Customers left in limbo: ASIC sues Westpac over delayed responses to hardship notices

- Replies 2

Westpac could be hit with massive financial penalties if the Federal Court rules in favour of the Australian Securities and Investments Commission (ASIC) in its latest move.

On Tuesday, September 5, the regulatory body announced that it initiated civil penalty proceedings against Westpac, alleging that the bank failed to respond promptly to hardship notices from 229 customers between 2015 and 2022.

Customers facing financial hardships within a credit contract can legally and formally inform their banks about their inability to meet repayment obligations. Both the bank and the customer can then negotiate an alternative payment arrangement.

However, if the lender declines to modify the contract, they must notify the customer, who can take their complaints to the Australian Financial Complaints Authority (AFCA).

According to findings by ASIC, numerous customers have allegedly been adversely affected by Westpac's failure to address their hardship notices promptly.

These customers have also revealed challenging circumstances and vulnerabilities, such as their inability to work, the burden of serious medical conditions, or caregiver responsibilities. In some distressing cases, customers found themselves hounded by debt collectors.

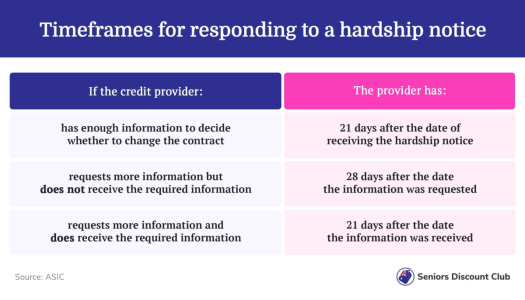

Under the provisions of section 72(4) of the National Credit Code, lenders must inform customers within 21 days if they reject contract changes or require additional information to make a decision.

ASIC has accused Westpac of violating this code by failing to respond within the stipulated time frame and for not adhering to principles of efficiency, honesty, and fairness when addressing their customers' hardship pleas.

ASIC's Deputy Chair, Sarah Court, emphasised the responsibility of financial institutions to promptly address customers' hardship notices in accordance with the law.

'Submitting a hardship notice, which results in a change to the credit contract, can be a lifeline for people experiencing challenging financial circumstances,' she said.

'Westpac's failures to respond to these notices compounded their customers' difficult financial circumstances.'

The date for the first case management hearing is yet to be scheduled.

In a statement submitted to the Federal Court, ASIC alleged that the issues at hand stemmed from a system failure and/or IT error within Westpac.

Scott Collary, the Chief Information Officer of Westpac Group, has acknowledged the initiation of civil penalty proceedings. He also confirmed that the ‘technology failure’ resulted in the bank's inability to assist some customers.

'For this, we are deeply sorry,' he said. 'While we have assisted some of these customers in subsequent contact, it is not good enough that we missed their initial attempt to get in touch.'

'Since we uncovered this issue, we've contacted these customers and completed a remediation program, including refunds of fees and interest, debt waivers and payments for non-financial loss, totalling approximately $900,000.'

He said, 'We have strengthened our processes and are upgrading our online hardship applications.'

This news comes after reports that household financial stress indicators are rising, and banks are sounding the alarm about the impending interest rate hikes.

Recent research conducted by the finance comparison platform Finder revealed that the average debt burden of Australians has surged to $20,238, marking an 11 per cent surge compared to the previous year's figure of $18,301.

With the inflation rate soaring to 7 per cent, Australians are grappling with the pressure of skyrocketing living expenses. Finder's data underscored the extent of this issue, with approximately 54 per cent of Australian adults, equating to 10.9 million individuals, currently holding at least one credit card as of the last month.

Credit card debt has ballooned to $18.6 billion, while personal loans have surged to $19.6 billion. Car loans, too, have seen a notable increase, now standing at an estimated $32.3 billion.

For more information about this issue, read the full article here.

We understand that these situations can be extremely tough to experience, and we hope that the result of this court case will bring some relief for those affected.

If you are dealing with financial hardship, we encourage you to contact your lender as soon as possible. Banks are legally required to have a hardship process and work constructively with you to come to an arrangement that suits your current situation.

What are your thoughts on this news, members? Let us know in the comments below.

