Protect your money: Westpac takes extra steps to stop scams

- Replies 9

As technology advances, so do the methods of deception used by scammers and fraudsters, posing a growing threat to the financial security of Australians. With online transactions becoming more prevalent, it's vital to remain vigilant against these cyber criminals.

Fortunately, Westpac has taken proactive steps to safeguard its customers' accounts by implementing cutting-edge security measures, following in the footsteps of the Commonwealth Bank.

Recently, Westpac announced that it would introduce a new software called Westpac Verify, which will provide additional levels of online security to protect customers from potential scams.

The move comes after the bank saw a new record high of customer losses due to scams in December of last year, with an increasing number of reported incidents.

What is Westpac Verify?

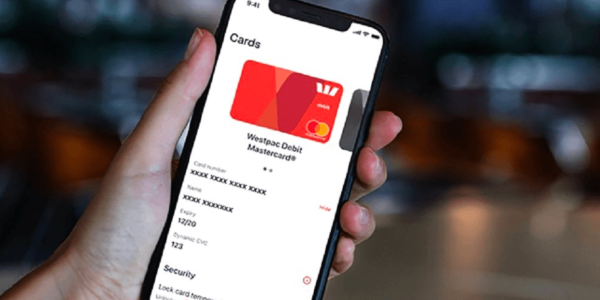

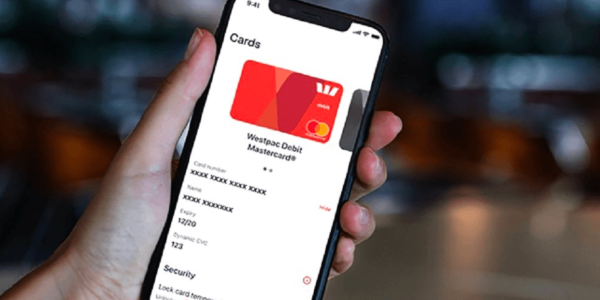

Westpac Verify will send out more alerts to customers about suspicious transactions.

This software allows customers to cancel payments before the money is sent if they suspect a scam. The alerts will notify customers if there is a potential account name mismatch for payments to new BSBs and account numbers via the New Payments Platform (NPP).

Customers will also be alerted if someone tries transferring money to a Westpac account they have never interacted with. In both cases, the attempted payment will be put on hold for four hours, and customers will receive a text message asking them to review the transfer.

According to Chris de Bruin, the bank's Chief Executive of Consumer and Business Banking, the number of scams has skyrocketed. In December, customer losses reached a new record high, double the figure from the previous year.

Scammers trick customers into transferring money to them through online or mobile banking. They do this by creating fake accounts or posing as legitimate businesses or individuals. Unfortunately, many customers fall victim to these scams and lose their hard-earned money.

'The majority of scam-related transactions happen when a customer is tricked into transferring their money to a scammer via online or mobile banking,' said Mr de Bruin.

'They may think they're sending money to a legitimate business, individual, or bank account they've been told has been set up in their name, but they're not.'

'Westpac will now pause some payments and give customers an opportunity to check if the recipient details are correct before proceeding with a transaction, adding another layer in the net to catch potential scams.'

The Australian Financial Complaints Authority (AFCA) has welcomed these new measures, with its chief executive, David Locke, stating that the AFCA is deeply concerned about the increase in scam complaints, the increasing sophistication of scams and the losses caused by them.

He added that the more people are aware of the dangers of scams, the less likely they are to fall victim to them.

Westpac's new features are currently undergoing testing and will be rolled out to customers over the next month.

Although Westpac has taken initiatives to tackle this growing scam problem, what about other big banks?

CommBank has introduced a groundbreaking feature called NameCheck, which acts as an early warning system for customers when entering banking information online. This innovative technology detects and alerts customers if any discrepancies arise, helping to prevent false billing scams and mistaken payments.

NAB has also stepped up its game by registering its phone numbers on the 'Do Not Originate' list to reduce spoofing or impersonation scams. Additionally, NAB is providing free online security webinars and educational resources on popular social media platforms to help educate customers on how to stay safe from scams.

ANZ has implemented ANZ Shield, a cutting-edge security app designed to verify ANZ internet banking activity and offer extra security for different types of transactions. This added layer of protection gives customers peace of mind and the confidence to conduct their banking activities safely.

Protecting your financial security is a top priority. While it's reassuring that Australia's biggest banks have implemented measures to detect and prevent scams, it's also essential to remain vigilant and educated on the latest scams.

