Lost Super: The $18 Billion Retirement Treasure Hunt for Aussie Seniors

- Replies 0

Imagine suddenly discovering tens of thousands of dollars you didn’t even know you had. It sounds like a late-night infomercial promise–but it actually happened to one Australian.

And for older Aussies, it could happen to you too.

A Perth mother of two in her late 50s, Fiona, recently got the surprise of her life after a quick five-minute check on her superannuation through the myGov website. She expected nothing unusual–yet to her astonishment, she found $45,000 sitting in a forgotten super account from a job 14 years ago.

'I nearly fell off my chair. I thought it was a joke,' Fiona said when she learned of her windfall. Once she confirmed the money was legitimately hers, the shock turned into relief and excitement.

Fiona’s now planning to put that surprise cash towards paying off her mortgage and boosting her retirement nest egg. And she’s urging others, especially fellow older Australians, to do a simple check of their own super accounts.

Fiona’s story might sound extraordinary, but she’s far from alone. In fact, she’s one of millions of Australians who have money languishing in 'lost' or unclaimed super accounts. According to the latest figures from the Australian Taxation Office (ATO), there’s about $17.8 billion in lost or unclaimed super waiting to be found, spread across more than 7.1 million account.

Yes, you read that right: nearly 18 billion dollars of Australians’ retirement savings are essentially misplaced–sitting with old super funds or the ATO, rather than in people’s pockets or investment accounts where they belong. Some of that money could very well be yours or someone you know.

One in five Australians holds multiple super accounts, often from changing jobs or super funds over the years. Each new job might have signed you up to a different default super fund, especially before recent reforms kicked in. If you’ve worked various jobs in your 20s, 30s, or 40s and never consolidated your super, you could be among those with more than one account to their name – and maybe an old account you’ve forgotten entirely.

Moving houses or changing contact details is another common culprit. Perhaps you shifted cities for a new job or downsized after the kids moved out, and in the process stopped getting statements from a super fund. If your fund doesn’t have your current address, they can’t reach you, and after a while your account may be flagged as 'lost' because you’ve become uncontactable.

In fact, super funds are allowed to classify an account as lost if they haven’t been able to contact you for 12 months and no contributions have come in during that time. Similarly, if an account hasn’t received any new contributions or rollovers in five years, it’s considered inactive–another pathway to the lost super pile. Over time, these orphaned accounts either sit idle with the super fund or get transferred to the ATO as unclaimed money, especially if the balances are small or the member has reached a certain age.

And then there’s simple forgetfulness. Many of us adopt a 'set and forget' mindset with superannuation, especially earlier in our careers when retirement feels a lifetime away. We contribute because it’s compulsory, skim the annual statements (if we bother to open them at all), and assume all is well.

National Seniors Australia calls this approach out bluntly: ‘Set and forget’ is a mistake for superannuation, whether you’re working or retired. The reality is that neglecting your super can lead to lost opportunities and even lost accounts. Over the decades, policies have changed and funds have merged or closed; if you haven’t kept your details up to date, your money can slip through the cracks of the system.

To give a sense of how disengaged people can be with their super: Four out of five Australians don’t even know how much money is being put into their super on their behalf, and many have no idea how much they’ve accumulated in total. It’s a classic out-of-sight, out-of-mind situation. But as retirement nears (or has already begun), what you don’t know can hurt you, or at least, it can leave you poorer than you should be.

It turns out there are very good reasons to care. For one, even retirees can have unclaimed super floating around. The ATO reports it is holding $471 million on behalf of people aged 65-plus–money that belongs to seniors who, for whatever reason, never claimed it. These could be small amounts from long-ago jobs or employer contributions that never found their way to your main fund. If you’ve ever changed your name (for example, after marriage) or forgotten to roll over an old workplace fund, there’s a chance some of your money didn’t follow you into retirement.

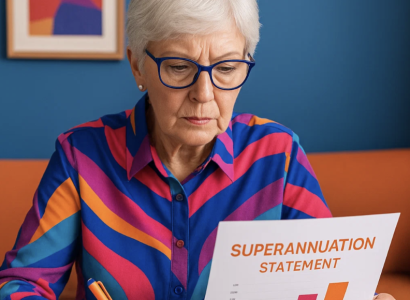

Australians have been urged to run a 'health check' on their superannuation to find lost or underperforming accounts. Many have been surprised by what they discover. Secondly, every dollar counts, particularly on a fixed income. With the cost of living biting hard, recovering a lost super account could mean an extra few hundred, a few thousand, or even tens of thousands of dollars back in your control. That could fund a dream holiday, pay for home improvements, bolster your medical fund, or simply give you more breathing room day-to-day.

As Fiona put it after finding her $45,000, those funds will help her pay off the mortgage faster and still leave 'plenty left over to live her life' in retirement. Not every forgotten account will be that large, of course – some might only hold a modest sum (one Aussie got a surprise deposit of about $198 from the ATO, essentially a mini 'second tax refund' representing lost super that was reunited with her). But whether it’s $200 or $20,000, why leave your own money on the table?

