One click. That's all it took for Deb Jennings to hand criminals the keys to her entire identity—and potentially her life savings. Her story isn't unique, and that's exactly why the federal government has just announced a crucial $15 million funding boost to help Australians fight back against identity theft.

For thousands of Australians over 60, this funding could be the difference between financial ruin and recovery.

While you might think identity theft mainly targets younger, tech-savvy generations, the reality is far more concerning for older Australians.

The hidden truth about seniors and identity theft

Here's a statistic that might surprise you: seniors aged 55 and over actually experience identity theft at lower rates than younger Australians—just 0.4 per cent compared to 0.8 per cent for those under 55. But before you breathe a sigh of relief, there's a crucial catch.

When identity theft does happen to older adults, it takes longer to detect and results in much greater financial losses than any other age group. In fact, Americans aged 60 and over lost $3.4 billion to identity theft in 2023 alone—more than any other demographic.

Why seniors face higher financial losses from identity theft

Greater savings and assets accumulated over decades

Excellent credit histories built up over time

Less frequent monitoring of accounts and credit reports

More difficulty navigating complex recovery processes

Longer detection time allows more damage to occur

The latest figures from the Australian Bureau of Statistics paint a concerning picture of the broader fraud landscape. In 2023-24, an estimated 255,100 Australians experienced identity theft, while card fraud affected 9.9 per cent of Australians, up from 8.7 per cent the previous year.

When seconds turn into months of misery

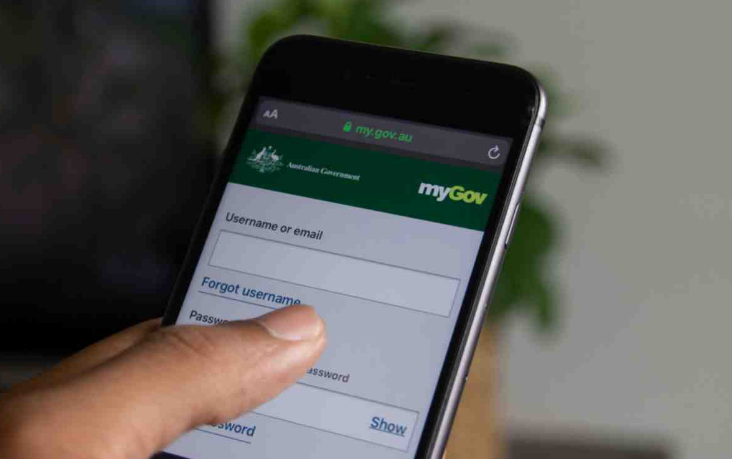

Deb Jennings' experience perfectly illustrates why this government funding is so desperately needed. In July 2024, she clicked on what appeared to be a legitimate MyGov text message.

In those crucial seconds, she unknowingly provided enough information for criminals to begin systematically destroying her financial identity.

'Unfortunately I clicked on it and I must have given them a little bit more information. It was probably my driving licence as well as my phone number that allowed them to pinch my ID,' Jennings explained..

The truly frightening part? She didn't discover the theft for three months. It was only when a Centrelink worker called about redirecting her pension payments to a new Westpac account that Jennings realised something was terribly wrong.

'It was quite frightening actually because I thought I've done nothing wrong except click on this darn link. It caused me weeks and weeks of frustration'

By then, the criminals had already applied for seven bank accounts in her name. Without the right help, Jennings could have faced years of credit damage and financial chaos.

Your lifeline: ID-CARE's essential services

This is where the government's $15 million investment becomes crucial. ID-CARE is an independent not-for-profit and the only service of its kind globally, offering expert support when every scam or cyber incident is unique, with their expert team assessing each situation to develop a tailored response plan.

The funding ensures ID-CARE can continue helping 100,000 victims annually over the next three years—individuals, small businesses, and major corporations alike.

What ID-CARE offers you for free

- Expert case management tailored to your specific situation

- Help repairing damaged credit histories

- Assistance rebuilding your reputation

- Guidance through the recovery process step-by-step

- Support available 8am-5pm AEST, Monday to Friday on 1800 595 160

ID-CARE offers a completely free service to assist victims with repairing damage to their reputation, credit history and identity information, helping you make a plan to limit the damage of identity theft.

The service goes beyond just crisis response. ID-CARE's Cyber Resilience Outreach Clinics provide expert guidance to communities across Australia, using real-time data on the latest scams impacting each community to deliver targeted education on specific risks, including group presentations and tailored workshops.

