffer when we have governance failures in the charity sector."

Written by Cason Ho, ABC News.