Outback businesses raise concerns about Services Australia's Centrepay reforms

By

ABC News

- Replies 0

Retailers and small businesses in northern Australia have expressed alarm over major changes to a debt repayment system coming into effect next month.

Centrepay is a federal government system used by about 500,000 social security recipients to incrementally pay for goods and services such as furniture, food, utilities or clothes.

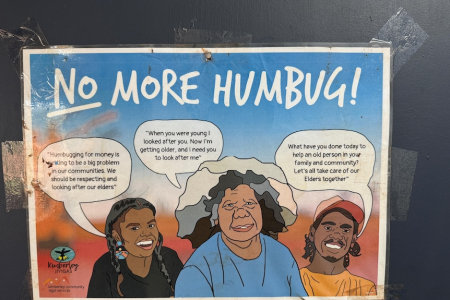

Kimberley-based retailer Brett Perkins said Centrepay worked well because "it deters humbug".

The term refers to people in the Kimberley and Northern Territory being pestered by family to hand over their welfare payments.

"The cash is actually going into their bank account and they choose to debit it into the supermarket or the furniture shop," Mr Perkins said.

"That money sits in their account for their use only and it really helps when it comes to the humbug situation."

Two of Mr Perkins's businesses are in the Kimberley town of Derby and will no longer be eligible to use Centrepay from November 3, when a raft of reforms begin, sparked by financial scandals.

He said between 10 and 20 per cent of customers at his independent supermarket and general store used the money management system.

Household goods, sports equipment, furniture, vehicle registration, church donations, funeral plans and in some cases food, are among the items that will no longer be allowed to be bought using Centrepay.

Customers will still be able to buy food using the scheme at remote Aboriginal community stores — but not other goods sold at the same shop.

Services Australia customer engagement officer Justin Bott said the changes were being implemented due to financial scandals.

"We were concerned that when customers were put into ongoing contracts or fee structures they paid more than they needed to, or were put at a disadvantage" he said.

"The purpose is to bring Centrepay back to its original goal of providing an ongoing budgeting tool for some services."

Mr Bott said it was up to businesses to inform clients of the changes rather than Services Australia.

Using Centrepay for accommodation and utilities is unchanged, while other categories have new low repayment limits while clients pay it off.

Mr Perkins, who has been in retail in the Kimberley for 17 years, lobbied for exemptions for food, fridges, washing machines, air conditioners and beds during Services Australia's public consultation period.

"It's sad that they're taking away the essential goods," he said.

"The sad reality that Canberra doesn't understand the humbug situations in our towns and is making these decisions for the north west and across the Top End."

He was critical of the lack of money management support for Services Australia clients and the lack of information about the changes.

He said it could lead to "trouble at the till".

"The target market that are using Centrepay have no other option and [many] regional and remote areas don't have banks," he said.

Dr Fyffe said 50 per cent of clients at her clinic in Tennant Creek, in the Northern Territory, relied on Centrepay to help manage their vet bills.

She has worked at the clinic for six years and took over ownership two months ago, triggering the "new business" clause under reforms already implemented.

Vet fees remain on the Centrepay scheme but repayments are reduced to $50 a fortnight maximum, meaning a debt could potentially last years.

"My options are that I don't provide the service because the clients will be unable or unwilling to pay — therefore I'm rejecting treatment of patients that potentially have life-threatening conditions," Dr Fyffe said.

"Alternatively, I provide the treatment … at my own cost and I risk that my business never recoups the costs.

"You run the risk of losing huge amounts of money."

Dr Fyffe feared pets could die because people would be reluctant to seek help.

"I try and get them to pay a deposit to at least cover a consultation fee so at least I've got something to pay my debts, wages," she said.

"Pet health isn't governed by what [owners] are allowed to put on their Centrepay."

The full list of changes is available through the Services Australia website.

Written by Vanessa Mills, ABC News.

Centrepay is a federal government system used by about 500,000 social security recipients to incrementally pay for goods and services such as furniture, food, utilities or clothes.

Kimberley-based retailer Brett Perkins said Centrepay worked well because "it deters humbug".

The term refers to people in the Kimberley and Northern Territory being pestered by family to hand over their welfare payments.

"The cash is actually going into their bank account and they choose to debit it into the supermarket or the furniture shop," Mr Perkins said.

"That money sits in their account for their use only and it really helps when it comes to the humbug situation."

Two of Mr Perkins's businesses are in the Kimberley town of Derby and will no longer be eligible to use Centrepay from November 3, when a raft of reforms begin, sparked by financial scandals.

He said between 10 and 20 per cent of customers at his independent supermarket and general store used the money management system.

Household goods, sports equipment, furniture, vehicle registration, church donations, funeral plans and in some cases food, are among the items that will no longer be allowed to be bought using Centrepay.

Customers will still be able to buy food using the scheme at remote Aboriginal community stores — but not other goods sold at the same shop.

Services Australia customer engagement officer Justin Bott said the changes were being implemented due to financial scandals.

"We were concerned that when customers were put into ongoing contracts or fee structures they paid more than they needed to, or were put at a disadvantage" he said.

"The purpose is to bring Centrepay back to its original goal of providing an ongoing budgeting tool for some services."

Mr Bott said it was up to businesses to inform clients of the changes rather than Services Australia.

Using Centrepay for accommodation and utilities is unchanged, while other categories have new low repayment limits while clients pay it off.

Mr Perkins, who has been in retail in the Kimberley for 17 years, lobbied for exemptions for food, fridges, washing machines, air conditioners and beds during Services Australia's public consultation period.

"It's sad that they're taking away the essential goods," he said.

"The sad reality that Canberra doesn't understand the humbug situations in our towns and is making these decisions for the north west and across the Top End."

He was critical of the lack of money management support for Services Australia clients and the lack of information about the changes.

He said it could lead to "trouble at the till".

"The target market that are using Centrepay have no other option and [many] regional and remote areas don't have banks," he said.

Fears 'pets might die'

Veterinarian Dr Kelsey Fyffe has already incurred debts of $35,000 from clients unable to pay up-front for pet care in the past two months.Dr Fyffe said 50 per cent of clients at her clinic in Tennant Creek, in the Northern Territory, relied on Centrepay to help manage their vet bills.

She has worked at the clinic for six years and took over ownership two months ago, triggering the "new business" clause under reforms already implemented.

Vet fees remain on the Centrepay scheme but repayments are reduced to $50 a fortnight maximum, meaning a debt could potentially last years.

"My options are that I don't provide the service because the clients will be unable or unwilling to pay — therefore I'm rejecting treatment of patients that potentially have life-threatening conditions," Dr Fyffe said.

"Alternatively, I provide the treatment … at my own cost and I risk that my business never recoups the costs.

"You run the risk of losing huge amounts of money."

Vet fees will be reduced to a maximum repayment of $50 a fortnight under the reforms. (ABC Kimberley: Vanessa Mills)

Dr Fyffe feared pets could die because people would be reluctant to seek help.

"I try and get them to pay a deposit to at least cover a consultation fee so at least I've got something to pay my debts, wages," she said.

"Pet health isn't governed by what [owners] are allowed to put on their Centrepay."

The full list of changes is available through the Services Australia website.

Written by Vanessa Mills, ABC News.