There’s also the issue of fees and charges. If you have multiple super accounts that you haven’t consolidated, you could be losing money each year to duplicate fees and insurance premiums. Each account often charges an annual admin fee, and many include life insurance or other cover that costs money. Unless you genuinely want or need those multiple insurance policies, those fees are eating away at your balance for no good reason. Combining your super into one preferred fund can save on fees, meaning more of your money stays invested and growing for you.

'Having super with more than one fund might be adding to your financial clutter,' says AustralianSuper’s education manager, Peter Treseder, who likens decluttering your super to tidying up your home – simplifying things can set you up for success. The simpler and leaner your super setup, the easier it is to manage and the less likely you are to lose track of any of it.

Even if you only have one super account, monitoring it regularly is important. Funds can make changes to your investment options or insurance as you age. 'A lot of the defaults are age-based,' financial advisor Kate McCallum explains. 'If you flip over an age category, you may find that you’ve been automatically moved out of, let’s say, a growth portfolio into a balanced, and that may not be what you want'.

In other words, if you’re not paying attention, your super fund might shift your money into more conservative investments once you hit a certain age, potentially impacting your returns. That could be fine, or it might not suit your plans at all. By checking your statements at least annually, you stay in the driver’s seat.

McCallum also recommends taking a look at what fees you’re paying, because these aren’t always obvious at a glance: 'You don’t see that investment management fee because it’s actually taken out of your investment returns,' she notes, and it can average around 1% of your balance every year Over time, that adds up. Ensuring your fees are reasonable (and that you’re not doubling up on fees via multiple accounts) is a smart move for anyone, but especially for those on the cusp of retirement who want to maximize every dollar.

In short, tracking your super isn’t just about finding lost money; it’s about making sure your hard-earned savings are working for you optimally. It’s about avoiding nasty surprises (like discovering your employer hadn’t paid some contributions–it happens–or that you’ve been paying for two insurance policies when one would do). And ultimately, it’s about peace of mind. As we age, financial peace of mind becomes just as valuable as physical health and security. Knowing exactly where your retirement money is and that it’s all accounted for can relieve a lot of stress.

'I feel stupid I didn’t do it earlier,' she admits, noting the online search via myGov took mere minutes and just her Tax File Number to yield results. 'You really do need to look after yourself. Spend a few minutes making sure everything you have worked for is attributed to you correctly,' Fiona says. In other words: it’s your money, make sure it finds its way home to you.

Fiona’s case might be exceptional in the dollar amount, but it’s not an isolated incident. In fact, in the past couple of years the ATO has stepped up efforts to proactively reunite people with unclaimed super. Since 2021, the tax office says it has already reunited nearly $6.4 billion of lost super with its rightful owners. Some of that has been through people taking action themselves, and some through government initiatives.

For example, if you’re over 65 or you have very small lost super balances (under $200), the ATO may even automatically pay that money out to you by depositing it into your bank account, provided they have your details. (This led to a few pleasant surprises, like that $198 'mystery deposit' one woman received out of the blue, which turned out to be her unclaimed super–a nice little bonus that she hadn’t expected.)

Still, despite these reunification efforts, the overall pool of lost and unclaimed super hasn’t disappeared–in fact, it’s grown in recent years. The total amount rose by about $4 billion since 2021, meaning new forgotten accounts are accumulating even as old ones are found. Part of that increase might simply be due to investment growth (super money left idle can still earn returns – or fees – which change the balance over time), but it’s also a sign that there are still millions of Australians who haven’t checked or consolidated everything yet. Procrastination, it seems, is alive and well.

The good news is that Australians are gradually becoming more aware of this issue. The government and super industry have been actively spreading the word. We’ve seen media stories on all major outlets – from ABC News talking about 'billions in lost money waiting to be claimed' to commercial news segments urging people to take a 'super health check.'

Even the name 'lost super' has a bit of an adventurous ring to it, as if your money went walkabout and needs rescuing. And who doesn’t love the idea of found money? It’s one of the rare instances in life where you can get a positive financial surprise.

Crucially, these stories are prompting action. According to Deputy Commissioner Emma Rosenzweig of the ATO, the agency wants to reunite people with their super and is imploring Aussies to take a look. 'If you’ve changed job, moved house or simply forgotten to update your details, you may have lost or unclaimed super,' Rosenzweig explains, and that applies even to those now retired. 'We’re urging Australians to check if some of the $17.8 billion in lost and unclaimed super belongs to them… Even if you’ve retired you could have lost or unclaimed super,' she says. That message is clearly targeted at older Australians as well: after all, nearly half a billion dollars of that stash is held for the 65+ age group alone.

What’s particularly heartening is that people like Fiona who do find their lost super often share their stories, creating a ripple effect. They remind their peers that it’s not too late to check. Fiona admits that during her working years in different jobs and moving around, she didn’t always prioritize keeping tabs on super. She even confessed that when statements from one old fund did arrive, she sometimes tossed them aside thinking they were just junk mail or advertising. (It’s an easy mistake: those envelopes often don’t exactly scream 'important financial info inside!')

