The numbers painted a sobering picture of modern Australia. Nearly two in three older Australians depended on the Age Pension to survive, with many saying it was the thin line between security and hardship. Now, Sussan Ley’s warning suggested that this fragile balance could soon be under threat.

In her first major economic speech as Opposition Leader, Ley argued that Australia’s welfare system had created too much dependency. She declared it had become ‘taboo’ to suggest that ‘not everyone is entitled to every government benefit.’ For millions of seniors who relied on the pension system, her words raised fears of potential changes that could reshape their financial stability.

In this article

The First Woman at the Helm

Ley made history as the first woman to lead the Liberal Party, the Coalition, and serve as Leader of the Opposition at the federal level. Yet her rise was not built on symbolism alone.

Her background included a Bachelor of Economics, Master of Taxation Law, and a Master of Accounting—credentials that gave her economic arguments weight. Before entering Parliament in 2001, she worked as a commercial pilot, a farmer, and later as a senior officer with the Australian Taxation Office, eventually becoming Director of Technical Training.

Her path was far from smooth. She resigned as Health Minister in 2017 amid controversy over travel expenses. But her narrow victory over Angus Taylor in the leadership ballot, with 29 votes to 25, showed the party placed its confidence in her economic credibility.

‘Unfortunately, in the past few years, the pendulum has swung too far toward dependency.’

The Age Pension in Real Life

The Age Pension was not simply a number on a government ledger. It was the primary income source for 39 per cent of Australians over 67 receiving the full pension and 24 per cent receiving a part pension.

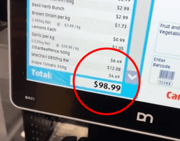

For single pensioners, the maximum payment was $959.70 per fortnight, or about $24,952 per year. For many, this modest amount allowed them to pay rent, keep food on the table, and maintain independence.

In September 2025, indexation brought a small but welcome rise—an extra $29.70 per fortnight for singles. While a relief, these increases often barely kept pace with rising living costs.

Beyond the base payment, seniors relied on a patchwork of supplements and concessions. The Energy Supplement provided help with power bills. Pharmaceutical allowances cut the cost of essential medicines. The Pensioner Concession Card meant discounted transport, cheaper healthcare, and utility relief. For those living with chronic conditions or in areas with limited public transport, these benefits were not perks but lifelines.

Age Pension Basics (September 2025)

Singles: $959.70 per fortnight ($24,952 per year)

Couples (each): $774.30 per fortnight ($20,132 per year)

Includes pension supplement and energy supplement—Automatic increases every March and September based on inflation—Recipients also receive Pensioner Concession Card benefits

A Spending Debate with High Stakes

Ley argued that government spending had reached 27 per cent of gross domestic product—the highest level outside of a recession since 1986. Her claim tapped into long-standing debates about dependency versus sustainability.

The numbers told another story, however. In 2021–22, welfare services and payments amounted to $212.4 billion, with the Commonwealth funding 88 per cent of that figure.

Compared internationally, Australia’s spending was far from extravagant. Countries like Finland spent 22 per cent of GDP on welfare, while Italy and France hovered around 21 per cent. Australia’s expenditure sat below the OECD median, showing a more restrained system than many believed.

Safety Net or Dependency Trap?

At the heart of Ley’s speech was a philosophical question. She warned that ‘a welfare system that attempts to be all things to all people will eventually collapse under its own weight.’

Critics of welfare expansion argued it discouraged work and saving. Supporters countered that pensions upheld dignity and security for those who had worked all their lives.

For seniors, the debate carried special weight. Unlike unemployment benefits, the Age Pension was not temporary but permanent recognition that decades of labour deserved security in retirement. Many older Australians had spent their working years before compulsory superannuation existed, leaving them reliant on government support as a necessity rather than a choice.

Where Might the Cuts Land?

Ley had not yet specified what changes a Coalition government might pursue. But her emphasis on ‘genuine need’ suggested stricter means testing could be on the horizon.

That could mean part-pension recipients—often with modest savings or assets—might lose access. Supplementary payments, such as the Energy or Pharmaceutical Supplements, might be reduced or eliminated.

Eligibility for concession cards could be tightened, leaving many seniors paying more for healthcare and transport. Home care packages, already stretched thin, could face further delays or reduced funding.

Did you know?

Australia’s Age Pension history Australia’s Age Pension was first introduced in 1909, making it one of the earliest old-age pensions in the world. It began as a means-tested payment for those over 65 who had lived in Australia for at least 25 years. Today, means testing remains, but with more generous income and asset thresholds.

More than Numbers: The Human Impact

The risks of welfare cuts extended far beyond budget figures. For many seniors, the Age Pension supported basic housing stability. Rent assistance made the difference between keeping a roof overhead or slipping into homelessness.

Healthcare was another critical area. Bulk billing and Pharmaceutical Benefits Scheme subsidies meant retirees could afford to see doctors and buy prescriptions. Without these, chronic illnesses could quickly spiral into crises.

