Changes are coming for residential aged care. Here’s what to know

- Replies 0

The way Australians pay for residential aged care, or nursing homes, is changing from November 1.

Payment arrangements will be grouped into four main areas:

There will be no changes for residents who are living in aged care homes on October 31.

In addition, new residents who are assessed as having low financial means will not be affected. These are typically full pensioners without major assets who have an income of less than A$34,762 (for a single pensioner, slightly less if one of a couple) and assets of less than $63,000. The government will cover the full costs of their care.

All low-means residents will continue to pay a basic daily fee to contribute to their everyday living expenses. This is calculated as 85% of the basic single age pension, which is $65.55 at the current pension rate. The government also pays providers an extra Hotelling Supplement to top up their funding.

Clinical care will be fully subsidised for all

Who will have to pay for non-clinical and everyday living?

New means tested fees will be payable as a contribution to the costs of non-clinical care and everyday living for new residents who have higher means.

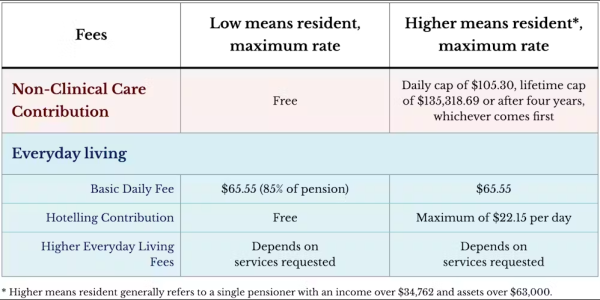

The government has published the Schedule of Fees and Charges that will apply from November 1 as well as a Fee Estimator. The following provides a simplified guide to these fees:

For those who can afford to contribute, payments for help with non-clinical care will be means tested and capped at $105.30 per day, with a lifetime cap of $135,318.69 (or after four years, whichever is reached first). Fees paid under the Support at Home program will be counted toward the cap.

All residents receive a wide range of everyday living services and, as now, will continue to pay a basic daily fee to contribute to their cost.

However, the fee does not meet the full costs of these services. From November 1, new residents with significant means will contribute to some or all of the cost of the top-up Hotelling Supplement, up to a maximum of $22.15 per day.

Some providers also offer extra or higher quality services and can set their prices which will become Higher Everyday Living Fees from November 1. These services are optional and payment of this fee cannot be made a condition of entry to an aged care home.

How is accommodation funding changing and who is affected?

The government will continue to pay the accommodation costs of all current and future low means residents by way of an accommodation supplement. Currently about 19% of residents are fully supported in this way.

A further 19% of residents are partially supported through government funding and pay their contribution through a refundable lump sum or an ongoing rental payment, or a combination. The contributions are capped and can’t exceed the value of the government’s accommodation supplement.

The remaining approximately 62% of residents are non-supported. They pay a set room price agreed with the provider, again by refundable lump sum and/or paying rent.

From November 1, providers will be able to deduct 2% of the balance of a resident’s lump sum each year for the first five years of residence or until the resident leaves, if earlier than five years.

If a non-supported resident (not eligible for government funding) is making rental payments, this amount will be indexed twice each year.

The government has a description of these funding changes here.

Why is aged care changing again?

The aged care system faces several long-term challenges. The demand for aged care continues to rise as the population ages, and the standards of care need to keep improving.

At the same time, nearly half of aged care homes operate at a loss, particularly in their delivery of everyday living services and accommodation. Homes making ongoing losses are at greater risk of closing, meaning less places available for older people in need of care in their local area.

The government has responded to a range of recommendations in recent reports on how to raise the quality and financial viability of aged care by rewriting the Aged Care Act.

Starting on November 1, the new Act aims to strengthens the rights of older people to receive high quality care and recognises the need to increase the funding of everyday living and accommodation services.

Increased funding will help support quality providers to be viable, build more homes and attract more skilled workers through higher wages and better conditions.

This additional funding should be shared equitably between taxpayers and older people who have significant income and assets, while ensuring those with low means receive the services they need.

Will there be further changes?

The changes to accommodation funding will not solve all of its issues, with the government announcing a further pricing review.