But her wake-up call came when she learned about the rising trend of older women facing homelessness due to inadequate savings. That prompted her to finally do her 'homework' and hop onto myGov for a search. The result was life-changing. Now, she’s telling everyone who’ll listen to do the same: 'I tell everyone I come across to do a lost super search,' Fiona says. 'Make sure that everything you have worked for is attributed to you.'

By now you’re probably wondering: Alright, I’m convinced – so how do I actually check if I have any lost super, and how do I get it back?

Fortunately, it’s fairly easy and free to do it yourself. You don’t need to pay a cent to any third-party service or financial advisor just to find your own money. In fact, regulators like ASIC have warned that some companies advertise 'lost super search' or consolidation services that end up charging hefty fees–sometimes $500 or more, or even a percentage of the funds–for something you can do in a few minutes online at no cost. Save your money; you’ll want all of it for your retirement. Here’s a simple step-by-step guide to tracking down and reclaiming what’s yours:

1. Get your details in order (and get online if you can). First, make sure you have a myGov account set up, and that it’s linked to the ATO. MyGov is the government’s online portal that lets you access services like Medicare, Centrelink, and the ATO in one place. If you haven’t used it before, you’ll need to create an account (it’s straightforward – you just need an email and some personal details) and then link the ATO service by proving your identity (using your tax file number, address, etc.). Once that’s done, you’ll have access to information about your super. The ATO highly encourages using the online portal as the quickest way to do a 'super check'. If you’re not comfortable with the online route, there are alternatives: you can call the ATO’s automated super search line at 13 28 65 to inquire about lost super, or you can contact your super funds directly and ask them to search for any accounts in your name. But for most, the myGov method will be the simplest and most comprehensive, since it can show all your accounts in one place.

2. Check your contact details and TFN with each fund. Once you’re in the ATO’s online system (or while calling your fund), verify that your contact information is up to date – especially your postal address, email, and phone number. An outdated address is a big reason people become 'lost' members in the first place. Also ensure your tax file number (TFN) is on file with each of your super funds. Having your TFN linked is important: it helps funds and the ATO match accounts to you, and it can prevent unnecessary tax withholding. (Some older accounts might not have your TFN if you didn’t provide it back in the day–adding it now can reunite accounts or even avoid extra fees.) While you’re at it, check that your bank account details are updated with any fund or with the ATO. This is crucial if you’re eligible to withdraw some super money (for instance, if you’re over 65 or consolidating funds) so that any payments go to the right place.

3. Look for lost and unclaimed super. Now for the treasure hunt. Within the ATO online services, navigate to the section for Super. There will be an option to 'View super holdings' or 'Find lost super' (the wording might vary). This will search the ATO’s records for any super accounts associated with your name and TFN. It will list your active accounts (the ones you know about) and importantly, any lost or ATO-held super. This could include accounts from years ago that you forgot, or small amounts that were transferred to the ATO as unclaimed. If you use the myGov portal, from the Super menu you can select 'Fund details' to see all the accounts and details. Don’t be surprised if there’s something there, many of us have changed jobs or names, and it only takes one oversight to misplace an account. As Fiona learned, even a short stint at a job can leave behind a super account that quietly grows (or at least persists) without you realizing. If the system does show that you have ATO-held super or accounts you weren’t aware of, take note of them. Typically, it will show the fund name and member account number, and often a balance. In Fiona’s case, seeing the fund name jogged her memory of that old employer’s default fund from 14 years ago.

photo

4. Reclaim and consolidate your super. Once you’ve identified any lost super, the next step is to get it back under your control. The ATO’s online tool makes this easy too. You can choose to transfer (roll over) any lost super into your active super account right there through the online portal. There should be a 'Transfer Super' or 'Consolidate' option where you select which account you want to move money from and which account to move it to. If you have multiple active accounts and you’ve found extras, you’ll need to decide which fund you want to consolidate into – usually whichever has the best performance, lowest fees, or the one you’re most comfortable with. A lot of people choose their main current fund to consolidate everything into.

Important tip: Before consolidating, compare your funds’ fees, performance, and insurance. If one of your older accounts has particularly good insurance coverage that you still need and might lose by closing that account, you might consider keeping it or arranging replacement cover elsewhere. As ASIC notes, consolidation done wrong can sometimes cause unintended losses (like cancelling a life insurance policy you actually wanted to keep).

So, double-check those details. In most cases, though, consolidating is beneficial–it’s the decluttering we talked about earlier, potentially saving you money on fees and making life simpler. Peter Treseder from AustralianSuper points out that combining accounts means more of your super is invested in one place with the potential to grow, and fewer accounts makes it easier to keep track of everything. Many funds and the ATO offer guidance to ensure you don’t accidentally lose insurance you need; just be mindful as you go through the process.

