Can young Aussies survive the cost of living crisis? Seniors offer advice

As the cost of living crisis intensifies, many are scrambling to find ways to make ends meet.

With younger Australians increasingly facing uncertain times, senior Aussies are offering some perhaps controversial advice.

Their suggestions include starting superannuation contributions early, forgoing luxuries like dining out and Netflix, and being mindful of expenses.

With the Big Four banks (Commonwealth, ANZ, Westpac and NAB) hinting at another interest rate hike to tackle inflation for November, these words of wisdom might be worth considering.

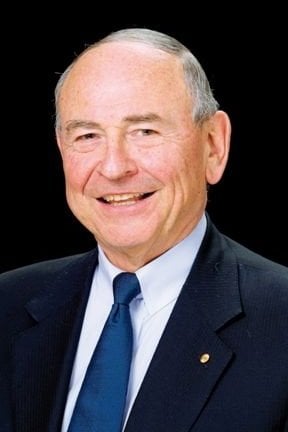

Maurice Newman, 85, who once led the ABC and the Australian Securities Exchange, recalled his childhood escape from London in 1943 during World War II at the age of five.

After being relocated to a farm in Devon to steer clear of Nazi bombings, Mr Newman recounted surviving on horse meat.

‘You don't see them as privations,’ he said.

‘That's how it is. Certainly, as a child, it’s the way it is. You sort of suck it up.’

‘We never went without food on the table—we ate horse meat and whale meat, and that sort of stuff.’

Mr Newman, also a former chancellor at Macquarie University, said that today’s youth might find it challenging to go without a Netflix subscription, which currently costs $23 monthly.

‘We didn't have Netflix—I don’t know where people’s priorities are, I suspect probably they see Netflix and home entertainment as being a priority.’

‘Without being judgmental about young people today, I’d have to say that my generation is more resilient because it had to be—we didn’t have those sorts of luxuries.’

While Mr Newman advises doing away with subscriptions, another senior takes things to another level.

59-year-old grandmother Rachel Wellstead commits to full-time night shifts at an Amazon warehouse, intending to continue until she’s 70 to ensure a comfortable retirement.

Starting her shift as a safety coordinator in Melbourne at 6:15 pm and wrapping up a post at 4:00 am, she benefits from a 30 per cent late-night wage bonus.

To prepare for her retirement—and leave fiscal space for possible Asian cruises—she avoids upscale dining, a luxury many Australians find unaffordable due to rising living costs.

Her prudent living and smart work-time choices might serve as an inspiration to the younger generation.

‘One of the reasons why I do nights is because it’s a little bit higher paid,’ she shared.

‘I don't need it to survive, it helps with my savings.

‘I could quite easily do the day shift and still be able to pay the rent, that's no problem.’

Miss Wellstead sees herself as a diligent and financially astute member of her generation, which encompasses those born between 1946 and 1964.

She aspires to relocate to Lakes Entrance, a seaside town situated 300km east of Melbourne, and enjoy a humble retirement with the occasional cruise, feasible with her savings of around $250,000.

Her advice to young generations is to start building their superannuation early.

The Association of Superannuation Funds of Australia recommends $595,000 for individuals and $690,000 for couples to retire comfortably and receive the age pension at 67.

‘I think if you start early enough, yes, but if you left it too later on, it wouldn't be achievable because of the cost of living.’

Miss Wellstead stressed, ‘You get out of life what you put into it.’

She believes in putting in the effort if one wishes to achieve more. She and her partner have set their sights on working until the age of 70 to make the most of both their pre and post-retirement years.

Having raised a family of five, she opts for night shifts to fund dream trips, such as a cruise from Sydney to Singapore or an adventure in Japan, before age becomes a barrier.

Her decisions are aligned with her aspirations for the future. Currently, she and her partner are eyeing a cruise in the upcoming years and are in the planning stages of this anticipated trip.

To save up, Miss Wellstead prefers the local club for her meals instead.

‘When we go for a meal, we go to the local club.’

She and her partner are vigilant about their finances, ensuring they deliberate thoroughly on significant expenditures.

Having raised five children now in their twenties and thirties, she highlights their upbringing, which instilled in them the value of self-sufficiency.

She feels this approach has not only set her children on a path to independence but also allows her to relish her years as an empty nester without the financial strain of supporting them.

For her, this phase in life is about seizing the moment and cherishing every experience.

Meanwhile, demographer Bernard Salt dispelled any notions that his generation wasn’t talking down to younger generations on financial matters, including savings.

‘In retirement, they'll be very focused on keeping fit, keeping well, keeping engaged, making a contribution, volunteering where they can, helping out their family wherever they can in some way, is also consistent with the evidence I've seen,’ he commented.

A significant number of today’s seniors pursued higher education during the era of tuition-free college, a policy from 1974 to 1989. This included notable figures like Prime Minister Anthony Albanese.

Furthermore, Mr Salt highlighted a trend among older Australians; many have preferred to shift to part-time work from home as a stepping stone towards retirement, as evidenced by a survey.

‘Seniors benefited from the educational policies of the Whitlam government in the 1970s, elevating their tertiary education levels,’ he noted.

‘This equipped them for knowledge-based roles, giving them the flexibility to extend their careers if desired.’

Recent data highlights a growing number of Australians opting for remote work, especially among the older age groups.

Mr Salt suggests that their senior positions or specific skill sets might explain this trend.

