Expert warns of future rent hikes as Aussies caught in cost-of-living crisis - what are your rights as a renter?

- Replies 7

As if trying to get by while everything gets more expensive isn’t bad enough, Aussies now face an additional squeeze in the form of rising rent.

Over the last year, rent prices have increased by an average of $161 per month around Australia, and a new warning suggests that this trend is set to continue.

It’s no wonder why — with interest rates on the rise, mortgage repayments are increasing, and landlords are passing costs on to their tenants.

'From insurance premium price hikes, rising grocery bills and exploding energy prices, the last thing Aussies need is for their rent to increase,’ Phil Portman of Compare the Market said.

‘Unfortunately, that's what we're seeing, putting more households under further financial pressure.'

According to the Daily Mail, rent prices have risen unevenly.

In a recent poll conducted by the price comparison website Compare the Market, over half of the renters said their rent increased in 2022.

Western Australia (WA) was the worst off at $180 per month for the last year in the survey, with Queensland (QLD) at a close second with $177 and Victoria (VIC) at third with $169.

South Australia (SA) and New South Wales (NSW) followed with $158 and $142, respectively.

Annually, these rent hikes translate to $2,160 a year for WA, $2,124 for QLD, $2,028 for VIC, $1,896 for SA, and $1,704 for NSW renters. Ouch.

No data was given for Tasmania (TAS), the Australian Capital Territory (ACT), and the Northern Territory (NT), citing small increases compared to the areas mentioned.

However, similar research from CoreLogic revealed that as of December 2022, the rent prices for Hobart (TAS), Canberra (ACT), and Darwin (NT) were at $552, $681, and $594, respectively. The three areas saw rents increase by as high as 5.3 per cent in 12 months.

'Over a year, it's enough to pay for a return trip overseas, fill up a 50-litre tank around 22 times or potentially pay for more than a year's worth of electricity,’ Portman said.

The Reserve Bank of Australia (RBA) also raised interest rates for the ninth consecutive time early this month, adding 25 basis points (.25 per cent) to the 3.10 per cent cash target rate at 3.35 per cent.

While most of us are hoping that this is the last of RBA rate hikes to come, the central bank already gave advanced notice that more are on the horizon.

‘The Board is seeking to return inflation to the 2–3 per cent range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one,’ the RBA said.

‘The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.’

Estimates made by key finance industry players like NAB and ING, of further interest rate hikes, vary. NAB expects the RBA to raise the cash target rate to 3.60 per cent in March and hold it for the rest of 2023.

ING, meanwhile, forecast a spike to 4.10 per cent in the coming months, which they said the RBA would also retain for 2023.

For Portman, this translates to bad news for renters across the country.

‘Many landlords are passing these costs onto their tenants, which is why we're seeing rental prices soar around the country,’ he said.

Impending permanent crisis aside, Compare the Market also has advice for renters who find themselves at the pointy end of yet another rent hike.

Natasha Innes, Media and Communications Adviser for the company, said renters should make it a point to check rental prices in the vicinity of the space to see if a price is too high. If it is, this act opens an opportunity for negotiating the increase or looking for a rental with more affordable rates.

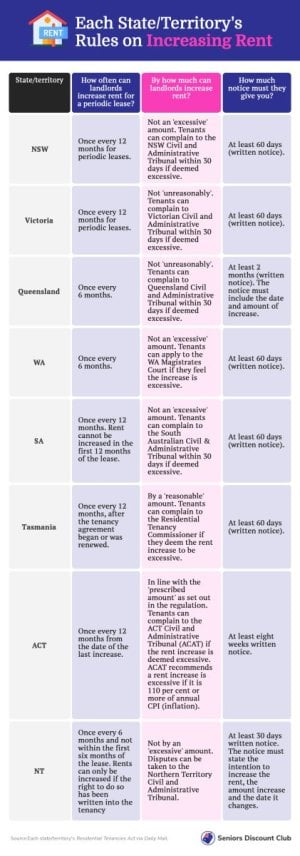

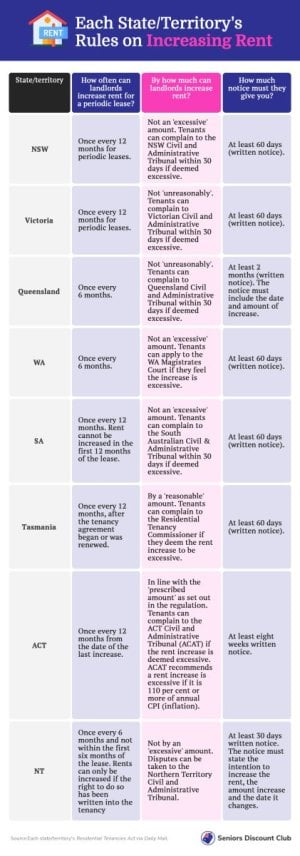

She also said to be aware of local laws and ordinances which govern how much landlords can raise the rent. Same as her first tip, Innes said this could help renters find out if an increase can be voided if it runs contrary to allowable increases.

On the note of discussions, Innes also emphasised an oft-repeated rule in negotiating: get everything in writing. More than anything, this is a failsafe in cases of disputes, which can degenerate into a he-said-she-said very quickly with the lack of documentation.