Scammers are becoming more sophisticated, and it's essential to be cautious about new transaction requests and always double-check the details before proceeding. Don't hesitate to contact your bank if you're unsure or suspect fraud. Your bank is there to help you and can offer invaluable advice to ensure your financial safety.

Remember, regardless of financial status, age, or education level, scams can happen to anyone. It's crucial to stay informed and ahead of these threats to protect yourself and your hard-earned money. Taking a proactive approach to your financial security gives you peace of mind and confidence in your banking activities.

Feel free to check out the Scam Watch forum on the SDC website to stay on top of the latest news. Stay safe out there, members!

Fortunately, Westpac has taken proactive steps to safeguard its customers' accounts by implementing cutting-edge security measures, following in the footsteps of the Commonwealth Bank.

Recently, Westpac announced that it would introduce a new software called Westpac Verify, which will provide additional levels of online security to protect customers from potential scams.

The move comes after the bank saw a new record high of customer losses due to scams in December of last year, with an increasing number of reported incidents.

The bank's newest software, Westpac Verify, will result in customers receiving more alerts about suspicious transactions. Credit: Facebook/Westpac.

What is Westpac Verify?

Westpac Verify will send out more alerts to customers about suspicious transactions.

This software allows customers to cancel payments before the money is sent if they suspect a scam. The alerts will notify customers if there is a potential account name mismatch for payments to new BSBs and account numbers via the New Payments Platform (NPP).

Customers will also be alerted if someone tries transferring money to a Westpac account they have never interacted with. In both cases, the attempted payment will be put on hold for four hours, and customers will receive a text message asking them to review the transfer.

According to Chris de Bruin, the bank's Chief Executive of Consumer and Business Banking, the number of scams has skyrocketed. In December, customer losses reached a new record high, double the figure from the previous year.

Scammers trick customers into transferring money to them through online or mobile banking. They do this by creating fake accounts or posing as legitimate businesses or individuals. Unfortunately, many customers fall victim to these scams and lose their hard-earned money.

'The majority of scam-related transactions happen when a customer is tricked into transferring their money to a scammer via online or mobile banking,' said Mr de Bruin.

'They may think they're sending money to a legitimate business, individual, or bank account they've been told has been set up in their name, but they're not.'

'Westpac will now pause some payments and give customers an opportunity to check if the recipient details are correct before proceeding with a transaction, adding another layer in the net to catch potential scams.'

The Australian Financial Complaints Authority (AFCA) has welcomed these new measures, with its chief executive, David Locke, stating that the AFCA is deeply concerned about the increase in scam complaints, the increasing sophistication of scams and the losses caused by them.

He added that the more people are aware of the dangers of scams, the less likely they are to fall victim to them.

Westpac's new features are currently undergoing testing and will be rolled out to customers over the next month.

Key Takeaways

- Westpac has launched Westpac Verify, an alert system to protect customers from potential scams when sending money.

- Westpac’s chief executive of consumer and business banking, Chris de Bruin says scam-related transactions where customers are tricked into sending money to illegitimate businesses, people and banks have grown at an unprecedented rate.

Although Westpac has taken initiatives to tackle this growing scam problem, what about other big banks?

CommBank has introduced a groundbreaking feature called NameCheck, which acts as an early warning system for customers when entering banking information online. This innovative technology detects and alerts customers if any discrepancies arise, helping to prevent false billing scams and mistaken payments.

NAB has also stepped up its game by registering its phone numbers on the 'Do Not Originate' list to reduce spoofing or impersonation scams. Additionally, NAB is providing free online security webinars and educational resources on popular social media platforms to help educate customers on how to stay safe from scams.

ANZ has implemented ANZ Shield, a cutting-edge security app designed to verify ANZ internet banking activity and offer extra security for different types of transactions. This added layer of protection gives customers peace of mind and the confidence to conduct their banking activities safely.

Protecting your financial security is a top priority. While it's reassuring that Australia's biggest banks have implemented measures to detect and prevent scams, it's also essential to remain vigilant and educated on the latest scams.

Scammers are becoming more sophisticated, and it's essential to be cautious about new transaction requests and always double-check the details before proceeding. Don't hesitate to contact your bank if you're unsure or suspect fraud. Your bank is there to help you and can offer invaluable advice to ensure your financial safety.

Remember, regardless of financial status, age, or education level, scams can happen to anyone. It's crucial to stay informed and ahead of these threats to protect yourself and your hard-earned money. Taking a proactive approach to your financial security gives you peace of mind and confidence in your banking activities.

Feel free to check out the Scam Watch forum on the SDC website to stay on top of the latest news. Stay safe out there, members!