Even social connection depended on concessions. Discounted fares let seniors visit family, attend community events, and maintain vital support networks.

And then there was dignity. A regular, reliable income allowed older Australians to manage small luxuries, unexpected bills, or simple independence without leaning on family.

The COVID-19 pandemic showed how fragile life could be. Seniors were hit hardest by isolation and rising costs, and government support proved critical. Cuts now, many argued, could leave them dangerously exposed to the next crisis.

Learning from Abroad

Other nations had grappled with similar dilemmas. In the United Kingdom, post-GFC austerity measures slashed services, and older people bore much of the burden. Nordic countries, by contrast, maintained generous welfare and still managed robust growth.

The lesson seemed clear: balance was difficult but possible. Sustainability need not mean stripping away dignity.

The Political Divide

The Albanese Government resisted claims of reckless spending. They pointed to achieving budget surpluses in their first term before a return to deficit, and argued recent spending was necessary to support health, disability services, and cost-of-living relief during inflationary pressures.

Labor claimed that sustaining welfare bolstered consumer confidence and preserved Australia’s AAA credit rating. Cutting payments during a cost-of-living crisis, they warned, risked worsening the economy by slashing the spending power of low-income households.

What This Means for Australian Seniors

- No immediate changes are proposed—this is opposition policy positioning

- Any cuts would likely affect part-pension recipients first

- Supplementary payments and concessions could face review

- International comparisons suggest Australia’s welfare spending is moderate

- Stay informed through official government sources about any proposed changes

- Consider reviewing your financial situation and exploring additional income sources

Preparing for an Uncertain Future

For now, Age Pension recipients continued receiving payments as usual. But the debate stirred unease about what might come next.

Financial experts urged seniors to review income sources, consider whether part-time work or additional super contributions were feasible, and seek advice from financial counsellors where possible.

Community groups and advocacy organisations remained vital voices, providing seniors with updates and pushing back against proposals that threatened vulnerable groups. Staying connected to Services Australia and the Department of Social Services also ensured access to accurate information rather than speculation.

The Bigger Picture

Ley described her approach as ‘sustainable compassion’—an attempt to protect those most in need while trimming what she considered excess. But defining ‘genuine need’ would always be contentious.

With an ageing population and increasing life expectancy, the pressure on welfare would only intensify. For many seniors, the pension was not about dependency but about the social contract that recognised their contribution to the nation.

Her narrow leadership victory suggested even within her own party, opinions differed on how far reforms should go. The future of welfare remained an open debate—one that would likely dominate political discourse in the years to come.

What This Means For You

The Age Pension supported nearly two-thirds of Australians over 67, making it a cornerstone of retirement security for most seniors. Yet Sussan Ley’s warning that welfare dependency had gone too far raised fears that stricter means testing could be on the way. This came despite the fact that Australia’s welfare spending sat below the OECD median, challenging the idea that the nation was overspending.

For older Australians, the reality was clear—any cuts would not just be numbers on a budget sheet but would hit housing, healthcare, and dignity directly. Seniors who had worked their whole lives to build modern Australia deserved stability in retirement, not uncertainty about losing the support that kept them afloat.

The debate over welfare reform isn’t just political—it has very real consequences for those who rely on payments to make ends meet.

One recent change already making waves involves the government’s deeming rates, which directly affect how much support recipients keep in their pocket.

To understand how quickly a policy shift can reduce payments, here’s a closer look at a major update that recently hit thousands of people.

Read more: Your age pension could drop by $203 a fortnight: Major deeming rate changes hit 460,000 Australians

New push to cut Centrelink payments in Australia: ‘Not everyone is entitled to every government benefit’ — Daily Mail report on Sussan Ley’s warning that welfare dependency has gone too far and could trigger cuts.

https://www.dailymail.co.uk/news/ar...tml?ns_mchannel=rss&ns_campaign=1490&ito=1490

Age Pension rates (September 2025 to March 2026) — Provides up-to-date pension payment amounts, including fortnightly and annual figures for singles and couples.

https://www.superguide.com.au/in-retirement/age-pension-rates

Sussan Ley — Wikipedia profile of Ley’s political career, leadership role, and details of her election victory over Angus Taylor.

https://en.wikipedia.org/wiki/Sussan_Ley

Sussan Ley and the Liberal right: a short history • Karen Middleton — Analysis of Ley’s political background and achievements within the Liberal Party.

https://insidestory.org.au/sussan-ley-and-the-liberal-right-a-short-history/

About Sussan — The Hon. Sussan Ley MP — Official biography outlining her education, professional background, and political career milestones.

https://sussanley.com/about-sussan/

Welfare expenditure — Australian Institute of Health and Welfare report on government spending, noting $212.4 billion in 2021–22 and Australia’s position below the OECD median.

https://www.aihw.gov.au/reports/australias-welfare/welfare-expenditure

Losing access to a pension is more than losing money—it is losing independence, dignity, and peace of mind—so what part of this welfare debate worries you the most?