Karl Stefanovic launches scathing attack on 'greedy' banks after latest interest rate hike

- Replies 13

It's a fact of life these days — when the Reserve Bank of Australia speaks, it’s to announce an interest rate hike. This often signals tougher days ahead, at least in terms of finances, for everyday Aussies and seniors across the nation.

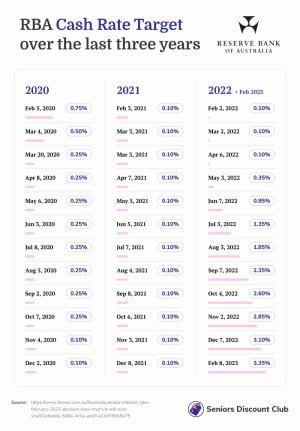

Just recently, RBA Governor Philip Lowe released a statement outlining that the bank would be raising interest rates by another 25 basis points (0.25 per cent).

This brings the current target cash rate by the central bank to 3.35 per cent after nine straight months of increases — the last of which was another 25 basis point (or 0.25 per cent) hike last December at 3.10 per cent.

Unfortunately, along with the hike comes a slew of problems for retirees, homeowners, investors with mortgage debt, and those who depend on their savings with banks like ANZ and NAB set to reflect the change in monetary policy.

Today show host Karl Stefanovic, perhaps among the many exhausted from yet another sign of belt-tightening, unleashed an impassioned and scathing rant towards the big banks and the RBA.

'I’m completely off the RBA and the big banks this morning… Hard-working Australians are being let down,' Stefanovic bluntly stated during the first hour of the show on Wednesday.

He then continued his impassioned attack against the major banks, alluding to their community-focused image as a giant farce.

'What about our banks this morning? Our kind-hearted, community-focused banks,’ he said.

‘You’ve all seen the ads, “We care about you, we see you.”’

'But how much do they really care? Do you remember during the pandemic when we had rate cuts, the banks seldom passed them on, and now they‘re like greedy moths to the flame, eating away at your savings, eating into your standard of living, eating into your future? They should be ashamed of themselves.'

Stefanovic's comments echoed the views of Nick McKim, Treasury spokesman for the Greens, who had earlier stated that the RBA was ‘willing to smash Australia into recession’ with its pro-rich policy.

The NSW Premier, Dominic Perrottet, also shared his distaste at the banks' decision to raise interest rates, claiming it would 'hurt household budgets' and referring to the banks' 'double standards' when it came to rate hikes in the past.

‘I was Treasurer of this state for five years. During some of the darkest days in the pandemic when the Reserve Bank was cutting rates,’ he said.

‘Only on one occasion did the banks pass that rate cut on in full, and on another occasion, they didn’t pass it on in full.’

‘They’re very quick to raise rates but not very quick to cut them.’

Source: YouTube/Test 5

Initial reports said that NAB and ANZ announced an increase in rates. NAB won’t be passing the change on to savings clients for the time being, while ANZ Plus Save account holders will now be seeing a 4 per cent interest rate.

Steve Mickenbecker of Canstar expects this most recent rate hike to hit many Aussies already reeling from high costs of living.

‘The increased cost of living is eroding our household budget. Every cost is going up and we are looking for ways to save on groceries, phone plans, petrol, electricity, insurances and everything else,’ he said.

‘There is no line in the household budget that is hurting borrowers more than the home loan. Nor is there one that has the potential for greater savings.’

‘The $500,000 home loan will be up by $12,000 this coming year.

‘That $12,000 increase is the equivalent of your annual home insurance, car insurance, electricity bills, home internet and mobile phone plan.

‘It underlines which expense is the real big picture for your finances.’

And in case you’re hoping that this will be the last of rate hikes to come, the RBA said in a statement announcing the hike that more will be needed to tamp down on soaring inflation.

‘The Board’s priority is to return inflation to target,’ the RBA said.

‘High inflation makes life difficult for people and damages the functioning of the economy. And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later.’

‘The Board is seeking to return inflation to the 2–3 per cent range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one.

‘The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.

‘In assessing how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.

‘The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.’

Er… with what’s looming ahead, you might be interested in how to shop smarter at the grocery store.

What are your thoughts on this most recent interest rate hike by the RBA? Do you share Karl’s views, or do you agree with the central bank that this is necessary to control inflation?

And in the meantime, what adjustments will you make, if there are any, to the anticipated effects of the development?