The growing threat landscape

The timing of this funding couldn't be more critical. Recent estimates indicate that identity crime costs Australia upwards of $1.6 billion per year, with the majority ($900 million) lost by individuals through credit card fraud, identity theft and scams.

The Australian government recently passed legislation targeting scams, placing increased responsibilities on banking and finance, telecommunications and digital platforms organisations to protect customers.

Suspicious numbers can now be accompanied by a warning of 'potential fraud' on your smartphone screen.

Protecting yourself: practical steps you can take today

While government support and services like ID-CARE are crucial, your first line of defence is prevention. Here are specific steps tailored for older Australians:

Secure your digital life:

- Use strong, unique passwords across your accounts, and consider using a password manager to help with this

- Turn on multi-factor authentication where available, as it can add an extra layer of security to protect your identity online

- Use virus protection software to help stop hackers from accessing your information, which can help protect you if you click on a suspicious link or visit a fake website

Protect your physical documents:

- Letters from your bank, super fund and employer can all contain personal details scammers can use—shred these kinds of letters before you throw them out

- Keep identity documents secure and never carry unnecessary cards or documents

Stay vigilant:

- Watch for warning signs like unusual activity on bank statements, debt collectors contacting you about purchases you didn't make, or government agencies contacting you about benefits you didn't apply for

- If you use a public computer, make sure you clear your internet history and log out of your accounts

What to do if you're already affected

If you suspect you've been targeted, time is critical. Act quickly to minimise any financial loss—report the matter to your local police and ask for a police report or reference number so you have evidence to present to organisations like government agencies, financial institutions or credit agencies.

Contact ID-CARE on 1800 595 160 or visit their website—they can help you make a plan for free to limit the damage of identity theft.

Did you know?

Did you know?

Australians aged 55 and over are more likely than those under 55 to report their most serious scam incident to authorities (43 per cent versus 33 per cent). This higher reporting rate helps protect others and aids in tracking criminal activity.

For government service-related identity theft, if identity documents with your Centrelink Customer Reference Number, Medicare or myGov details have been compromised, contact Services Australia Scams and Identity Theft help desk on 1800 941 126.

The broader fight against scammers

This $15 million investment represents just one part of a broader government strategy to protect Australians from increasingly sophisticated criminals.

The Australian Competition and Consumer Commission has established the National Anti-Scam Centre to coordinate government, law enforcement and the private sector to combat scams, running Scamwatch to provide information on recognising, avoiding and reporting all scams.

The government's commitment to maintaining ID-CARE's services for three years provides stability and reassurance that help will be available when you need it most.

Looking ahead: your role in staying safe

Deb Jennings considers herself 'one of the lucky ones' because she discovered ID-CARE before the hackers could access her money. 'I was very lucky there, I got away with that one,' she said.

But luck shouldn't be your only defence. With half a million Australians falling victim to scams every year, this government funding ensures that when prevention fails, professional help is just a phone call away.

The $15 million investment in ID-CARE means you're not alone in the fight against identity thieves. Whether you're dealing with the aftermath of a click on a suspicious link or want to better protect yourself from future threats, expert help is available.

What This Means For You

Remember: if something feels suspicious, trust your instincts. It's always better to check with ID-CARE on 1800 595 160 than to ignore warning signs that could cost you thousands of dollars and months of stress.

Have you or someone you know been affected by identity theft or online scams? Share your experience in the comments below—your story could help protect a fellow member of our community.

Original Article

https://7news.com.au/news/governmen...ost-to-help-identity-theft-victims-c-20064924

Personal Fraud, 2023-24 financial year | Australian Bureau of Statistics

Cited text: In 2023-24, an estimated 1.2 per cent of persons (255,100) experienced identity theft.

Excerpt: seniors aged 55 and over actually experience identity theft at lower rates than younger Australians—just 0.4 per cent compared to 0.8 per cent for those under 55

https://www.abs.gov.au/statistics/people/crime-and-justice/personal-fraud/latest-release

In focus: persons aged 55 years and over | Australian Bureau of Statistics

Cited text: An estimated 0.4 per cent (25,900 persons) of the population aged 55 and over in Australia experienced identity theft in the 12 months prior to survey in 2014...

Excerpt: seniors aged 55 and over actually experience identity theft at lower rates than younger Australians—just 0.4 per cent compared to 0.8 per cent for those under 55

https://www.abs.gov.au/articles/focus-persons-aged-55-years-and-over

2025 Statistics on Senior Identity Theft

Cited text: Identity theft among older adults often takes longer to report and results in much greater financial loss.