If the lost super you’ve found is currently held by the ATO (unclaimed money) rather than still sitting in a fund, you have a slightly different option: you could withdraw it to your bank account, if you meet certain criteria. Specifically, if the amount is under $200, or if you’re over 65 years old, you can choose to have the ATO pay it out to you directly, rather than transferring it to a super fund.

This makes sense–for small amounts, or for people at retirement age, you might as well take the cash. The online system will let you do this withdrawal request, or you can call the ATO to arrange it. Be aware that if you’re under pension age and still working, generally it’s better to roll the money into your super (since you typically can’t access it until retirement anyway, and it can continue to grow in super). But if you’re eligible to withdraw and you need the money now, it’s your call.

5. Keep an eye on things going forward. Congratulations if you’ve managed to track down and consolidate any lost super! The final step is ensuring you don’t lose track again. This is as simple as making a habit of checking your super at least once a year. A great time to do this is when you’re doing your taxes–the ATO itself suggests doing an annual 'super health check' around tax time. Think of it like an annual medical check-up, but for your finances.

Log into myGov, glance over your super balances, make sure your employer contributions (if you’re still receiving them) have been going in on time, and verify your contact details are current. If anything looks off, say, a contribution is missing, speak up. Contact your employer or fund; in a worst-case scenario where an employer hasn’t paid what they should, you can report it to the ATO. Also, review your beneficiary nominations periodically. This isn’t about finding money, but it ensures that if something happens to you, whatever you’ve accumulated in super goes to the loved ones you intend. Many people don’t realize that their will does not cover superannuation by default. You have to nominate beneficiaries with your super fund directly. Most binding nominations need updating every three years to stay valid, although some funds allow non-expiring nominations. It’s wise to confirm yours is up to date–it saves your family a lot of hassle down the track.

Finally, be sure to guard your super details against scammers. Unfortunately, wherever there’s money, there can be opportunists. If someone calls out of the blue claiming they can help you access lost super (especially for a fee), or pressures you to share personal details, it’s likely a scam. The ATO and super funds don’t cold-call people to ask for passwords or TFNs. Always use official channels–such as the myGov website or calling your fund’s publicly listed number–to handle your super. And as mentioned, you don’t need to pay third parties to find or consolidate super for you. As ASIC cautions, some so-called 'free' super find services have hidden charges that could eat up a chunk of your balance in fees. Just say no to those offers and DIY instead.

Not only might you reclaim money that you’d forgotten about, but you’ll also gain a clearer picture of your retirement resources. You’ll know exactly which fund is holding your nest egg, what it’s invested in, what fees you’re paying, and who the money will go to when the time comes. It transforms super from a murky, confusing concept into something you have a handle on. And once it’s done, you typically won’t have to do it again – at least not with the same urgency.

With new rules in place (like the government’s 'stapling' reform, which now ensures that when you change jobs your super account follows you to the new employer unless you choose otherwise), the era of people collecting a new super account with every new job is largely over. That means future generations should see far fewer lost accounts. But for those of us who built our careers in the decades before, there’s some cleanup duty to attend to, and it’s worth doing.

In an era when we constantly hear about the challenges facing retirees–from rising healthcare costs to pension eligibility and economic uncertainty–it’s nice to have a win. Finding your own money and boosting your retirement savings without having to scrimp or save an extra cent is definitely a win. It’s like discovering a long-forgotten bank account that’s been quietly accruing value for you. Some folks have even compared it to a mini lotto win, except it’s not luck at all, it’s literally your wages and contributions that you earned fair and square.

So as you enjoy your hard-earned retirement or plan for the years ahead, take a moment to consider whether some of your money is still out there, waiting for you to claim it. The process is easier than ever, and as we’ve seen, it can pay off in a big way. As National Seniors Australia has said, treating super as a 'set and forget' proposition is a mistake, instead, set aside a bit of time to give it the attention it deserves. You might end up with a richer retirement for it.

In the end, the whole idea of lost super boils down to this: it’s your money, and nobody will care about it more than you. Governments and funds are improving systems to help, but the person best positioned to look after your super is you. The steps are straightforward, the resources are there, and there’s friendly help available if you need it (from the ATO, your fund, or community organizations helping seniors with digital services). With a little effort, you can make sure every dollar you’ve earned finds its way back under your watch.

Now, a question to ponder: If you discovered extra money in your super tomorrow, what difference would it make to your life today, and isn’t it worth taking a look to find out?

Read more: Call for change: Is it time to reform the Work Bonus for pensioners?

And for older Aussies, it could happen to you too.

A Perth mother of two in her late 50s, Fiona, recently got the surprise of her life after a quick five-minute check on her superannuation through the myGov website. She expected nothing unusual–yet to her astonishment, she found $45,000 sitting in a forgotten super account from a job 14 years ago.

'I nearly fell off my chair. I thought it was a joke,' Fiona said when she learned of her windfall. Once she confirmed the money was legitimately hers, the shock turned into relief and excitement.

