The extraordinary rise in house prices has become a national disaster, yet governments still don’t seem to grasp the basics: Economics 101 teaches that supply and demand regulate the market.

Right now, supply is woefully short while demand remains insatiable. So how do governments respond? By offering ever more assistance to first home buyers—measures that only push demand higher.

From 1 October, the First Home Buyer (FHB) Guarantee rules will be loosened, adding more fuel to the fire.

The FHB Guarantee lets eligible buyers avoid lenders’ mortgage insurance (LMI) while purchasing with just a 5% deposit.

Strict income caps have always applied—$125,000 for singles and $200,000 for couples—so many higher earners were excluded from a program designed to ease the savings hurdle despite being able to service a loan.

But starting this October, those income limits will disappear.

Whether your income is $150,000, $250,000, or even $500,000, if you’re buying your first home, you’ll need only a 5% deposit, will pay no LMI, and get access to competitive rates.

By scrapping the caps, the government has opened the scheme to thousands more first-home buyers who may have been renting for years while watching prices surge ahead of their savings.

The timing could not be more significant.

Interest rates have already been cut three times this year, and analysts predict another two or three reductions by January. Every cut boosts borrowing power, so the three we’ve had translate to at least a 15% increase in what banks are willing to lend, even without wage growth or regulatory shifts from APRA.

This extra capacity could make the difference between staying on the sidelines and finally entering the market.

But history shows that once confidence returns, momentum can drive prices higher in a very short time.

After the consolidation and wage inflation of 2022 to 2025, conditions are now primed for the next leg-up in affordability pressures.

If the Reserve Bank cash rate falls below 3%, buyer sentiment will surge.

More buyers, with more borrowing power, competing for a limited pool of properties, is a recipe for rising prices.

What’s more, the changes to the FHB Guarantee don’t stop there.

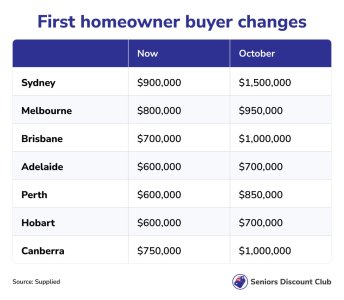

The other limit on the FHB Guarantee was property price caps: the maximum value of eligible homes. These are also being lifted dramatically across the country.

In New South Wales, for example, the ceiling jumps from $900,000 to $1.5 million. So first home buyers will no longer be confined to fringe suburbs or small units; they’ll be able to buy in areas where they actually want to settle for the long term.

These changes transform the FHB Guarantee from one limited to entry-level homes (about one-third of the market) into a realistic chance to secure the kind of property people aspire to.

It’s a policy that will worsen Australia’s housing price crisis, but it is a wonderful opportunity for first-home buyers who move fast.

Waiting until October to act may be too late. If you are a keen first home buyer, get organised now.

That means having finance pre-approved, understanding your borrowing limit, and working with a mortgage broker or bank so you are ready to act as soon as the right property appears.

But remember, just because you can borrow more doesn’t mean you should.

The golden rule is never to borrow at your maximum capacity. Interest rates are falling now, but they won’t stay low forever. Always leave a margin for future rate increases, changes in your circumstances, or unexpected expenses.

Owning a home is a long-term commitment, and stretching to the absolute limit can turn a dream into a nightmare.

The coming months represent the most favourable conditions in decades for first-home buyers.

The removal of income caps, the increase in price thresholds, and the likelihood of further rate cuts combine to create a rare opportunity. But the basics still apply: buy a quality property in a good area, avoid overcommitting, and focus on building equity steadily.

The golden rule is never to borrow at your maximum capacity. Interest rates are falling now, but they won’t stay low forever. Always leave a margin for future rate increases, changes in your circumstances, or unexpected expenses.

Owning a home is a long-term commitment, and stretching to the absolute limit can turn a dream into a nightmare.

The coming months represent the most favourable conditions in decades for first-home buyers.

The removal of income caps, the increase in price thresholds, and the likelihood of further rate cuts combine to create a rare opportunity. But the basics still apply: buy a quality property in a good area, avoid overcommitting, and focus on building equity steadily.

The message is clear. Don’t wait for October—prepare now, but do so with your eyes wide open. The market is about to move!

About the author:

Noel Whittaker, AM, is the author of Wills, death & taxes made simple and numerous other books on personal finance. An international bestselling author, finance and investment expert, radio broadcaster, newspaper columnist and public speaker, Noel Whittaker is one of the world’s foremost authorities on personal finance. Connect via Twitter or email ([email protected]). You can shop his personal finance books here.

Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. Always seek professional advice that takes into account your personal circumstances before making any financial decisions. The views expressed in this publication are those of the author.