Members, what other guidance can you offer younger Aussies based on your experiences or advice you wish you'd received earlier? Let us know in the comments below!

With younger Australians increasingly facing uncertain times, senior Aussies are offering some perhaps controversial advice.

Their suggestions include starting superannuation contributions early, forgoing luxuries like dining out and Netflix, and being mindful of expenses.

With the Big Four banks (Commonwealth, ANZ, Westpac and NAB) hinting at another interest rate hike to tackle inflation for November, these words of wisdom might be worth considering.

Maurice Newman, 85, who once led the ABC and the Australian Securities Exchange, recalled his childhood escape from London in 1943 during World War II at the age of five.

After being relocated to a farm in Devon to steer clear of Nazi bombings, Mr Newman recounted surviving on horse meat.

‘You don't see them as privations,’ he said.

‘That's how it is. Certainly, as a child, it’s the way it is. You sort of suck it up.’

‘We never went without food on the table—we ate horse meat and whale meat, and that sort of stuff.’

Mr Newman, also a former chancellor at Macquarie University, said that today’s youth might find it challenging to go without a Netflix subscription, which currently costs $23 monthly.

‘We didn't have Netflix—I don’t know where people’s priorities are, I suspect probably they see Netflix and home entertainment as being a priority.’

‘Without being judgmental about young people today, I’d have to say that my generation is more resilient because it had to be—we didn’t have those sorts of luxuries.’

While Mr Newman advises doing away with subscriptions, another senior takes things to another level.

59-year-old grandmother Rachel Wellstead commits to full-time night shifts at an Amazon warehouse, intending to continue until she’s 70 to ensure a comfortable retirement.

Starting her shift as a safety coordinator in Melbourne at 6:15 pm and wrapping up a post at 4:00 am, she benefits from a 30 per cent late-night wage bonus.

To prepare for her retirement—and leave fiscal space for possible Asian cruises—she avoids upscale dining, a luxury many Australians find unaffordable due to rising living costs.

Her prudent living and smart work-time choices might serve as an inspiration to the younger generation.

‘One of the reasons why I do nights is because it’s a little bit higher paid,’ she shared.

‘I don't need it to survive, it helps with my savings.

‘I could quite easily do the day shift and still be able to pay the rent, that's no problem.’

Miss Wellstead sees herself as a diligent and financially astute member of her generation, which encompasses those born between 1946 and 1964.

She aspires to relocate to Lakes Entrance, a seaside town situated 300km east of Melbourne, and enjoy a humble retirement with the occasional cruise, feasible with her savings of around $250,000.

Her advice to young generations is to start building their superannuation early.

The Association of Superannuation Funds of Australia recommends $595,000 for individuals and $690,000 for couples to retire comfortably and receive the age pension at 67.

‘I think if you start early enough, yes, but if you left it too later on, it wouldn't be achievable because of the cost of living.’

Miss Wellstead stressed, ‘You get out of life what you put into it.’

She believes in putting in the effort if one wishes to achieve more. She and her partner have set their sights on working until the age of 70 to make the most of both their pre and post-retirement years.

Having raised a family of five, she opts for night shifts to fund dream trips, such as a cruise from Sydney to Singapore or an adventure in Japan, before age becomes a barrier.

Her decisions are aligned with her aspirations for the future. Currently, she and her partner are eyeing a cruise in the upcoming years and are in the planning stages of this anticipated trip.

To save up, Miss Wellstead prefers the local club for her meals instead.

‘When we go for a meal, we go to the local club.’

She and her partner are vigilant about their finances, ensuring they deliberate thoroughly on significant expenditures.

Having raised five children now in their twenties and thirties, she highlights their upbringing, which instilled in them the value of self-sufficiency.

She feels this approach has not only set her children on a path to independence but also allows her to relish her years as an empty nester without the financial strain of supporting them.

For her, this phase in life is about seizing the moment and cherishing every experience.

Meanwhile, demographer Bernard Salt dispelled any notions that his generation wasn’t talking down to younger generations on financial matters, including savings.

‘In retirement, they'll be very focused on keeping fit, keeping well, keeping engaged, making a contribution, volunteering where they can, helping out their family wherever they can in some way, is also consistent with the evidence I've seen,’ he commented.

A significant number of today’s seniors pursued higher education during the era of tuition-free college, a policy from 1974 to 1989. This included notable figures like Prime Minister Anthony Albanese.

Furthermore, Mr Salt highlighted a trend among older Australians; many have preferred to shift to part-time work from home as a stepping stone towards retirement, as evidenced by a survey.

‘Seniors benefited from the educational policies of the Whitlam government in the 1970s, elevating their tertiary education levels,’ he noted.

‘This equipped them for knowledge-based roles, giving them the flexibility to extend their careers if desired.’

Recent data highlights a growing number of Australians opting for remote work, especially among the older age groups.

Mr Salt suggests that their senior positions or specific skill sets might explain this trend.

Key Takeaways

- Senior Aussies advise cutting luxuries like Netflix and pricey meals to tackle the Australian cost of living crisis.

- Maurice Newman emphasises resilience, hinting at challenges for younger people without modern comforts.

- Rachel Wellstead, 59, works night shifts at Amazon until 70, prioritising frugality for retirement savings.

- Demographer Bernard Salt notes seniors in their early 60s focus on volunteering and health and rejects claims of lecturing younger generations on saving.