Commonwealth Bank alerts homeowners about home prices—what you need to know

By

- Replies 2

As we navigate the ever-changing tides of the Australian housing market, homeowners and prospective buyers must stay informed about the latest forecasts and trends.

Recently, the Commonwealth Bank, one of Australia's leading financial institutions, has issued a warning that could have significant implications for property owners and those eyeing the market.

The bank's head of Australian economics, Gareth Aird, has projected that house prices are set to decline in early 2025 despite anticipated cuts to interest rates by the Reserve Bank of Australia (RBA).

This prediction may surprise many, especially considering that lower interest rates typically stimulate the housing market.

Aird explains that the national housing market may experience a period of fatigue, with affordability remaining a challenge based on conventional metrics.

'It is not unusual to see some fatigue creep into the national housing market given affordability remains stretched on most conventional metrics,' he said.

This suggested that even with the expected rate cuts, the high cost of housing relative to income levels could continue to dampen market activity.

In Sydney and Melbourne, where property prices have historically been high, the Commonwealth Bank does not foresee a sudden price surge as rates drop.

This is partly due to the increased number of properties listed for sale, with advertised stock levels sitting well above the five-year average for this time.

The RBA's anticipated rate cut in February 2025 would be the first easing since November 2020.

The Commonwealth Bank expects four rate cuts throughout the year, which could lead to a fall in house prices in the first half of the year, followed by a rebound in the latter half.

Overall, they predict an annual increase of four per cent in house prices.

'Prices are likely to continue to edge lower in the first half of 2025 before lifting over the second half of the year as borrowing capacity increases due to lower mortgage rates,' Mr Aird stated.

This forecast suggests a potential opportunity for buyers to enter the market when prices are lower, with the expectation of growth later in the year.

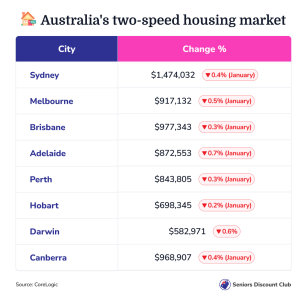

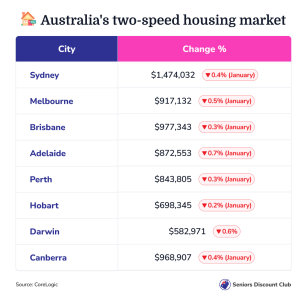

Australia's housing market is experiencing a two-speed dynamic, with prices falling in major cities like Sydney, Melbourne, Hobart, and Canberra while rising in Brisbane, Adelaide, Perth, and Darwin.

CoreLogic's research director, Tim Lawless, believed that any national downturn is likely short-lived, citing lower mortgage rates, increased borrowing capacity, and an undersupply of newly built housing as factors that could mitigate a deep housing downturn.

However, the market is not expected to experience explosive growth in 2023 and early 2024 as immigration levels normalise from record highs.

'The easing cycle for interest rates is likely to be gradual, and we also have the ongoing headwinds of affordability constraints, normalising population growth, and generally soft economic conditions to contend with,' Lawless added.

In light of these predictions, homeowners must be vigilant and consider their long-term financial strategies.

Those looking to sell may want to assess the timing of their sale, while buyers could benefit from waiting for potential price drops.

It's also a good time for homeowners to review their mortgages and consider refinancing options to take advantage of lower rates when they come into effect.

The Reserve Bank of Australia held the cash rate steady at 4.35 per cent, defying expectations of a shift in tone amid inflation progress.

ANZ and NAB economists offered contrasting perspectives on the decision, with forecasts suggesting a more neutral stance. You can read more about it here.

Have you noticed changes in your local property market? Are you considering buying or selling in the near future? Let's discuss how we can navigate these waters together, armed with knowledge and foresight.

Recently, the Commonwealth Bank, one of Australia's leading financial institutions, has issued a warning that could have significant implications for property owners and those eyeing the market.

The bank's head of Australian economics, Gareth Aird, has projected that house prices are set to decline in early 2025 despite anticipated cuts to interest rates by the Reserve Bank of Australia (RBA).

This prediction may surprise many, especially considering that lower interest rates typically stimulate the housing market.

Aird explains that the national housing market may experience a period of fatigue, with affordability remaining a challenge based on conventional metrics.

'It is not unusual to see some fatigue creep into the national housing market given affordability remains stretched on most conventional metrics,' he said.

This suggested that even with the expected rate cuts, the high cost of housing relative to income levels could continue to dampen market activity.

In Sydney and Melbourne, where property prices have historically been high, the Commonwealth Bank does not foresee a sudden price surge as rates drop.

This is partly due to the increased number of properties listed for sale, with advertised stock levels sitting well above the five-year average for this time.

The RBA's anticipated rate cut in February 2025 would be the first easing since November 2020.

The Commonwealth Bank expects four rate cuts throughout the year, which could lead to a fall in house prices in the first half of the year, followed by a rebound in the latter half.

Overall, they predict an annual increase of four per cent in house prices.

'Prices are likely to continue to edge lower in the first half of 2025 before lifting over the second half of the year as borrowing capacity increases due to lower mortgage rates,' Mr Aird stated.

This forecast suggests a potential opportunity for buyers to enter the market when prices are lower, with the expectation of growth later in the year.

Australia's housing market is experiencing a two-speed dynamic, with prices falling in major cities like Sydney, Melbourne, Hobart, and Canberra while rising in Brisbane, Adelaide, Perth, and Darwin.

CoreLogic's research director, Tim Lawless, believed that any national downturn is likely short-lived, citing lower mortgage rates, increased borrowing capacity, and an undersupply of newly built housing as factors that could mitigate a deep housing downturn.

However, the market is not expected to experience explosive growth in 2023 and early 2024 as immigration levels normalise from record highs.

'The easing cycle for interest rates is likely to be gradual, and we also have the ongoing headwinds of affordability constraints, normalising population growth, and generally soft economic conditions to contend with,' Lawless added.

In light of these predictions, homeowners must be vigilant and consider their long-term financial strategies.

Those looking to sell may want to assess the timing of their sale, while buyers could benefit from waiting for potential price drops.

It's also a good time for homeowners to review their mortgages and consider refinancing options to take advantage of lower rates when they come into effect.

The Reserve Bank of Australia held the cash rate steady at 4.35 per cent, defying expectations of a shift in tone amid inflation progress.

ANZ and NAB economists offered contrasting perspectives on the decision, with forecasts suggesting a more neutral stance. You can read more about it here.

Key Takeaways

- The Commonwealth Bank forecasts a fall in Australian house prices in early 2025 despite expected interest rate cuts.

- There is an anticipation of national fatigue in the housing market due to stretched affordability.

- The bank predicts rate cuts in February 2025, with house prices to decline in the first half but increase in the second half of the year.

- There are regional disparities, with prices in cities like Sydney and Melbourne falling, while Brisbane, Adelaide, Perth, and Darwin see increases.

Last edited by a moderator: