Coles customer credit card details compromised - Here’s what you need to know

By

- Replies 8

In today's world, the internet has become an integral part of our lives.

With the vast amount of information available at our fingertips, it's no wonder that cyber security has become a growing concern for individuals and businesses alike.

Data breaches have become all too common in recent years, with hackers constantly devising new ways to compromise online systems and steal sensitive information.

Unfortunately, it looks like this was the case with Coles Financial Services, which confirmed that historical customer credit card details has fallen victim to a massive hack.

The retailer expressed its disappointment after learning that the massive Latitude Financial data hack has impacted its customers.

A Coles representative said in a statement: ‘We are disappointed that this cyber incident has taken place and apologise for the inconvenience and uncertainty created.’

‘As a former service provider, Latitude Financial Services has informed Coles Financial Services that historical Coles credit cardholder data has been affected by the recent cyber incident.’

According to the spokesperson, Latitude has not yet provided Coles with any specific information regarding the number of affected customers or details of the breach.

‘In March 2018, Coles Financial Services moved its credit cards to Citibank,’ they continued.

‘In the event you have any questions about your current Coles Mastercard please visit our Coles Financial Services contact centre page.’

Latitude Financial provides personal finance products, such as interest-free credit cards and buy now, pay later schemes, to customers in Australia and New Zealand.

It was previously owned by GE Australia before being acquired by Värde Partners, KKR, and Deutsche Bank in 2015. The company has partnerships with several major retailers through its different credit cards, including Apple, Harvey Norman, Domayne, and Joyce Mayne.

Its Gem Visa card is partnered with JB Hi-Fi, Amart Furniture, The Good Guys, and offers interest-free offers with 91 other businesses.

Latitude Financial's CEO, Bob Belan, stated that the company will not pay a ransom to the cybercriminals responsible for stealing their data.

Belan said that rewarding criminal behaviour would not benefit consumers and no guarantee paying the ransom would result in the destruction of customer data.

Additionally, he believes that paying the ransom would only encourage further extortion attempts on businesses in Australia and New Zealand.

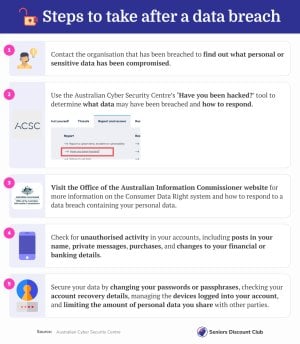

The recent data breach involving Coles Financial Services highlights the growing concern for cyber security in today's world.

With hackers constantly devising new ways to compromise online systems and steal sensitive information, it is important for individuals and businesses to take steps to protect themselves.

We also recommend reading this article where we reported on how some of the data stolen from organisations were found on the deep web.

What are your thoughts on this, folks? Also, feel free to share this article to your friends and loved ones, especially those who may be impacted.

With the vast amount of information available at our fingertips, it's no wonder that cyber security has become a growing concern for individuals and businesses alike.

Data breaches have become all too common in recent years, with hackers constantly devising new ways to compromise online systems and steal sensitive information.

Unfortunately, it looks like this was the case with Coles Financial Services, which confirmed that historical customer credit card details has fallen victim to a massive hack.

The retailer expressed its disappointment after learning that the massive Latitude Financial data hack has impacted its customers.

A Coles representative said in a statement: ‘We are disappointed that this cyber incident has taken place and apologise for the inconvenience and uncertainty created.’

‘As a former service provider, Latitude Financial Services has informed Coles Financial Services that historical Coles credit cardholder data has been affected by the recent cyber incident.’

Of the approximately 14 million customer records that were exposed in the attack, Coles’ historical credit card holder’s personal information is the latest to be identified. Credit: Shutterstock.

According to the spokesperson, Latitude has not yet provided Coles with any specific information regarding the number of affected customers or details of the breach.

‘In March 2018, Coles Financial Services moved its credit cards to Citibank,’ they continued.

‘In the event you have any questions about your current Coles Mastercard please visit our Coles Financial Services contact centre page.’

Latitude Financial provides personal finance products, such as interest-free credit cards and buy now, pay later schemes, to customers in Australia and New Zealand.

It was previously owned by GE Australia before being acquired by Värde Partners, KKR, and Deutsche Bank in 2015. The company has partnerships with several major retailers through its different credit cards, including Apple, Harvey Norman, Domayne, and Joyce Mayne.

Its Gem Visa card is partnered with JB Hi-Fi, Amart Furniture, The Good Guys, and offers interest-free offers with 91 other businesses.

Latitude Financial's CEO, Bob Belan, stated that the company will not pay a ransom to the cybercriminals responsible for stealing their data.

Belan said that rewarding criminal behaviour would not benefit consumers and no guarantee paying the ransom would result in the destruction of customer data.

Additionally, he believes that paying the ransom would only encourage further extortion attempts on businesses in Australia and New Zealand.

Key Takeaways

- Coles Financial Services has expressed disappointment after learning that historical customer credit card details were stolen in the Latitude data breach.

- Coles credit card holders' personal details are among 14 million customer records compromised in the hack.

- Latitude Financial Services has informed Coles of the breach and is contacting affected customers.

- The hack included details for 7.9 million driver’s licences and roughly 53,000 passport numbers among the stolen customer records.

The recent data breach involving Coles Financial Services highlights the growing concern for cyber security in today's world.

With hackers constantly devising new ways to compromise online systems and steal sensitive information, it is important for individuals and businesses to take steps to protect themselves.

We also recommend reading this article where we reported on how some of the data stolen from organisations were found on the deep web.

What are your thoughts on this, folks? Also, feel free to share this article to your friends and loved ones, especially those who may be impacted.