RBA hikes cash rate by 25 basis points amid inflation, uncertainty

- Replies 2

The Reserve Bank of Australia has started raising interest rates again, after keeping them steady for the past four months—a move that is putting more financial pressure on households, businesses, and people with mortgages.

During their recent meeting on Tuesday, the RBA decided to increase the cash rate by 0.25 per cent, bringing it to 4.35 per cent.

As a result, if you're an average borrower with a $500,000 loan and 25 years left to pay, your monthly mortgage payments will go up by approximately $76.

NAB's Chief Economist, Alan Oster, earlier expressed concerns about prolonged high inflation, which may be the reason behind the RBA's decision to raise the cash rate.

'Services inflation is too high, the economy looks a bit better than most of us thought and quite high wage numbers are coming,' he said.

'That pushes the prospects of the Reserve Bank getting the inflation rate below three by late 2025 to be a bit challenging.'

HSBC's Chief Economist, Paul Bloxham, also predicted the rate increase to 4.35 per cent. He also suggested that if inflation remains stubbornly high, there might be another rate hike in February 2024.

'The critical question is whether it can plausibly argue that inflation will still fall back to its target band by the second half of 2025,' he said.

'We think it will be difficult for them to still expect that inflation will fall back to target without delivering a further tightening.'

The likelihood of a rate increase went up significantly when new inflation data came out in late October, leading financial markets to reconsider the need for further monetary tightening. Inflation is currently at 5.4 per cent, well above the RBA's target range of 2 to 3 per cent.

Recent economic indicators, such as a 0.9 per cent increase in retail spending and a drop in unemployment to 3.6 per cent in September, suggested that the economy can handle rate hikes without sliding into a recession.

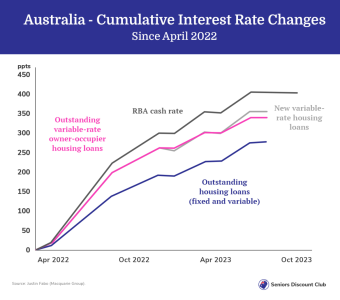

However, households are feeling the pinch as the central bank has raised interest rates 12 times since May of the previous year.

People with an average mortgage of $585,000 are now paying $1,415 more per month than they were before the RBA's current round of rate hikes began, according to Compare the Market.

If there is another rate hike of 25 basis points before the end of the year, the average monthly mortgage payments would increase by an additional $96.

Fiona Morris, a small business owner, has also been feeling the impact of the RBA's series of interest rate hikes that began in May last year. Her variable mortgage payments have significantly increased, reaching 7.28 per cent now. She's worried about the possibility of another rate hike before Christmas.

In the time she's had her loan, her payments have risen from around $334 to $588. While everything else's prices are going up, her income hasn't, leading her to cut back on property repairs and improvements.

Despite her business being somewhat 'recession-proof', Fiona is concerned about the financial strain on her employees.

'I've got staff that can't go away; they're asking for more hours, but I don't want to work my staff into the ground so they can afford the bare necessities,' said Ms Morris.

Ms Morris also argued that the banks are making record profits and still passing on the rate hikes to consumers; that is why she believes it's time for the government to step in and address the situation.

'There's no doubt the RBA is out of touch, but so are our politicians; they're not listening to us when they make their decisions,' she ranted.

This news comes after the International Monetary Fund (IMF) recommended the RBA to lift interest rates and governments to pull back on infrastructure projects to control inflation.

Treasurer Jim Chalmers also praised the government's economic approach, stating that the IMF's report strongly 'endorses' it.

Members, while the path ahead looks bumpy, keep calm and focus on what you can control. With prudent financial management, you can ride out this economic storm. Do you have some money-saving tips and advice? Share them with us below in the comments!

During their recent meeting on Tuesday, the RBA decided to increase the cash rate by 0.25 per cent, bringing it to 4.35 per cent.

As a result, if you're an average borrower with a $500,000 loan and 25 years left to pay, your monthly mortgage payments will go up by approximately $76.

NAB's Chief Economist, Alan Oster, earlier expressed concerns about prolonged high inflation, which may be the reason behind the RBA's decision to raise the cash rate.

'Services inflation is too high, the economy looks a bit better than most of us thought and quite high wage numbers are coming,' he said.

'That pushes the prospects of the Reserve Bank getting the inflation rate below three by late 2025 to be a bit challenging.'

The Reserve Bank of Australia has raised interest rates, increasing financial pressure on mortgage holders. Credit: Shutterstock.

HSBC's Chief Economist, Paul Bloxham, also predicted the rate increase to 4.35 per cent. He also suggested that if inflation remains stubbornly high, there might be another rate hike in February 2024.

'The critical question is whether it can plausibly argue that inflation will still fall back to its target band by the second half of 2025,' he said.

'We think it will be difficult for them to still expect that inflation will fall back to target without delivering a further tightening.'

The likelihood of a rate increase went up significantly when new inflation data came out in late October, leading financial markets to reconsider the need for further monetary tightening. Inflation is currently at 5.4 per cent, well above the RBA's target range of 2 to 3 per cent.

Recent economic indicators, such as a 0.9 per cent increase in retail spending and a drop in unemployment to 3.6 per cent in September, suggested that the economy can handle rate hikes without sliding into a recession.

However, households are feeling the pinch as the central bank has raised interest rates 12 times since May of the previous year.

People with an average mortgage of $585,000 are now paying $1,415 more per month than they were before the RBA's current round of rate hikes began, according to Compare the Market.

If there is another rate hike of 25 basis points before the end of the year, the average monthly mortgage payments would increase by an additional $96.

Fiona Morris, a small business owner, has also been feeling the impact of the RBA's series of interest rate hikes that began in May last year. Her variable mortgage payments have significantly increased, reaching 7.28 per cent now. She's worried about the possibility of another rate hike before Christmas.

In the time she's had her loan, her payments have risen from around $334 to $588. While everything else's prices are going up, her income hasn't, leading her to cut back on property repairs and improvements.

Despite her business being somewhat 'recession-proof', Fiona is concerned about the financial strain on her employees.

'I've got staff that can't go away; they're asking for more hours, but I don't want to work my staff into the ground so they can afford the bare necessities,' said Ms Morris.

Ms Morris also argued that the banks are making record profits and still passing on the rate hikes to consumers; that is why she believes it's time for the government to step in and address the situation.

'There's no doubt the RBA is out of touch, but so are our politicians; they're not listening to us when they make their decisions,' she ranted.

This news comes after the International Monetary Fund (IMF) recommended the RBA to lift interest rates and governments to pull back on infrastructure projects to control inflation.

Treasurer Jim Chalmers also praised the government's economic approach, stating that the IMF's report strongly 'endorses' it.

Key Takeaways

- The Reserve Bank raised the official cash rate by 25 basis points to 4.35 per cent, in line with earlier expectations.

- This increase would mark the first rate rise in five months and is reflective of concerns about prolonged high inflation.

- Recent economic data indicates the Australian economy is weathering the effects of rate hikes, as evidenced by increased retail spending and declining unemployment.

- Despite the seemingly robust economic performance, households face increased financial strain due to rising mortgage repayments and the cost of living.

Members, while the path ahead looks bumpy, keep calm and focus on what you can control. With prudent financial management, you can ride out this economic storm. Do you have some money-saving tips and advice? Share them with us below in the comments!

Last edited by a moderator: