Is Afterpay cheating merchants? Discover how their rolling reserve scheme is affecting businesses

In the world of e-commerce, buy now, pay later (BNPL) services like Afterpay have become a popular choice for consumers.

However, several small businesses have raised concerns about Afterpay's 'rolling reserve' policy, which they claimed withholds tens of thousands of dollars of their revenue.

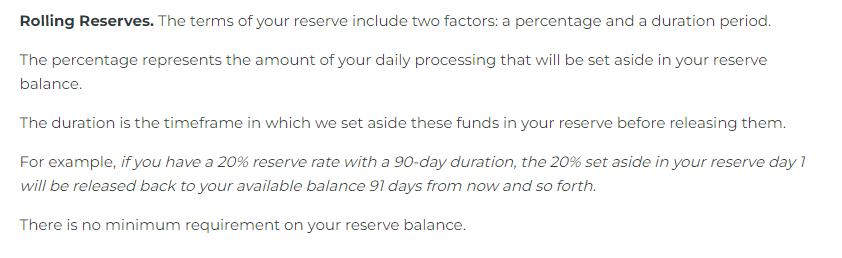

The rolling reserve is a clause in the merchant agreement that allows Afterpay to withhold a certain percentage of a business's sales if they deemed the business to be a higher-than-normal risk.

In some cases, this can be as much as 30 per cent of sales, held for up to three months before it is gradually released.

This practice has been described as 'crippling' by several small businesses, who claimed they were given little or no clarity on why the reserve has been placed on their funds.

Ayla Jennings-Bade, a mother of three who runs a western and country attire brand called CKL Country and Kids, was one of the business owners affected by this policy. She claimed that Afterpay's rolling reserve almost destroyed her business.

‘This tactic from Afterpay has nearly killed our business,’ she said. ‘Now we pray the majority of our orders don’t come through Afterpay.’

After adding Afterpay as a payment option for her business, she discovered that 30 per cent of her sales through the platform were held for 90 days. This left her scrambling to cover costs and even borrowing money from her father to keep her business afloat.

‘I was actually in tears, we had expected that money, I had people waiting for that money,’ Ms Jennings-Bade shared.

‘It was released in little bits, maybe it was $50, [and] it would come in dribs and drabs. Which isn’t ideal, it’s still a killer. I’ve paid for all this stock, then you’re getting it back very, very slowly,’ she added.

Despite providing Afterpay with over 100 tracking numbers as proof of her business fulfilling orders, the company refused to budge.

The effect was bad enough that she tried to remove Afterpay as a service, but it caused a massive drop in sales so she decided to offer it again to her customers.

Yasmin Tolley, who runs Milk and Honey Wigs, a Sydney business that creates custom wigs for those experiencing hair loss, has also been affected by Afterpay's rolling reserve policy.

She claimed that up to $25,000 of her sales was withheld over three months, which could have been used to cover rent, wages, or stock for her business.

‘It feels like we’re trapped, they’re not willing to compromise, which I find crazy. I just think that Afterpay is going to face an exodus in merchants leaving,’ she said.

Afterpay has not commented specifically on any case but previously stated: ‘Afterpay may take additional measures to reduce risk exposure for our customers and our business.’

They have yet to respond to requests for comment regarding whether they would pay interest for the time spent holding merchants' funds.

In the meantime, businesses that use Afterpay are advised to carefully read and understand the terms of their merchant agreement and to consider the potential impact of the rolling reserve policy on their cash flow.

What are your thoughts on Afterpay's rolling reserve policy, members? Share your thoughts in the comments below.

However, several small businesses have raised concerns about Afterpay's 'rolling reserve' policy, which they claimed withholds tens of thousands of dollars of their revenue.

The rolling reserve is a clause in the merchant agreement that allows Afterpay to withhold a certain percentage of a business's sales if they deemed the business to be a higher-than-normal risk.

In some cases, this can be as much as 30 per cent of sales, held for up to three months before it is gradually released.

This practice has been described as 'crippling' by several small businesses, who claimed they were given little or no clarity on why the reserve has been placed on their funds.

Ayla Jennings-Bade, a mother of three who runs a western and country attire brand called CKL Country and Kids, was one of the business owners affected by this policy. She claimed that Afterpay's rolling reserve almost destroyed her business.

‘This tactic from Afterpay has nearly killed our business,’ she said. ‘Now we pray the majority of our orders don’t come through Afterpay.’

After adding Afterpay as a payment option for her business, she discovered that 30 per cent of her sales through the platform were held for 90 days. This left her scrambling to cover costs and even borrowing money from her father to keep her business afloat.

‘I was actually in tears, we had expected that money, I had people waiting for that money,’ Ms Jennings-Bade shared.

‘It was released in little bits, maybe it was $50, [and] it would come in dribs and drabs. Which isn’t ideal, it’s still a killer. I’ve paid for all this stock, then you’re getting it back very, very slowly,’ she added.

Despite providing Afterpay with over 100 tracking numbers as proof of her business fulfilling orders, the company refused to budge.

The effect was bad enough that she tried to remove Afterpay as a service, but it caused a massive drop in sales so she decided to offer it again to her customers.

Yasmin Tolley, who runs Milk and Honey Wigs, a Sydney business that creates custom wigs for those experiencing hair loss, has also been affected by Afterpay's rolling reserve policy.

She claimed that up to $25,000 of her sales was withheld over three months, which could have been used to cover rent, wages, or stock for her business.

‘It feels like we’re trapped, they’re not willing to compromise, which I find crazy. I just think that Afterpay is going to face an exodus in merchants leaving,’ she said.

Afterpay has not commented specifically on any case but previously stated: ‘Afterpay may take additional measures to reduce risk exposure for our customers and our business.’

They have yet to respond to requests for comment regarding whether they would pay interest for the time spent holding merchants' funds.

In the meantime, businesses that use Afterpay are advised to carefully read and understand the terms of their merchant agreement and to consider the potential impact of the rolling reserve policy on their cash flow.

Key Takeaways

- Small businesses criticised Afterpay for withholding a significant portion of their revenue—up to 30 per cent in some cases—for up to three months due to a clause in the merchant agreement.

- Business owners, such as Ayla Jennings-Bade from CKL Country and Kids, claimed that this practice has severely affected their businesses.

- Ms Jennings-Bade removed Afterpay as a service due to the financial impact but experienced significant sales drops as a result.

- Afterpay would not comment on any specific case or whether they would pay interest for the time spent holding merchants’ funds.

What are your thoughts on Afterpay's rolling reserve policy, members? Share your thoughts in the comments below.