Excerpt: When identity theft does happen to older adults, it takes longer to detect and results in much greater financial losses than any other age group

https://www.seniorliving.org/identity-theft-protection/statistics/

2025 Statistics on Senior Identity Theft

Cited text: As you can see from the table above, adults age 60 and above accounted for 24.08 percent of all identity theft claims in 2023 and experienced about 41...

Excerpt: When identity theft does happen to older adults, it takes longer to detect and results in much greater financial losses than any other age group

https://www.seniorliving.org/identity-theft-protection/statistics/

2025 Statistics on Senior Identity Theft

Cited text: In fact, identity theft of Americans age 60 and older resulted in financial losses of $3.4 billion in 2023 alone, far more than any other age group1.

Excerpt: Americans aged 60 and over lost $3.4 billion to identity theft in 2023 alone

https://www.seniorliving.org/identity-theft-protection/statistics/

Scams and card fraud on the rise | Australian Bureau of Statistics

Cited text: William Milne, ABS head of crime statistics, said: ‘We found that 9.9 per cent of Australians aged 15 years and over were victims of card fraud in 202...

Excerpt: card fraud affected 9.9 per cent of Australians, up from 8.7 per cent the previous year

https://www.abs.gov.au/media-centre/media-releases/scams-and-card-fraud-rise

IDCARE Official Website | Identity Theft & Cyber Support

Cited text: IDCARE is an independent not-for-profit and the only service of its kind globally, offering expert support and frontline insights into scams, identity...

Excerpt: ID-CARE is an independent not-for-profit and the only service of its kind globally, offering expert support when every scam or cyber incident is unique, with their expert team assessing each situation to develop a tailored response plan

Identity protection and recovery | Attorney-General's Department

Cited text: iDcare offers a free service to assist victims with repairing the damage to their reputation, credit history and identity information.

Excerpt: ID-CARE offers a completely free service to assist victims with repairing damage to their reputation, credit history and identity information, helping you make a plan to limit the damage of identity theft

https://www.ag.gov.au/national-security/identity-security/identity-protection-and-recovery

Identity theft—Moneysmart.gov.au

Cited text: They can help you make a plan (for free) to limit the damage of identity theft.

Excerpt: ID-CARE offers a completely free service to assist victims with repairing damage to their reputation, credit history and identity information, helping you make a plan to limit the damage of identity theft

https://moneysmart.gov.au/online-safety/identity-theft

IDCARE Official Website | Identity Theft & Cyber Support

Cited text: ... IDCARE’s Cyber Resilience Outreach Clinics (CROC) provide expert guidance to communities across Australia, helping individuals stay safe from scam...

Excerpt: ID-CARE's Cyber Resilience Outreach Clinics provide expert guidance to communities across Australia, using real-time data on the latest scams impacting each community to deliver targeted education on specific risks, including group…

Identity Theft—NSW Police Public Site

Cited text: Recent estimates by the Commonwealth Attorney General's Department indicate that identity crime costs Australia upwards of $1.6 billion per year,...

Excerpt: Recent estimates indicate that identity crime costs Australia upwards of $1.6 billion per year, with the majority ($900 million) lost by individuals through credit card fraud, identity theft and scams

https://www.police.nsw.gov.au/crime/frauds_and_scams/fraud_categories/identity_theft

Identity Theft—NSW Police Public Site

Cited text: Recent estimates by the Commonwealth Attorney General's Department indicate that identity crime costs Australia upwards of $1.6 billion per year, with...

Excerpt: Recent estimates indicate that identity crime costs Australia upwards of $1.6 billion per year, with the majority ($900 million) lost by individuals through credit card fraud, identity theft and scams

https://www.police.nsw.gov.au/crime/frauds_and_scams/fraud_categories/identity_theft

QUT—3.5 million Australians experienced fraud last year. This could be avoided through 6 simple steps

Cited text: The Australian government recently passed legislation which targets scams. It places increased responsibilities on banking and finance, telecommunicat...

Excerpt: The Australian government recently passed legislation targeting scams, placing increased responsibilities on banking and finance, telecommunications and digital platforms organisations to protect customers

https://www.qut.edu.au/news/realfocus/3.5-million-australians-experienced-fraud-last-year

QUT—3.5 million Australians experienced fraud last year. This could be avoided through 6 simple steps

Cited text: Suspicious numbers can now be accompanied a warning of “potential fraud” on your smartphone screen.

Excerpt: Suspicious numbers can now be accompanied by a warning of 'potential fraud' on your smartphone screen

https://www.qut.edu.au/news/realfocus/3.5-million-australians-experienced-fraud-last-year

QUT—3.5 million Australians experienced fraud last year. This could be avoided through 6 simple steps

Cited text: Passwords: it is important to have strong, unique passwords across your accounts. Using a password manager can help with this.