Fiona’s now planning to put that surprise cash towards paying off her mortgage and boosting her retirement nest egg. And she’s urging others, especially fellow older Australians, to do a simple check of their own super accounts.

Fiona’s story might sound extraordinary, but she’s far from alone. In fact, she’s one of millions of Australians who have money languishing in 'lost' or unclaimed super accounts. According to the latest figures from the Australian Taxation Office (ATO), there’s about $17.8 billion in lost or unclaimed super waiting to be found, spread across more than 7.1 million account.

Yes, you read that right: nearly 18 billion dollars of Australians’ retirement savings are essentially misplaced–sitting with old super funds or the ATO, rather than in people’s pockets or investment accounts where they belong. Some of that money could very well be yours or someone you know.

How Does Super Go 'Missing' in the First Place?

To many, the idea of losing superannuation sounds odd. After all, it’s not like forgetting where you put your car keys. Yet it happens more often than you might think. Life has a way of making us lose track of things, and super is no exception.One in five Australians holds multiple super accounts, often from changing jobs or super funds over the years. Each new job might have signed you up to a different default super fund, especially before recent reforms kicked in. If you’ve worked various jobs in your 20s, 30s, or 40s and never consolidated your super, you could be among those with more than one account to their name – and maybe an old account you’ve forgotten entirely.

Moving houses or changing contact details is another common culprit. Perhaps you shifted cities for a new job or downsized after the kids moved out, and in the process stopped getting statements from a super fund. If your fund doesn’t have your current address, they can’t reach you, and after a while your account may be flagged as 'lost' because you’ve become uncontactable.

In fact, super funds are allowed to classify an account as lost if they haven’t been able to contact you for 12 months and no contributions have come in during that time. Similarly, if an account hasn’t received any new contributions or rollovers in five years, it’s considered inactive–another pathway to the lost super pile. Over time, these orphaned accounts either sit idle with the super fund or get transferred to the ATO as unclaimed money, especially if the balances are small or the member has reached a certain age.

And then there’s simple forgetfulness. Many of us adopt a 'set and forget' mindset with superannuation, especially earlier in our careers when retirement feels a lifetime away. We contribute because it’s compulsory, skim the annual statements (if we bother to open them at all), and assume all is well.

National Seniors Australia calls this approach out bluntly: ‘Set and forget’ is a mistake for superannuation, whether you’re working or retired. The reality is that neglecting your super can lead to lost opportunities and even lost accounts. Over the decades, policies have changed and funds have merged or closed; if you haven’t kept your details up to date, your money can slip through the cracks of the system.

To give a sense of how disengaged people can be with their super: Four out of five Australians don’t even know how much money is being put into their super on their behalf, and many have no idea how much they’ve accumulated in total. It’s a classic out-of-sight, out-of-mind situation. But as retirement nears (or has already begun), what you don’t know can hurt you, or at least, it can leave you poorer than you should be.

Why Tracking Your Super Matters – Especially for Seniors

If you’re over 60, you might be thinking: 'Well, I’m already retired (or close to it). I’ve got my super sorted, and maybe I’m drawing an income from it. Why should I worry about lost super now?'It turns out there are very good reasons to care. For one, even retirees can have unclaimed super floating around. The ATO reports it is holding $471 million on behalf of people aged 65-plus–money that belongs to seniors who, for whatever reason, never claimed it. These could be small amounts from long-ago jobs or employer contributions that never found their way to your main fund. If you’ve ever changed your name (for example, after marriage) or forgotten to roll over an old workplace fund, there’s a chance some of your money didn’t follow you into retirement.

Australians have been urged to run a 'health check' on their superannuation to find lost or underperforming accounts. Many have been surprised by what they discover. Secondly, every dollar counts, particularly on a fixed income. With the cost of living biting hard, recovering a lost super account could mean an extra few hundred, a few thousand, or even tens of thousands of dollars back in your control. That could fund a dream holiday, pay for home improvements, bolster your medical fund, or simply give you more breathing room day-to-day.

As Fiona put it after finding her $45,000, those funds will help her pay off the mortgage faster and still leave 'plenty left over to live her life' in retirement. Not every forgotten account will be that large, of course – some might only hold a modest sum (one Aussie got a surprise deposit of about $198 from the ATO, essentially a mini 'second tax refund' representing lost super that was reunited with her). But whether it’s $200 or $20,000, why leave your own money on the table?

There’s also the issue of fees and charges. If you have multiple super accounts that you haven’t consolidated, you could be losing money each year to duplicate fees and insurance premiums. Each account often charges an annual admin fee, and many include life insurance or other cover that costs money. Unless you genuinely want or need those multiple insurance policies, those fees are eating away at your balance for no good reason. Combining your super into one preferred fund can save on fees, meaning more of your money stays invested and growing for you.

'Having super with more than one fund might be adding to your financial clutter,' says AustralianSuper’s education manager, Peter Treseder, who likens decluttering your super to tidying up your home – simplifying things can set you up for success. The simpler and leaner your super setup, the easier it is to manage and the less likely you are to lose track of any of it.

