Ombudsman criticises Revenue NSW for trying to silence corruption watchdog complaints

By

ABC News

- Replies 0

A "deeply concerning" attempt by the NSW tax and fine collection agency to silence complaints and prevent people going to the corruption watchdog has been revealed, leading to a demand for a wideranging audit.

The NSW Ombudsman tabled a special report in state parliament on Monday, claiming the extraordinary action was warranted due to Revenue NSW's conduct.

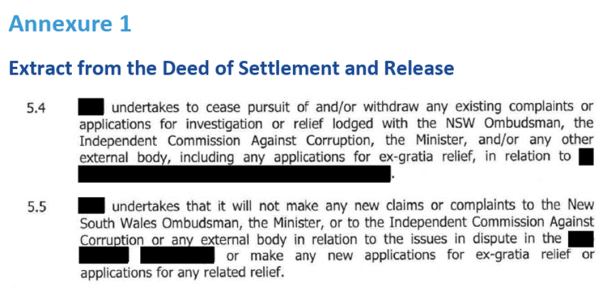

The agency tried to resolve a dispute using a deed of settlement and release, which explicitly stated complaints against it could not be lodged to the ombudsman or the Independent Commission Against Corruption (ICAC).

"The Deed impedes the work of integrity agencies, and is contrary to the public interest," ombudsman Paul Miller wrote in the report.

"The provision has a chilling effect on complaints and may result in agencies evading proper scrutiny."

The settlement contract also includes confidentiality clauses, prohibiting people who sign it from making its terms public.

The ICAC added taxpayers have a statutory right to complain to integrity agencies.

"Any attempt to enforce such a provision would also constitute detrimental action against a person for making a complaint," chief commissioner John Hatzistergos said, in response to a draft copy of the report.

The ombudsman said it came across the "deeply concerning" instance after reviewing public complaints made against Revenue NSW.

Revenue NSW acknowledges deed not 'appropriate'

Revenue NSW responded to the findings a week after receiving a copy of the ombudsman's draft report.

The agency said the deed was being used to settle a "prolonged" tax dispute last month, and that the contract passed a review conducted by the Crown Solicitor's Office.

"Even in such circumstances, I acknowledge that the inclusion of such terms was neither appropriate nor acceptable," deputy secretary Scott Johnston said.

He denied the problematic provision was part of the agency's standard practice, claiming similar provisions have not been spotted in other settlement contracts, in the week after learning about the report's findings.

But a research institute dedicated to preserving Australia's democratic foundations believes not enough is being done to determine if other agencies are including similar provisions in their contracts.

"There is every possibility that there could be 20 or 30 or hundreds of these deeds signed in circumstances where there could be instances of corrupt conduct within Revenue NSW and we wouldn't know," chair of the Centre for Public Integrity Anthony Whealy KC said.

Action sets 'dangerous precedent'

Mr Whealy said the risk of having the provision in more forms could be unchecked misconduct or corruption, as integrity agencies might not have had a basis to investigate.

"This is such a dangerous precedent and such a dangerous document that I think the only way the public could be satisfied was for a full audit to be carried out in all of the government departments."

His calls go beyond the recommendations made by Mr Miller, who instead recommended the Premier's Department and the Cabinet Office issue a directive to all government agencies, informing them "that this practice is inappropriate and unacceptable, and that it is not to be done".

Mr Miller also recommended Revenue NSW disregard any provision in a deed prohibiting someone from making complaints to integrity bodies, and to not take steps to enforce it.

The state government stopped short of committing to a course of action but condemned the use of the problematic provision.

"We'll have a look at [an audit] and whether there needs to be any reminders from the Department of Premier and cabinet," Acting Premier Ryan Park said.

"We have these instruments and agencies in place so that the community can have confidence in their public officials who administer their money."

Written by Tony Ibrahim, ABC News.