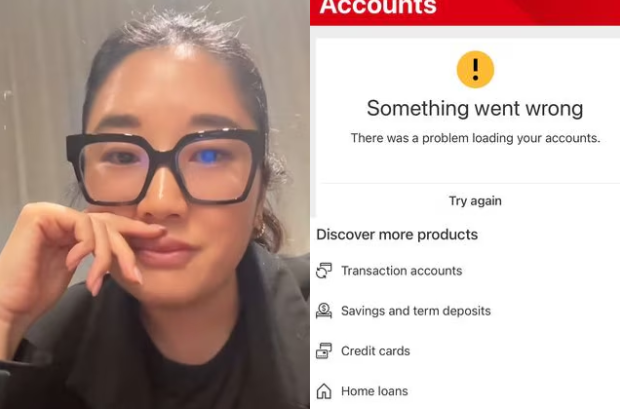

A Melbourne woman’s routine day took a shocking turn when she discovered she’d been locked out of her own money—and would remain so for 45 days.

What began as a simple fraud alert spiralled into financial paralysis, leaving her unable to pay bills or even move her salary to another bank.

Now, her story is exposing what many believe to be a major failure in how Australian banks handle fraud investigations.

Ms McMaster, 36, said she received a phone call from HSBC last week informing her that the bank’s investigation into suspected fraud on her accounts would take six and a half weeks to complete.

During that time, she would have no access to her salary account, no way to pay essential expenses, and no option to close her accounts and move elsewhere.

‘They called me to tell me their investigation team is going to take 45 days,’ she said. ‘I'm sorry but how is that okay? I don't understand.’

Her frustration is now echoing across Australia as HSBC faces growing criticism over its handling of fraud cases and customer complaints.

HSBC’s mounting troubles

Ms McMaster’s ordeal comes as HSBC Bank Australia Limited faces legal action from the Australian Securities and Investments Commission (ASIC) for allegedly failing to protect customers scammed out of millions of dollars.

Between January 2020 and August 2024, the bank received about 950 reports of unauthorised transactions, resulting in customer losses of around $23 million—with almost $16 million of that lost in just six months between October 2023 and March 2024.

The numbers tell a grim story for customers—HSBC has earned only 1.2 out of 5 stars from 857 verified reviews on ProductReview.com.au, making it one of Australia’s lowest-rated banks.

For Ms McMaster, those statistics have translated into a deeply personal nightmare.

The corporate worker used her HSBC accounts for everyday transactions and salary deposits before both were abruptly blocked.

She has not been told what the suspected ‘potential fraud’ was and has not been asked about any unusual activity.

‘My energy towards it has gone, as bad as that sounds, I've just accepted the money is gone,’ she said.

The ripple effects

The impact didn’t end there.

HSBC reportedly contacted Ms McMaster’s mortgage provider to flag the fraud investigation, which resulted in her home loan account being temporarily frozen.

Thankfully, her mortgage bank resolved the issue that same day—but not before adding to her stress and anxiety.

‘That definitely compounded the stress and made me anxious because I was worried I wouldn't be able to service my mortgage,’ she explained.

Ms McMaster said she doesn’t engage in any activities that might raise red flags.

She doesn’t transfer large sums, trade cryptocurrency, or make high-risk investments.

She simply uses her accounts for bills and everyday purchases, with a low-limit credit card.

'I don't really understand how a bank can take that long.'

What are your rights?

If you find yourself in a similar situation, there are steps you can take to protect yourself and regain control of your finances.

Immediate steps: Request written confirmation of the fraud investigation, including expected timeframes—Ask for emergency access to funds for essential expenses like rent and groceries—Document all communications with your bank—Contact other financial institutions if your credit is affected.

Escalation options: Complain to the Australian Financial Complaints Authority (AFCA) if the bank won’t budge—Contact your state’s consumer protection authority—Seek advice from financial counselling services.

While banks must investigate suspected fraud, they also have a duty to minimise hardship during the process.

Warning signs for seniors

Recent HSBC scam alerts have specifically warned about ‘bank impersonation scammers visiting elderly Australians’, underscoring how vulnerable seniors can be to these tactics.

Be cautious of: Unexpected visits from people claiming to be bank staff—Calls demanding urgent account verification—Emails requesting you to confirm details immediately—Anyone pressuring you to act quickly with your money.

Getting help if your account is frozen

Document everything in writing

Ask for emergency access to essential funds

Contact AFCA (free service): 1800 931 678

Seek free financial counselling: 1800 007 007

Contact your local consumer affairs office

A broader banking problem?

Ms McMaster believes there’s something ‘seriously wrong with banks’ in Australia—and the data may support her concern.

Reports of scams and customer losses rose again in 2024 compared to 2023, suggesting that major institutions are struggling to balance fraud prevention with customer care.

The lack of transparency also remains a major frustration for victims like Ms McMaster, who said she was never told what triggered the investigation or why it would take so long.

‘It is clearly out of my control and I can't do much more about it,’ she said. ‘It is so super annoying and I am feeling pretty deflated.’

As she waits out her 45-day ordeal—unable to access her own salary or even switch banks—her experience serves as a warning for other Australians to understand their rights and have contingency plans in place when financial systems fail.

What This Means For You

HSBC is currently facing legal action over claims it failed to protect customers from scams, with reports showing that between 2020 and 2024, Australians lost a staggering $23 million to unauthorised transactions. Seniors, in particular, continue to be prime targets for sophisticated bank impersonation scams, making vigilance more important than ever.

If you or someone you know experiences similar issues, remember that help is available—services like the Australian Financial Complaints Authority (AFCA) and free financial counselling hotlines can guide you through disputes and protect your rights. It’s a strong reminder that while banks must safeguard our money, we must also stay alert and prepared when things go wrong.

Stories like Ms McMaster’s highlight how vulnerable anyone can be when banks fail to act quickly or communicate clearly during a fraud investigation.

If you’ve ever worried about whether you’d recognise a scam before it strikes, there’s another story that sheds light on how easily professional scammers can appear legitimate.

It offers practical advice on spotting fake bank staff and protecting your money before it’s too late.

Read more: Protect your savings: Here's a guide to spotting bank impersonation scams

24-280MR ASIC sues HSBC Australia alleging failures to adequately protect customers from scams — ASIC alleges that HSBC Bank Australia Limited failed to adequately protect customers scammed out of millions of dollars, with approximately 950 unauthorised transaction reports and $23 million in losses recorded between January 2020 and August 2024.

https://www.asic.gov.au/about-asic/...s-to-adequately-protect-customers-from-scams/

HSBC reviews | ProductReview.com.au — HSBC received an average rating of 1.2 out of 5 stars from 857 verified customer reviews, reflecting widespread dissatisfaction among Australian users.

https://www.productreview.com.au/listings/hsbc

March 2025 Report of the National Anti-Scam Centre — The report highlights widespread scam activity and notes that scam reports and losses increased in 2024 compared to 2023, with cases involving multiple banks including HSBC.

https://www.scamwatch.gov.au/system/files/targeting-scams-report-2024.pdf

The Latest Scam Warnings | Banking Fraud Trends—HSBC AU — HSBC Australia has warned of emerging scams, including bank impersonation scammers targeting elderly Australians, as part of its July 2024 security update.

https://www.hsbc.com.au/help/security-centre/fraud/latest-scam-warnings/

Have you experienced similar issues with your bank’s fraud investigations? How did you handle the situation, and what advice would you give to others facing the same problem?