IGA has just shaken up the supermarket loyalty game, but the question is—will it really change how Australians shop?

Instead of handing out points that often feel like play money, IGA has gone straight for the wallet with actual cash rewards.

For seniors feeling the pinch of rising grocery costs, this move could be either a game-changer or just another loyalty gimmick.

IGA introduced IGA Rewards Cash Back, a program that ditched the old points model in favour of giving customers real money to spend in-store.

The chain said it made the system ‘even better with IGA Cash Back,’ where customers could ‘earn IGA Cash Back on selected purchases to spend on eligible items at participating IGA Rewards stores.’

Unlike Coles’ FlyBuys or Woolworths’ Everyday Rewards, where it took 2,000 points to earn $10, IGA simplified the system so shoppers knew exactly how much they were earning.

Every time a customer shopped an IGA Cash Back offer and scanned their rewards card, their IGA Cash balance grew.

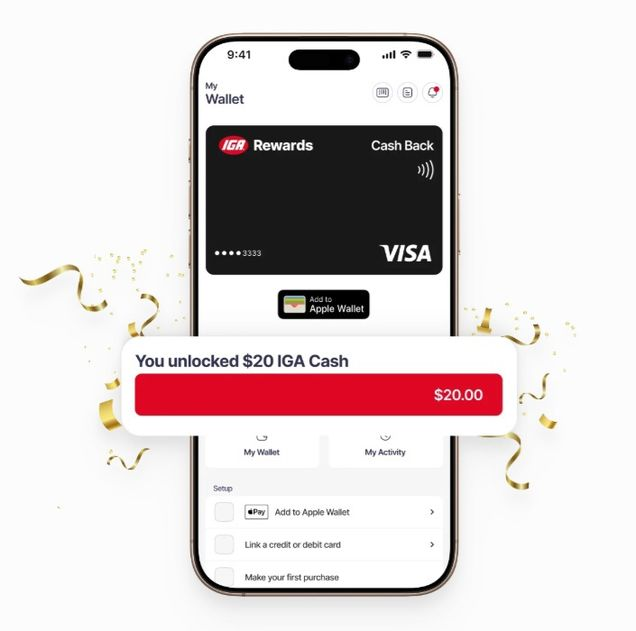

Once the balance hit $20, they could unlock a Digital Visa IGA Rewards Card, ready to use at participating stores, and even add it to their phone’s digital wallet.

'In a cost of living crisis, rewarding people with real money rather than shiny tokens shows they understand how hard it is now for some households to make ends meet.'

This clarity was refreshing after decades of points systems that left many shoppers guessing whether they were getting real value.

But while FlyBuys and Everyday Rewards came with perks like Qantas Points or retail partnerships, IGA Cash could only be spent in IGA stores.

Key differences at a glance

IGA Cash Back: Real dollars earned, $20 minimum to unlock digital Visa card, spend only at IGA

Coles FlyBuys: Points system, 2,000 points = $10, wide range of redemption partners

Woolworths Everyday: Points system, 2,000 points = $10, multiple spending options including Qantas Points

The catch for some seniors was the digital-first setup.

IGA Cash Back only worked through the IGA Rewards app, meaning customers needed a smartphone and a linked digital wallet.

For those less comfortable with tech, the system may have felt like an extra step rather than a benefit.

However, the option to link debit or credit cards for split payments meant balances could be easily topped up at the checkout.

To launch the program with a bang, IGA planned a one-day $100,000 giveaway at Ashcroft IGA Erskine Park on 19 September.

Shoppers who downloaded the app and linked their card could pick an envelope at the register, with prizes ranging from $100 to $4,000.

IGA’s independent model added another layer to the program.

While the chain had over 1,400 stores nationwide, only about 650 joined the rewards system, and cards were tied to nominated stores.

For seniors who preferred to shop locally and stick with one store, this actually felt familiar rather than limiting.

Participating products included everyday household staples like Baby Boo nappies, Purina pet food, and Connoisseur ice cream.

This focus on essentials suggested IGA wanted the rewards to feel immediately useful rather than promotional.

Getting the most from IGA Cash Back

- Stick to your regular shopping list—don't buy items just for cash back

- Download the app before your first visit to participating stores

- Check which IGA stores near you participate in the program

- Remember the $20 minimum threshold—plan your redemptions accordingly

- Consider it a bonus on top of competitive pricing rather than the main reason to switch

Research showed 65 per cent of shoppers now preferred cash back over points, and 74 per cent shopped across multiple brands.

This suggested old-fashioned loyalty was fading, replaced by practical strategies to save wherever possible.

For seniors on fixed incomes, the ability to see and use real cash without navigating complex conversions made the program appealing.

Whether it was worth switching ultimately came down to shopping habits.

For regular IGA customers who used smartphone apps, the program offered simple and immediate value.

But for shoppers invested in airline points or retail rewards, the narrower options may not have justified leaving Coles or Woolworths.

Adding IGA into the mix for certain items could give shoppers an extra edge without abandoning their existing systems.

IGA’s cash back program was a bold attempt to refresh loyalty schemes with something tangible.

It came with challenges for less tech-savvy shoppers, but for many, it felt like a fairer, more straightforward deal than the endless points chase.

What This Means For You

IGA replaced complicated points systems with straightforward cash back rewards, making it easier for shoppers to see real savings. The catch was that the program only worked through the IGA Rewards app and digital Visa card, and it was limited to participating IGA stores.

Even with these conditions, the appeal was clear—cash back offered a simple and practical way to stretch grocery budgets during a time of rising living costs. For seniors especially, this direct approach could feel far more rewarding than juggling confusing points and conversions, giving them a system that truly put money back in their pockets.

If the idea of swapping confusing points for real cash caught your attention, there’s another way to stretch your shopping budget even further.

Some shoppers are already using cashback platforms to earn money on top of their usual supermarket savings, turning everyday purchases into extra rewards.

It’s a practical approach that complements what IGA is offering, and could help you find even more value at the checkout.

Read more: Seniors are getting paid to shop! Here's the ultimate guide to cashback shopping

IGA Rewards | Real Value Every Time You Shop Local — Official program page outlining how shoppers can earn IGA Cash Back on selected purchases at participating stores.

https://www.igarewards.com.au/

Download the IGA Rewards App | Earn & Spend IGA Cash — Explains how the app works, including earning cash back, unlocking the $20 threshold, and using a Digital Visa card.

https://www.igarewards.com.au/download

earn iga cash back with iga rewards — Provides details of the program’s availability through the IGA Rewards app and participating stores only.

https://www.iga.com.au/iga-rewards/

The Ultimate Guide to IGA Rewards—Point Hacks — Independent guide breaking down the program’s limitations, store participation, and store-specific reward cards.

https://www.pointhacks.com.au/guides/loyalty-programs/iga-rewards/

Would you swap points for real cash back, or do you prefer the flexibility of traditional loyalty programs?