Even if you only have one super account, monitoring it regularly is important. Funds can make changes to your investment options or insurance as you age. 'A lot of the defaults are age-based,' financial advisor Kate McCallum explains. 'If you flip over an age category, you may find that you’ve been automatically moved out of, let’s say, a growth portfolio into a balanced, and that may not be what you want'.

In other words, if you’re not paying attention, your super fund might shift your money into more conservative investments once you hit a certain age, potentially impacting your returns. That could be fine, or it might not suit your plans at all. By checking your statements at least annually, you stay in the driver’s seat.

McCallum also recommends taking a look at what fees you’re paying, because these aren’t always obvious at a glance: 'You don’t see that investment management fee because it’s actually taken out of your investment returns,' she notes, and it can average around 1% of your balance every year Over time, that adds up. Ensuring your fees are reasonable (and that you’re not doubling up on fees via multiple accounts) is a smart move for anyone, but especially for those on the cusp of retirement who want to maximize every dollar.

In short, tracking your super isn’t just about finding lost money; it’s about making sure your hard-earned savings are working for you optimally. It’s about avoiding nasty surprises (like discovering your employer hadn’t paid some contributions–it happens–or that you’ve been paying for two insurance policies when one would do). And ultimately, it’s about peace of mind. As we age, financial peace of mind becomes just as valuable as physical health and security. Knowing exactly where your retirement money is and that it’s all accounted for can relieve a lot of stress.

Lost Super, Found Money: Real-Life Reunions with Forgotten Funds

If you’re feeling a bit guilty now about neglecting your super, don’t be too hard on yourself. You’re in very good company, and the tide is turning as more people share stories of reuniting with their long-lost superannuation. We’ve already heard Fiona’s story, which reads like a modern-day treasure hunt yielding buried gold. She’s now something of a superannuation evangelist, encouraging friends and colleagues – especially women who may have gaps in work history due to raising children or caring for family – to take a few minutes and do a lost super search.'I feel stupid I didn’t do it earlier,' she admits, noting the online search via myGov took mere minutes and just her Tax File Number to yield results. 'You really do need to look after yourself. Spend a few minutes making sure everything you have worked for is attributed to you correctly,' Fiona says. In other words: it’s your money, make sure it finds its way home to you.

Fiona’s case might be exceptional in the dollar amount, but it’s not an isolated incident. In fact, in the past couple of years the ATO has stepped up efforts to proactively reunite people with unclaimed super. Since 2021, the tax office says it has already reunited nearly $6.4 billion of lost super with its rightful owners. Some of that has been through people taking action themselves, and some through government initiatives.

For example, if you’re over 65 or you have very small lost super balances (under $200), the ATO may even automatically pay that money out to you by depositing it into your bank account, provided they have your details. (This led to a few pleasant surprises, like that $198 'mystery deposit' one woman received out of the blue, which turned out to be her unclaimed super–a nice little bonus that she hadn’t expected.)

Still, despite these reunification efforts, the overall pool of lost and unclaimed super hasn’t disappeared–in fact, it’s grown in recent years. The total amount rose by about $4 billion since 2021, meaning new forgotten accounts are accumulating even as old ones are found. Part of that increase might simply be due to investment growth (super money left idle can still earn returns – or fees – which change the balance over time), but it’s also a sign that there are still millions of Australians who haven’t checked or consolidated everything yet. Procrastination, it seems, is alive and well.

The good news is that Australians are gradually becoming more aware of this issue. The government and super industry have been actively spreading the word. We’ve seen media stories on all major outlets – from ABC News talking about 'billions in lost money waiting to be claimed' to commercial news segments urging people to take a 'super health check.'

Even the name 'lost super' has a bit of an adventurous ring to it, as if your money went walkabout and needs rescuing. And who doesn’t love the idea of found money? It’s one of the rare instances in life where you can get a positive financial surprise.

Crucially, these stories are prompting action. According to Deputy Commissioner Emma Rosenzweig of the ATO, the agency wants to reunite people with their super and is imploring Aussies to take a look. 'If you’ve changed job, moved house or simply forgotten to update your details, you may have lost or unclaimed super,' Rosenzweig explains, and that applies even to those now retired. 'We’re urging Australians to check if some of the $17.8 billion in lost and unclaimed super belongs to them… Even if you’ve retired you could have lost or unclaimed super,' she says. That message is clearly targeted at older Australians as well: after all, nearly half a billion dollars of that stash is held for the 65+ age group alone.

What’s particularly heartening is that people like Fiona who do find their lost super often share their stories, creating a ripple effect. They remind their peers that it’s not too late to check. Fiona admits that during her working years in different jobs and moving around, she didn’t always prioritize keeping tabs on super. She even confessed that when statements from one old fund did arrive, she sometimes tossed them aside thinking they were just junk mail or advertising. (It’s an easy mistake: those envelopes often don’t exactly scream 'important financial info inside!')

