Is owning an average Australian house becoming impossible? The latest interest rate hike just made it 3x harder!

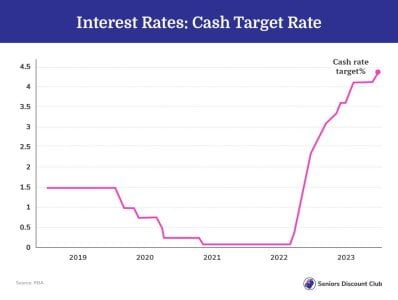

When the Reserve Bank of Australia (RBA) announced an increase in the cash rate to 4.35 per cent, it felt like the inevitable.

Prior to the 25 basis point hike, experts seemed nearly unanimous on an increase, driven partly by still-high inflation.

Unfortunately, this interest rate hike just made it a whole lot harder—near impossible, even—for the average homeowner to buy a house at median prices in Australia, which are around $926,899.

Price comparison website Finder's data shows that the average Australian household now needs a minimum wage of $182,000—nearly three times the median income of $65,000 from 2022—to do the feat, which is no small task considering the cost-of-living crisis.

Meanwhile, to afford the average Australian apartment, which costs $659,130, the average single-income household would need a salary of almost $130,000.

It’s a big ask for even the most fortunate double-income households.

This means that those with $590,000 mortgages would be paying an additional $1,345 every month compared to April 2022.

Finder’s Head of Consumer Research Graham Cooke shared some alarming figures that further highlight how significant a burden this hike will be for mortgage holders.

‘That’s a huge amount of extra money to be spending on your mortgage, especially when the cost of almost everything else is also going up,’ said Cooke.

He further pointed out that the decision to increase the cash rate would most adversely affect mortgage holders, causing them to be ‘already on the ropes’.

Although the rate hike was widely anticipated, it has faced substantial criticism due to the disproportionate burden it will place on individuals with lower incomes.

‘The RBA’s decision to lift the cash rate to 4.35 per cent will hurt people with low incomes the most,’ explained Australian Council of Social Service CEO Cassandra Goldie.

‘The worthy goal of reducing inflation must not come at the expense of jobs and incomes…’

‘Instead of relying solely on the blunt tool of rate rises, the government must step in to aid the RBA with measures to tackle inflation at its roots.’

‘This should include working with states and territories to curb soaring rents and additional measures to bring down energy bills for those who can least afford it.’

The RBA’s announcement of a 4.35 per cent interest rate increase yesterday was expected by some economists due to the higher-than-expected inflation figures from the previous month.

However, subsequent data showed that international petrol prices, unaffected by interest rates, and rising mortgages were the main drivers of the increased cost of living.

For its part, the Housing Industry Association had previously expressed that the RBA should have waited longer before its most recent hike, citing an already slowing economic growth.

Now, with the rate increase in effect, their concerns remain relevant.

‘The fastest increase in the cash rate in a generation is the primary cause of these poor results in indicators of future growth,’ noted Chief Economist Tim Reardon.

‘The RBA's monetary policy tightening is yet to adversely impact the lagging indicators of economic activity like unemployment or inflation.’

‘There were very long lags in this cycle due to the strength of the economy at the start of the RBA's rate-rising cycle in the first half of 2022.’

Reardon noted the decision would reduce home construction, despite the pressing need for increased supply during the housing crisis.

‘Today's rate rise is unnecessary and will cause further contraction in new home building, constraining the supply of new homes,’ he explained.

He added that this would further decrease the affordability of the average mortgage.

With this in mind, members, we highly recommend talking to your mortgage lender or financial advisor about a budget that best suits your circumstances.

Take advantage of the government subsidies available to seniors, and take note of any potential discounts or affordable repayment plans.

Keeping up with such an interest rate hike is difficult, so it's wise to explore options!

Members, what do you think of this rate hike and its effects on mortgage rates? Share your thoughts in the comments below!

Prior to the 25 basis point hike, experts seemed nearly unanimous on an increase, driven partly by still-high inflation.

Unfortunately, this interest rate hike just made it a whole lot harder—near impossible, even—for the average homeowner to buy a house at median prices in Australia, which are around $926,899.

Price comparison website Finder's data shows that the average Australian household now needs a minimum wage of $182,000—nearly three times the median income of $65,000 from 2022—to do the feat, which is no small task considering the cost-of-living crisis.

Meanwhile, to afford the average Australian apartment, which costs $659,130, the average single-income household would need a salary of almost $130,000.

It’s a big ask for even the most fortunate double-income households.

This means that those with $590,000 mortgages would be paying an additional $1,345 every month compared to April 2022.

Finder’s Head of Consumer Research Graham Cooke shared some alarming figures that further highlight how significant a burden this hike will be for mortgage holders.

‘That’s a huge amount of extra money to be spending on your mortgage, especially when the cost of almost everything else is also going up,’ said Cooke.

He further pointed out that the decision to increase the cash rate would most adversely affect mortgage holders, causing them to be ‘already on the ropes’.

Although the rate hike was widely anticipated, it has faced substantial criticism due to the disproportionate burden it will place on individuals with lower incomes.

‘The RBA’s decision to lift the cash rate to 4.35 per cent will hurt people with low incomes the most,’ explained Australian Council of Social Service CEO Cassandra Goldie.

‘The worthy goal of reducing inflation must not come at the expense of jobs and incomes…’

‘Instead of relying solely on the blunt tool of rate rises, the government must step in to aid the RBA with measures to tackle inflation at its roots.’

‘This should include working with states and territories to curb soaring rents and additional measures to bring down energy bills for those who can least afford it.’

The RBA’s announcement of a 4.35 per cent interest rate increase yesterday was expected by some economists due to the higher-than-expected inflation figures from the previous month.

However, subsequent data showed that international petrol prices, unaffected by interest rates, and rising mortgages were the main drivers of the increased cost of living.

For its part, the Housing Industry Association had previously expressed that the RBA should have waited longer before its most recent hike, citing an already slowing economic growth.

Now, with the rate increase in effect, their concerns remain relevant.

‘The fastest increase in the cash rate in a generation is the primary cause of these poor results in indicators of future growth,’ noted Chief Economist Tim Reardon.

‘The RBA's monetary policy tightening is yet to adversely impact the lagging indicators of economic activity like unemployment or inflation.’

‘There were very long lags in this cycle due to the strength of the economy at the start of the RBA's rate-rising cycle in the first half of 2022.’

Reardon noted the decision would reduce home construction, despite the pressing need for increased supply during the housing crisis.

‘Today's rate rise is unnecessary and will cause further contraction in new home building, constraining the supply of new homes,’ he explained.

He added that this would further decrease the affordability of the average mortgage.

Key Takeaways

- The minimum wage required to comfortably afford a mortgage for the average house in Australia, which costs $926,899, is $182,000, almost three times last year's median income.

- The recent rate rise means borrowers with a $590,000 mortgage will be paying an extra $1,345 per month compared to April last year.

- The decision to lift the cash rate to 4.35 per cent has been criticised for its potentially disproportionate impact on low-income earners.

- The Housing Industry Association argues the rate rise will lead to fewer new homes being built, exacerbating the existing housing crisis.

Take advantage of the government subsidies available to seniors, and take note of any potential discounts or affordable repayment plans.

Keeping up with such an interest rate hike is difficult, so it's wise to explore options!

Members, what do you think of this rate hike and its effects on mortgage rates? Share your thoughts in the comments below!