The review is exploring how to ensure older people with low means have access to high-quality aged care homes, while enabling providers to invest in the additional supply of quality accommodation needed to meet rising demand.

The findings will be publicly reported by July 2026 and may prompt further changes to accommodation payments.

This article is originally posted in The Conversation. You may read the original article here.

Payment arrangements will be grouped into four main areas:

- clinical care, which includes nursing, physiotherapy and medication management

- non-clinical care means help with personal care, such as showering, feeding and going to the toilet

- everyday living services, including meals, personal laundry and cleaning

- accommodation.

There will be no changes for residents who are living in aged care homes on October 31.

In addition, new residents who are assessed as having low financial means will not be affected. These are typically full pensioners without major assets who have an income of less than A$34,762 (for a single pensioner, slightly less if one of a couple) and assets of less than $63,000. The government will cover the full costs of their care.

All low-means residents will continue to pay a basic daily fee to contribute to their everyday living expenses. This is calculated as 85% of the basic single age pension, which is $65.55 at the current pension rate. The government also pays providers an extra Hotelling Supplement to top up their funding.

Clinical care will be fully subsidised for all

The government will fully fund all clinical care costs for all residents in aged care homes from November 1.

Who will have to pay for non-clinical and everyday living?

New means tested fees will be payable as a contribution to the costs of non-clinical care and everyday living for new residents who have higher means.

The government has published the Schedule of Fees and Charges that will apply from November 1 as well as a Fee Estimator. The following provides a simplified guide to these fees:

For those who can afford to contribute, payments for help with non-clinical care will be means tested and capped at $105.30 per day, with a lifetime cap of $135,318.69 (or after four years, whichever is reached first). Fees paid under the Support at Home program will be counted toward the cap.

All residents receive a wide range of everyday living services and, as now, will continue to pay a basic daily fee to contribute to their cost.

However, the fee does not meet the full costs of these services. From November 1, new residents with significant means will contribute to some or all of the cost of the top-up Hotelling Supplement, up to a maximum of $22.15 per day.

Some providers also offer extra or higher quality services and can set their prices which will become Higher Everyday Living Fees from November 1. These services are optional and payment of this fee cannot be made a condition of entry to an aged care home.

How is accommodation funding changing and who is affected?

The government will continue to pay the accommodation costs of all current and future low means residents by way of an accommodation supplement. Currently about 19% of residents are fully supported in this way.

A further 19% of residents are partially supported through government funding and pay their contribution through a refundable lump sum or an ongoing rental payment, or a combination. The contributions are capped and can’t exceed the value of the government’s accommodation supplement.

The remaining approximately 62% of residents are non-supported. They pay a set room price agreed with the provider, again by refundable lump sum and/or paying rent.

From November 1, providers will be able to deduct 2% of the balance of a resident’s lump sum each year for the first five years of residence or until the resident leaves, if earlier than five years.

If a non-supported resident (not eligible for government funding) is making rental payments, this amount will be indexed twice each year.

The government has a description of these funding changes here.

Why is aged care changing again?

The aged care system faces several long-term challenges. The demand for aged care continues to rise as the population ages, and the standards of care need to keep improving.

At the same time, nearly half of aged care homes operate at a loss, particularly in their delivery of everyday living services and accommodation. Homes making ongoing losses are at greater risk of closing, meaning less places available for older people in need of care in their local area.

The government has responded to a range of recommendations in recent reports on how to raise the quality and financial viability of aged care by rewriting the Aged Care Act.

Starting on November 1, the new Act aims to strengthens the rights of older people to receive high quality care and recognises the need to increase the funding of everyday living and accommodation services.

Increased funding will help support quality providers to be viable, build more homes and attract more skilled workers through higher wages and better conditions.

This additional funding should be shared equitably between taxpayers and older people who have significant income and assets, while ensuring those with low means receive the services they need.

Will there be further changes?

The changes to accommodation funding will not solve all of its issues, with the government announcing a further pricing review.

The review is exploring how to ensure older people with low means have access to high-quality aged care homes, while enabling providers to invest in the additional supply of quality accommodation needed to meet rising demand.

The findings will be publicly reported by July 2026 and may prompt further changes to accommodation payments.

This article is originally posted in The Conversation. You may read the original article here.