Tell us your thoughts below!

Source: YouTube/ABC News Australia

Just recently, RBA Governor Philip Lowe released a statement outlining that the bank would be raising interest rates by another 25 basis points (0.25 per cent).

This brings the current target cash rate by the central bank to 3.35 per cent after nine straight months of increases — the last of which was another 25 basis point (or 0.25 per cent) hike last December at 3.10 per cent.

Unfortunately, along with the hike comes a slew of problems for retirees, homeowners, investors with mortgage debt, and those who depend on their savings with banks like ANZ and NAB set to reflect the change in monetary policy.

Today show host Karl Stefanovic, perhaps among the many exhausted from yet another sign of belt-tightening, unleashed an impassioned and scathing rant towards the big banks and the RBA.

'I’m completely off the RBA and the big banks this morning… Hard-working Australians are being let down,' Stefanovic bluntly stated during the first hour of the show on Wednesday.

Today host Karl Stefanovic had some choice words for banks after the RBA announced the ninth straight interest rate hike. Image Credit: YouTube/Test 5

He then continued his impassioned attack against the major banks, alluding to their community-focused image as a giant farce.

'What about our banks this morning? Our kind-hearted, community-focused banks,’ he said.

‘You’ve all seen the ads, “We care about you, we see you.”’

'But how much do they really care? Do you remember during the pandemic when we had rate cuts, the banks seldom passed them on, and now they‘re like greedy moths to the flame, eating away at your savings, eating into your standard of living, eating into your future? They should be ashamed of themselves.'

Stefanovic's comments echoed the views of Nick McKim, Treasury spokesman for the Greens, who had earlier stated that the RBA was ‘willing to smash Australia into recession’ with its pro-rich policy.

The NSW Premier, Dominic Perrottet, also shared his distaste at the banks' decision to raise interest rates, claiming it would 'hurt household budgets' and referring to the banks' 'double standards' when it came to rate hikes in the past.

‘I was Treasurer of this state for five years. During some of the darkest days in the pandemic when the Reserve Bank was cutting rates,’ he said.

‘Only on one occasion did the banks pass that rate cut on in full, and on another occasion, they didn’t pass it on in full.’

‘They’re very quick to raise rates but not very quick to cut them.’

Source: YouTube/Test 5

Initial reports said that NAB and ANZ announced an increase in rates. NAB won’t be passing the change on to savings clients for the time being, while ANZ Plus Save account holders will now be seeing a 4 per cent interest rate.

Steve Mickenbecker of Canstar expects this most recent rate hike to hit many Aussies already reeling from high costs of living.

‘The increased cost of living is eroding our household budget. Every cost is going up and we are looking for ways to save on groceries, phone plans, petrol, electricity, insurances and everything else,’ he said.

‘There is no line in the household budget that is hurting borrowers more than the home loan. Nor is there one that has the potential for greater savings.’

‘The $500,000 home loan will be up by $12,000 this coming year.

‘That $12,000 increase is the equivalent of your annual home insurance, car insurance, electricity bills, home internet and mobile phone plan.

‘It underlines which expense is the real big picture for your finances.’

Key Takeaways

- Karl Stefanovic has unleashed on the ‘greedy’ big banks after the RBA issued a ninth consecutive interest rate hike.

- NSW Premier Dominic Perrottet accused banks of ‘double standards’ over recent rate rises.

- The change is expected to hit those with home loans hard, with expected interest rate hikes said to push an extra $12,000 towards Aussies already struggling to make ends meet.

- The RBA also admitted further rate hikes are on the horizon.

‘The Board’s priority is to return inflation to target,’ the RBA said.

‘High inflation makes life difficult for people and damages the functioning of the economy. And if high inflation were to become entrenched in people’s expectations, it would be very costly to reduce later.’

‘The Board is seeking to return inflation to the 2–3 per cent range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one.

‘The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.

‘In assessing how much further interest rates need to increase, the Board will be paying close attention to developments in the global economy, trends in household spending and the outlook for inflation and the labour market.

‘The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.’

Er… with what’s looming ahead, you might be interested in how to shop smarter at the grocery store.

What are your thoughts on this most recent interest rate hike by the RBA? Do you share Karl’s views, or do you agree with the central bank that this is necessary to control inflation?

And in the meantime, what adjustments will you make, if there are any, to the anticipated effects of the development?

Tell us your thoughts below!

Source: YouTube/ABC News Australia