Deeming is back in the news, with the surprise announcement this week by Minister Tanya Plibersek this week that deeming rates will rise on 20 September in parallel with the automatic indexation of the pension.

Deeming is a major issue for retirees – it doesn’t just affect income-tested pensioners, it also determines eligibility for the Commonwealth Seniors Health Card and plays a major role in calculating aged care fees.

Deeming began in 1990 to discourage pensioners from using low-interest accounts to dodge the income test. It was later extended to most investments, though never property. In theory, rates track the cash rate, but governments often lag.

In 2010, with the cash rate at 4%, deeming hovered around 3.5%. By 2019 it was 3%, and when the cash rate fell to 0.25% in 2020, deeming dropped to 0.25% and 2.25% depending on the size of the account — this is where it still sits.

The government was well aware the deeming rates were well below what they should be, but it was a potential minefield to move them more in line with the market. They affect poorer pensioners (they're the income-tested ones), and don’t affect the wealthier asset-tested pensioners.

An increase in the deeming rate would mean an automatic drop in pension for the poorer pensioners. Imagine the headlines!

They have finally bitten the bullet and increased the deeming rates, but they’ve done it in a very cunning fashion. By announcing the change at the same time as the pension’s automatic indexation, the numbers were arranged so that any reduction in pension from more onerous deeming rates was offset by the pension rise.

From 20 September 2025, the lower deeming rate lifts from 0.25% to 0.75% and the upper from 2.25% to 2.75%.

For singles, the lower rate applies to the first $60,400 of financial assets, with the higher rate on the balance. For couples, it applies to the first $100,200 combined, with the higher rate on the remainder.

At the same time, singles gain an extra $29 a fortnight, bringing the full fortnightly pension to $1,179, or $30,646 a year. Couples gain $22 each, lifting their full combined pension to $46,202 a year.

As assets increase and accordingly deemed income increases, the pension will slowly reduce at the rate of 50 cents for each additional dollar deemed to be earned.

Case Study

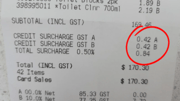

Harry is single with $308,000 in financial investments and $10,000 in household contents. Currently, he gets the maximum fortnightly pension of $1,149. On 20 September 2025, the maximum pension will rise to $1,179.

However, due to the increase in deeming rates, Harry will not receive the maximum. His deemed income will jump from $5,646 to $7,186 a year, reducing his fortnightly pension by $29. The increase in deeming rates almost exactly cancels out the pension rise.

To see how the changes affect your own personal situation just go to my website, www.noelwhittaker.com.au, to download the new pension charts and play with the age pension calculator and the deeming calculator, all of which have been updated with the new numbers.

Just bear in mind, they won't come into effect till September 20.

When the rate of pension goes up, the upper limit threshold cut-off point automatically increases as well - the cut-off point for a homeowner couple has just risen to $1,074,000. For a single, it's $714,500.

I'm often asked if the pension you draw from your superannuation fund is assessed as income for the income test. It is not. Your superannuation is given a deemed income for the income test and the account value of your superannuation fund is the amount assessed under the assets test.

And remember, if your superannuation fund drops in value at any time, you are at liberty to advise Centrelink immediately.

About the author:

Noel Whittaker, AM, is the author of Wills, death & taxes made simple and numerous other books on personal finance. An international bestselling author, finance and investment expert, radio broadcaster, newspaper columnist and public speaker, Noel Whittaker is one of the world’s foremost authorities on personal finance. Connect via Twitter or email ([email protected]). You can shop his personal finance books here.

Advice given in this article is general in nature and is not intended to influence readers’ decisions about investing or financial products. Always seek professional advice that takes into account your personal circumstances before making any financial decisions. The views expressed in this publication are those of the author.