On Tuesday, September 5, the regulatory body announced that it initiated civil penalty proceedings against Westpac, alleging that the bank failed to respond promptly to hardship notices from 229 customers between 2015 and 2022.

Customers facing financial hardships within a credit contract can legally and formally inform their banks about their inability to meet repayment obligations. Both the bank and the customer can then negotiate an alternative payment arrangement.

However, if the lender declines to modify the contract, they must notify the customer, who can take their complaints to the Australian Financial Complaints Authority (AFCA).

ASIC has launched civil penalty proceedings in the Federal Court against Westpac, alleging they failed to respond to customers' hardship notices. Credit: Shutterstock.

According to findings by ASIC, numerous customers have allegedly been adversely affected by Westpac's failure to address their hardship notices promptly.

These customers have also revealed challenging circumstances and vulnerabilities, such as their inability to work, the burden of serious medical conditions, or caregiver responsibilities. In some distressing cases, customers found themselves hounded by debt collectors.

Under the provisions of section 72(4) of the National Credit Code, lenders must inform customers within 21 days if they reject contract changes or require additional information to make a decision.

ASIC has accused Westpac of violating this code by failing to respond within the stipulated time frame and for not adhering to principles of efficiency, honesty, and fairness when addressing their customers' hardship pleas.

ASIC's Deputy Chair, Sarah Court, emphasised the responsibility of financial institutions to promptly address customers' hardship notices in accordance with the law.

'Submitting a hardship notice, which results in a change to the credit contract, can be a lifeline for people experiencing challenging financial circumstances,' she said.

'Westpac's failures to respond to these notices compounded their customers' difficult financial circumstances.'

The date for the first case management hearing is yet to be scheduled.

In a statement submitted to the Federal Court, ASIC alleged that the issues at hand stemmed from a system failure and/or IT error within Westpac.

Scott Collary, the Chief Information Officer of Westpac Group, has acknowledged the initiation of civil penalty proceedings. He also confirmed that the ‘technology failure’ resulted in the bank's inability to assist some customers.

'For this, we are deeply sorry,' he said. 'While we have assisted some of these customers in subsequent contact, it is not good enough that we missed their initial attempt to get in touch.'

'Since we uncovered this issue, we've contacted these customers and completed a remediation program, including refunds of fees and interest, debt waivers and payments for non-financial loss, totalling approximately $900,000.'

He said, 'We have strengthened our processes and are upgrading our online hardship applications.'

This news comes after reports that household financial stress indicators are rising, and banks are sounding the alarm about the impending interest rate hikes.

Recent research conducted by the finance comparison platform Finder revealed that the average debt burden of Australians has surged to $20,238, marking an 11 per cent surge compared to the previous year's figure of $18,301.

With the inflation rate soaring to 7 per cent, Australians are grappling with the pressure of skyrocketing living expenses. Finder's data underscored the extent of this issue, with approximately 54 per cent of Australian adults, equating to 10.9 million individuals, currently holding at least one credit card as of the last month.

Credit card debt has ballooned to $18.6 billion, while personal loans have surged to $19.6 billion. Car loans, too, have seen a notable increase, now standing at an estimated $32.3 billion.

For more information about this issue, read the full article here.

Key Takeaways

- The Australian Securities and Investments Commission (ASIC) has taken Westpac to court for allegedly failing to respond to 229 hardship notices within the legally required 21 days.

- Westpac is facing potential millions in fines over the matter.

- Affected Westpac customers claim they encountered financial hardship due to reasons such as inability to work or serious medical conditions. They were allegedly pursued by debt collectors while waiting for a response to their hardship notices.

- Westpac has acknowledged the proceedings and expressed regret over the issue, adding that they have contacted these customers and completed a remediation program, with refunds, debt waivers, and payments for non-financial loss totalling approximately $900,000.

We understand that these situations can be extremely tough to experience, and we hope that the result of this court case will bring some relief for those affected.

If you are dealing with financial hardship, we encourage you to contact your lender as soon as possible. Banks are legally required to have a hardship process and work constructively with you to come to an arrangement that suits your current situation.

What are your thoughts on this news, members? Let us know in the comments below.