But her wake-up call came when she learned about the rising trend of older women facing homelessness due to inadequate savings. That prompted her to finally do her 'homework' and hop onto myGov for a search. The result was life-changing. Now, she’s telling everyone who’ll listen to do the same: 'I tell everyone I come across to do a lost super search,' Fiona says. 'Make sure that everything you have worked for is attributed to you.'

A Practical Guide: How to Track and Recover Your Lost Super

By now you’re probably wondering: Alright, I’m convinced – so how do I actually check if I have any lost super, and how do I get it back?

Fortunately, it’s fairly easy and free to do it yourself. You don’t need to pay a cent to any third-party service or financial advisor just to find your own money. In fact, regulators like ASIC have warned that some companies advertise 'lost super search' or consolidation services that end up charging hefty fees–sometimes $500 or more, or even a percentage of the funds–for something you can do in a few minutes online at no cost. Save your money; you’ll want all of it for your retirement. Here’s a simple step-by-step guide to tracking down and reclaiming what’s yours:

1. Get your details in order (and get online if you can). First, make sure you have a myGov account set up, and that it’s linked to the ATO. MyGov is the government’s online portal that lets you access services like Medicare, Centrelink, and the ATO in one place. If you haven’t used it before, you’ll need to create an account (it’s straightforward – you just need an email and some personal details) and then link the ATO service by proving your identity (using your tax file number, address, etc.). Once that’s done, you’ll have access to information about your super. The ATO highly encourages using the online portal as the quickest way to do a 'super check'. If you’re not comfortable with the online route, there are alternatives: you can call the ATO’s automated super search line at 13 28 65 to inquire about lost super, or you can contact your super funds directly and ask them to search for any accounts in your name. But for most, the myGov method will be the simplest and most comprehensive, since it can show all your accounts in one place.

2. Check your contact details and TFN with each fund. Once you’re in the ATO’s online system (or while calling your fund), verify that your contact information is up to date – especially your postal address, email, and phone number. An outdated address is a big reason people become 'lost' members in the first place. Also ensure your tax file number (TFN) is on file with each of your super funds. Having your TFN linked is important: it helps funds and the ATO match accounts to you, and it can prevent unnecessary tax withholding. (Some older accounts might not have your TFN if you didn’t provide it back in the day–adding it now can reunite accounts or even avoid extra fees.) While you’re at it, check that your bank account details are updated with any fund or with the ATO. This is crucial if you’re eligible to withdraw some super money (for instance, if you’re over 65 or consolidating funds) so that any payments go to the right place.

3. Look for lost and unclaimed super. Now for the treasure hunt. Within the ATO online services, navigate to the section for Super. There will be an option to 'View super holdings' or 'Find lost super' (the wording might vary). This will search the ATO’s records for any super accounts associated with your name and TFN. It will list your active accounts (the ones you know about) and importantly, any lost or ATO-held super. This could include accounts from years ago that you forgot, or small amounts that were transferred to the ATO as unclaimed. If you use the myGov portal, from the Super menu you can select 'Fund details' to see all the accounts and details. Don’t be surprised if there’s something there, many of us have changed jobs or names, and it only takes one oversight to misplace an account. As Fiona learned, even a short stint at a job can leave behind a super account that quietly grows (or at least persists) without you realizing. If the system does show that you have ATO-held super or accounts you weren’t aware of, take note of them. Typically, it will show the fund name and member account number, and often a balance. In Fiona’s case, seeing the fund name jogged her memory of that old employer’s default fund from 14 years ago.

photo

4. Reclaim and consolidate your super. Once you’ve identified any lost super, the next step is to get it back under your control. The ATO’s online tool makes this easy too. You can choose to transfer (roll over) any lost super into your active super account right there through the online portal. There should be a 'Transfer Super' or 'Consolidate' option where you select which account you want to move money from and which account to move it to. If you have multiple active accounts and you’ve found extras, you’ll need to decide which fund you want to consolidate into – usually whichever has the best performance, lowest fees, or the one you’re most comfortable with. A lot of people choose their main current fund to consolidate everything into.

Important tip: Before consolidating, compare your funds’ fees, performance, and insurance. If one of your older accounts has particularly good insurance coverage that you still need and might lose by closing that account, you might consider keeping it or arranging replacement cover elsewhere. As ASIC notes, consolidation done wrong can sometimes cause unintended losses (like cancelling a life insurance policy you actually wanted to keep).

So, double-check those details. In most cases, though, consolidating is beneficial–it’s the decluttering we talked about earlier, potentially saving you money on fees and making life simpler. Peter Treseder from AustralianSuper points out that combining accounts means more of your super is invested in one place with the potential to grow, and fewer accounts makes it easier to keep track of everything. Many funds and the ATO offer guidance to ensure you don’t accidentally lose insurance you need; just be mindful as you go through the process.