Lastly, Innes said to carefully weigh the costs of paying extra by staying when rent is due for an increase or just moving somewhere more affordable. This saves money in the long run, but can also be costly in the short term due to moving-associated costs like cleaning and disconnection fees and hiring removalists.

With any luck, this economic squeeze may ease in the coming months, but for now, the best we can do is stay alert to any changes affecting our daily lives.

Speaking of rent, you might be interested to read about these stories:

Tell us in the comments section below!

Over the last year, rent prices have increased by an average of $161 per month around Australia, and a new warning suggests that this trend is set to continue.

It’s no wonder why — with interest rates on the rise, mortgage repayments are increasing, and landlords are passing costs on to their tenants.

'From insurance premium price hikes, rising grocery bills and exploding energy prices, the last thing Aussies need is for their rent to increase,’ Phil Portman of Compare the Market said.

‘Unfortunately, that's what we're seeing, putting more households under further financial pressure.'

According to the Daily Mail, rent prices have risen unevenly.

In a recent poll conducted by the price comparison website Compare the Market, over half of the renters said their rent increased in 2022.

Western Australia (WA) was the worst off at $180 per month for the last year in the survey, with Queensland (QLD) at a close second with $177 and Victoria (VIC) at third with $169.

South Australia (SA) and New South Wales (NSW) followed with $158 and $142, respectively.

Annually, these rent hikes translate to $2,160 a year for WA, $2,124 for QLD, $2,028 for VIC, $1,896 for SA, and $1,704 for NSW renters. Ouch.

No data was given for Tasmania (TAS), the Australian Capital Territory (ACT), and the Northern Territory (NT), citing small increases compared to the areas mentioned.

However, similar research from CoreLogic revealed that as of December 2022, the rent prices for Hobart (TAS), Canberra (ACT), and Darwin (NT) were at $552, $681, and $594, respectively. The three areas saw rents increase by as high as 5.3 per cent in 12 months.

'Over a year, it's enough to pay for a return trip overseas, fill up a 50-litre tank around 22 times or potentially pay for more than a year's worth of electricity,’ Portman said.

Rent prices have risen the most over the last year in Western Australia, according to Compare the Market. Image Credit: Unsplash

The Reserve Bank of Australia (RBA) also raised interest rates for the ninth consecutive time early this month, adding 25 basis points (.25 per cent) to the 3.10 per cent cash target rate at 3.35 per cent.

While most of us are hoping that this is the last of RBA rate hikes to come, the central bank already gave advanced notice that more are on the horizon.

‘The Board is seeking to return inflation to the 2–3 per cent range while keeping the economy on an even keel, but the path to achieving a soft landing remains a narrow one,’ the RBA said.

‘The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.’

Estimates made by key finance industry players like NAB and ING, of further interest rate hikes, vary. NAB expects the RBA to raise the cash target rate to 3.60 per cent in March and hold it for the rest of 2023.

ING, meanwhile, forecast a spike to 4.10 per cent in the coming months, which they said the RBA would also retain for 2023.

For Portman, this translates to bad news for renters across the country.

‘Many landlords are passing these costs onto their tenants, which is why we're seeing rental prices soar around the country,’ he said.

What renters can do when landlords hike rentImpending permanent crisis aside, Compare the Market also has advice for renters who find themselves at the pointy end of yet another rent hike.

Natasha Innes, Media and Communications Adviser for the company, said renters should make it a point to check rental prices in the vicinity of the space to see if a price is too high. If it is, this act opens an opportunity for negotiating the increase or looking for a rental with more affordable rates.

She also said to be aware of local laws and ordinances which govern how much landlords can raise the rent. Same as her first tip, Innes said this could help renters find out if an increase can be voided if it runs contrary to allowable increases.

Knowing your area's rules on rent hikes can be a great way to assess whether or not higher rental fees are fair. Click on the image to enlarge it. Image Credit: Seniors Discount Club

On the note of discussions, Innes also emphasised an oft-repeated rule in negotiating: get everything in writing. More than anything, this is a failsafe in cases of disputes, which can degenerate into a he-said-she-said very quickly with the lack of documentation.

Lastly, Innes said to carefully weigh the costs of paying extra by staying when rent is due for an increase or just moving somewhere more affordable. This saves money in the long run, but can also be costly in the short term due to moving-associated costs like cleaning and disconnection fees and hiring removalists.

With any luck, this economic squeeze may ease in the coming months, but for now, the best we can do is stay alert to any changes affecting our daily lives.

Key Takeaways

- Rental prices have risen across Australia over the last year, and according to Compare the Market's Phil Portman more hikes are due for 2023.

- The RBA earlier said further interest rate increases are due over the next months to control inflation.

- Various forecasts place cash target rate hikes to as high as 4.10 per cent for 2023.

- While rent hikes seem all but inevitable at this point, there are still things renters can do rates rise.

- Checking the prices of other rentals, knowing local rules and regulations on rent increases, and putting negotiations in writing can greatly help Aussies navigate today's tough times for renters.

- Sydney woman's heartbreaking eviction tale highlights the harsh reality of the housing crisis

- Landlord's rent payment rant draws strong responses on social media

- Rental crisis forces pensioner to leave her community and loved ones behind: 'It's greed, pure greed.'

Tell us in the comments section below!

Last edited: