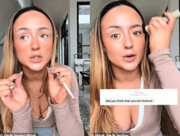

Discover the small sacrifice this Aussie mum made to save a whopping $18,200 in a year! Could you do the same?

- Replies 4

It's no news that the financial crisis regarding the cost of living in Australia keeps intensifying, and it could continue down this path before the light at the end of the tunnel starts to shine. So, the question that stands tall in the face of this crisis–how far can we stretch our pennies to survive in these turbulent economic waters?

One answer came from an extraordinary family living on the Sunshine Coast. Brooke Byrnes, her partner, and their two lovely daughters, aged seven and three, were able to save an astonishing $18,200 in a year and all it required was a small, but nevertheless savvy, sacrifice.

The family adopted this creative strategy while constructing their own home, as they faced the bitter punch of rent hikes regularly. 'The rent increase hasn't been as bad [for us] as for some, but it started at $700 and now it's $850–last lease it jumped up $100,' recounted Brooke Byrnes.

Turning adversity into an opportunity, the family decided to rent out the master bedroom of their three-bedroom residence. This meant they could charge a decent rent fee to the tenant who moved into the largest room in the house.

Finding the right person to share their living space was pure strategy. The room, fetching $350 a week inclusive of all bills, attracted a single, professional woman who was allotted space in the fridge, cupboards, and pantry. Unknowingly, the family had created an efficient system where the housemate rarely ever crossed paths with the family members, with the occasional harmonious interaction.

'They've got their own lounge room down there, and we just share the kitchen and the laundry. So, yeah, it's like upstairs downstairs,' explained Ms Byrnes, explaining the clever set-up.

In terms of keeping the peace, Ms Byrnes confessed to requesting her children to keep the noise down around their tenant, but she said it was a small price to pay considering the enormous cost-saving! The ying to this yang was, of course, ensuring the housemate was always in the loop regarding the property arrangements. The family ensured she was included in the lease, which is a fair move forging a sense of responsibility among all those residing in the house.

'If you're renting your own house, you know, that's fine, but if you're in a rental situation, owners need to know who's in the property, and it gives everyone that responsibility for the property,' she noted.

Resourceful websites like flatmates.com.au and roommates.com.au played cupid in this unique sharing situation by allowing the family to set out what kind of tenant they were looking for by age and other criteria. Their real estate agent was then looped in to vet the new tenant and set the deal in stone.

Please do keep in mind, members, that although setting this up for yourself could be a great cost-cutting arrangement that also allows for a bit of companionship, if you are on the age pension, you would need to notify Centrelink to let them know if there are any changes to your address of living arrangements.

We did some additional research and found that according to Finance and retirement expert Noel Whittaker, ‘if single-income support recipients share accommodation, the department will ask a series of questions about living arrangements to determine whether further assessment is required regarding the relationship.’

For example, the amount of rent assistance you receive may change depending on who you are sharing with i.e. a partner, a friend or a stranger, and how you contribute to costs.

For more information about whether or not it would be worthwhile to take on a roommate without impacting your pension, we highly recommend you talk to Centrelink.

So, what do you think of this story, members? Would you consider this a strategy if you needed to cut some costs? Or maybe you already do it? We’d love to read your thoughts in the comment section below.

One answer came from an extraordinary family living on the Sunshine Coast. Brooke Byrnes, her partner, and their two lovely daughters, aged seven and three, were able to save an astonishing $18,200 in a year and all it required was a small, but nevertheless savvy, sacrifice.

The family adopted this creative strategy while constructing their own home, as they faced the bitter punch of rent hikes regularly. 'The rent increase hasn't been as bad [for us] as for some, but it started at $700 and now it's $850–last lease it jumped up $100,' recounted Brooke Byrnes.

Turning adversity into an opportunity, the family decided to rent out the master bedroom of their three-bedroom residence. This meant they could charge a decent rent fee to the tenant who moved into the largest room in the house.

Finding the right person to share their living space was pure strategy. The room, fetching $350 a week inclusive of all bills, attracted a single, professional woman who was allotted space in the fridge, cupboards, and pantry. Unknowingly, the family had created an efficient system where the housemate rarely ever crossed paths with the family members, with the occasional harmonious interaction.

'They've got their own lounge room down there, and we just share the kitchen and the laundry. So, yeah, it's like upstairs downstairs,' explained Ms Byrnes, explaining the clever set-up.

In terms of keeping the peace, Ms Byrnes confessed to requesting her children to keep the noise down around their tenant, but she said it was a small price to pay considering the enormous cost-saving! The ying to this yang was, of course, ensuring the housemate was always in the loop regarding the property arrangements. The family ensured she was included in the lease, which is a fair move forging a sense of responsibility among all those residing in the house.

'If you're renting your own house, you know, that's fine, but if you're in a rental situation, owners need to know who's in the property, and it gives everyone that responsibility for the property,' she noted.

Resourceful websites like flatmates.com.au and roommates.com.au played cupid in this unique sharing situation by allowing the family to set out what kind of tenant they were looking for by age and other criteria. Their real estate agent was then looped in to vet the new tenant and set the deal in stone.

Key Takeaways

- An Australian family has saved an impressive $18,200 per year by renting out a room in their three-bedroom house located on Queensland's Sunshine Coast.

- The family charges the tenant a flat fee of $350 per week, inclusive of bills, for a master bedroom with an ensuite located on a different floor.

- The enterprising family used flatmates.com.au and roommates.com.au to find a tenant, ensuring the new person was added to the lease for everyone's responsibility for the property.

- Brooke Byrnes, the homeowner, acknowledged that they had to keep their children quieter due to the housemate but considered it a small price to pay given the considerable savings.

Please do keep in mind, members, that although setting this up for yourself could be a great cost-cutting arrangement that also allows for a bit of companionship, if you are on the age pension, you would need to notify Centrelink to let them know if there are any changes to your address of living arrangements.

We did some additional research and found that according to Finance and retirement expert Noel Whittaker, ‘if single-income support recipients share accommodation, the department will ask a series of questions about living arrangements to determine whether further assessment is required regarding the relationship.’

For example, the amount of rent assistance you receive may change depending on who you are sharing with i.e. a partner, a friend or a stranger, and how you contribute to costs.

For more information about whether or not it would be worthwhile to take on a roommate without impacting your pension, we highly recommend you talk to Centrelink.

So, what do you think of this story, members? Would you consider this a strategy if you needed to cut some costs? Or maybe you already do it? We’d love to read your thoughts in the comment section below.