Excerpt: Use strong, unique passwords across your accounts, and consider using a password manager to help with this

https://www.qut.edu.au/news/realfocus/3.5-million-australians-experienced-fraud-last-year

Identity theft—Moneysmart.gov.au

Cited text: Where available, turn on multi-factor authentication. It can add an extra layer of security to protect your identity online.

Excerpt: Turn on multi-factor authentication where available, as it can add an extra layer of security to protect your identity online

https://moneysmart.gov.au/online-safety/identity-theft

Identity theft—Moneysmart.gov.au

Cited text: Use virus protection software to help stop hackers from accessing your information. This software can help protect you if you click on a suspicious li...

Excerpt: Use virus protection software to help stop hackers from accessing your information, which can help protect you if you click on a suspicious link or visit a fake website

https://moneysmart.gov.au/online-safety/identity-theft

Identity theft—Moneysmart.gov.au

Cited text: Letters from your bank, super fund and employer can all contain personal details scammers can use to steal your identity. Shred these kinds of letters...

Excerpt: Letters from your bank, super fund and employer can all contain personal details scammers can use—shred these kinds of letters before you throw them out

https://moneysmart.gov.au/online-safety/identity-theft

Report and recover from identity theft | Cyber.gov.au

Cited text: These are some warning signs that someone may have stolen your identity: You notice unusual activity on your bank statements or credit history report....

Excerpt: Watch for warning signs like unusual activity on bank statements, debt collectors contacting you about purchases you didn't make, or government agencies contacting you about benefits you didn't apply for

https://www.cyber.gov.au/report-and-recover/recover-from/identity-theft

Report and recover from identity theft | Cyber.gov.au

Cited text: Debt collectors contact you about purchases or loans you didn’t make. Government agencies contact you about benefits you didn’t apply for.

Excerpt: Watch for warning signs like unusual activity on bank statements, debt collectors contacting you about purchases you didn't make, or government agencies contacting you about benefits you didn't apply for

https://www.cyber.gov.au/report-and-recover/recover-from/identity-theft

Identity theft—Moneysmart.gov.au

Cited text: If you use a public computer, for example, at a library, make sure you clear your internet history and log out of your accounts.

Excerpt: If you use a public computer, make sure you clear your internet history and log out of your accounts

https://moneysmart.gov.au/online-safety/identity-theft

Protect your identity, keep it safe | IDMatch

Cited text: Source: Office of the Australian Information Commissioner · If you have been a victim of identity crime or suspect your identity has been stolen, it i...

Excerpt: Act quickly to minimise any financial loss—report the matter to your local police and ask for a police report or reference number so you have evidence to present to organisations like government agencies, financial institutions or credit…

https://www.idmatch.gov.au/protect-your-identity/for-individuals

Identity theft—Moneysmart.gov.au

Cited text: They can help you make a plan (for free) to limit the damage of identity theft. Call 1800 595 160 or visit the IDCARE website.

Excerpt: Contact ID-CARE on 1800 595 160 or visit their website—they can help you make a plan for free to limit the damage of identity theft

https://moneysmart.gov.au/online-safety/identity-theft

In focus: persons aged 55 years and over | Australian Bureau of Statistics

Cited text: Australians aged 55 and over were more likely than those aged under 55 to report their most serious scam incident to an authority (43 per cent and 33 per cent respect...

Excerpt: Australians aged 55 and over are more likely than those under 55 to report their most serious scam incident to authorities (43 per cent versus 33 per cent)

https://www.abs.gov.au/articles/focus-persons-aged-55-years-and-over

Help if a scam or identity theft has affected you—Managing your money—Services Australia

Cited text: If your identity information has been misused or exposed, find out how to get help on the IDCARE website.

Excerpt: if identity documents with your Centrelink Customer Reference Number, Medicare or myGov details have been compromised, contact Services Australia Scams and Identity Theft help desk on 1800 941 126

https://www.servicesaustralia.gov.au/help-if-scam-or-identity-theft-has-affected-you?context=60271

Help if a scam or identity theft has affected you—Managing your money—Services Australia

Cited text: The Australian Competition and Consumer Commission (ACCC) has set up the National Anti-Scam Centre to coordinate government, law enforcement and the p...

Excerpt: The Australian Competition and Consumer Commission has established the National Anti-Scam Centre to coordinate government, law enforcement and the private sector to combat scams, running Scamwatch to provide information on recognising,…

https://www.servicesaustralia.gov.au/help-if-scam-or-identity-theft-has-affected-you?context=60271