If the lost super you’ve found is currently held by the ATO (unclaimed money) rather than still sitting in a fund, you have a slightly different option: you could withdraw it to your bank account, if you meet certain criteria. Specifically, if the amount is under $200, or if you’re over 65 years old, you can choose to have the ATO pay it out to you directly, rather than transferring it to a super fund.

This makes sense–for small amounts, or for people at retirement age, you might as well take the cash. The online system will let you do this withdrawal request, or you can call the ATO to arrange it. Be aware that if you’re under pension age and still working, generally it’s better to roll the money into your super (since you typically can’t access it until retirement anyway, and it can continue to grow in super). But if you’re eligible to withdraw and you need the money now, it’s your call.

5. Keep an eye on things going forward. Congratulations if you’ve managed to track down and consolidate any lost super! The final step is ensuring you don’t lose track again. This is as simple as making a habit of checking your super at least once a year. A great time to do this is when you’re doing your taxes–the ATO itself suggests doing an annual 'super health check' around tax time. Think of it like an annual medical check-up, but for your finances.

Log into myGov, glance over your super balances, make sure your employer contributions (if you’re still receiving them) have been going in on time, and verify your contact details are current. If anything looks off, say, a contribution is missing, speak up. Contact your employer or fund; in a worst-case scenario where an employer hasn’t paid what they should, you can report it to the ATO. Also, review your beneficiary nominations periodically. This isn’t about finding money, but it ensures that if something happens to you, whatever you’ve accumulated in super goes to the loved ones you intend. Many people don’t realize that their will does not cover superannuation by default. You have to nominate beneficiaries with your super fund directly. Most binding nominations need updating every three years to stay valid, although some funds allow non-expiring nominations. It’s wise to confirm yours is up to date–it saves your family a lot of hassle down the track.

Finally, be sure to guard your super details against scammers. Unfortunately, wherever there’s money, there can be opportunists. If someone calls out of the blue claiming they can help you access lost super (especially for a fee), or pressures you to share personal details, it’s likely a scam. The ATO and super funds don’t cold-call people to ask for passwords or TFNs. Always use official channels–such as the myGov website or calling your fund’s publicly listed number–to handle your super. And as mentioned, you don’t need to pay third parties to find or consolidate super for you. As ASIC cautions, some so-called 'free' super find services have hidden charges that could eat up a chunk of your balance in fees. Just say no to those offers and DIY instead.

Bringing Your Money Home – The Benefits of a Super Spring Clean

There’s a certain satisfaction in getting one’s affairs in order, and superannuation is a big one. Think of tracking down lost super as doing a long-overdue cleanup of your financial house. It might take an afternoon of effort, but the payoff can be tangible (money back in your pocket) and intangible (peace of mind and simplicity). As Peter Treseder elegantly put it, 'Decluttering your super is like tidying up your home'–you’re organising your finances to set yourself up for a more secure future. For many older Australians, especially those who’ve had multiple jobs or career breaks in the past, this process can be incredibly empowering.Not only might you reclaim money that you’d forgotten about, but you’ll also gain a clearer picture of your retirement resources. You’ll know exactly which fund is holding your nest egg, what it’s invested in, what fees you’re paying, and who the money will go to when the time comes. It transforms super from a murky, confusing concept into something you have a handle on. And once it’s done, you typically won’t have to do it again – at least not with the same urgency.

With new rules in place (like the government’s 'stapling' reform, which now ensures that when you change jobs your super account follows you to the new employer unless you choose otherwise), the era of people collecting a new super account with every new job is largely over. That means future generations should see far fewer lost accounts. But for those of us who built our careers in the decades before, there’s some cleanup duty to attend to, and it’s worth doing.

In an era when we constantly hear about the challenges facing retirees–from rising healthcare costs to pension eligibility and economic uncertainty–it’s nice to have a win. Finding your own money and boosting your retirement savings without having to scrimp or save an extra cent is definitely a win. It’s like discovering a long-forgotten bank account that’s been quietly accruing value for you. Some folks have even compared it to a mini lotto win, except it’s not luck at all, it’s literally your wages and contributions that you earned fair and square.

So as you enjoy your hard-earned retirement or plan for the years ahead, take a moment to consider whether some of your money is still out there, waiting for you to claim it. The process is easier than ever, and as we’ve seen, it can pay off in a big way. As National Seniors Australia has said, treating super as a 'set and forget' proposition is a mistake, instead, set aside a bit of time to give it the attention it deserves. You might end up with a richer retirement for it.

In the end, the whole idea of lost super boils down to this: it’s your money, and nobody will care about it more than you. Governments and funds are improving systems to help, but the person best positioned to look after your super is you. The steps are straightforward, the resources are there, and there’s friendly help available if you need it (from the ATO, your fund, or community organizations helping seniors with digital services). With a little effort, you can make sure every dollar you’ve earned finds its way back under your watch.

Now, a question to ponder: If you discovered extra money in your super tomorrow, what difference would it make to your life today, and isn’t it worth taking a look to find out?

Read more: Call for change: Is it time to reform the Work Bonus for pensioners?

Last edited: