Calls for change to insurance stamp duty as Queensland projected to profit more than $2 billion

By

ABC News

- Replies 1

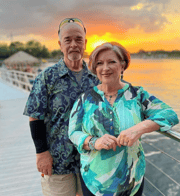

Pensioner Anne Sharrocks has watched her home and contents insurance, along with the government taxes associated with it, rise year after year.

The price to insure her Middle Park home, in Brisbane's west, jumped by more than $1,000 just this year, bringing the annual premium to $10,847.

The rising premium means a rising stamp duty.

This year Ms Sharrocks paid $895 to the state government, part of the $1.6 billion it reaped during the 2024-25 financial year from the tax.

Additionally, she paid $904 in GST.

The house flooded in 2011, but the family's insurer did not pay out because it did not cover riverine flooding, Ms Sharocks said.

It has left her struggling to stay in the house she built with her late husband when they moved from England.

"I live on my own — my husband passed away five years ago in December — and we lost most of our money rebuilding the house, so I live off a state pension," Ms Sharrocks said.

Now she must pay $903 a month "before anything else", she said.

The price included a 30 per cent discount for never making a claim, Ms Sharrock said.

Now in government, the LNP has not made changes to stamp duty on insurance premiums, which are projected to bring in more than $2 billion in the 2027-28 financial year.

The Insurance Council of Australia has consistently asked states to lessen stamp duty, which CEO Andrew Hall has called "lazy" and "punishing people for doing the right thing".

Associate Professor Kirsten McDonald from Griffith University said examples like Ms Sharrocks's are exactly why the state must look at stamp duty reform.

She said repeated natural disasters had led to a "significant rise" in premiums in Queensland, and people were questioning whether they should keep their insurance.

"It's certainly a prompt for the government to look at reform on stamp duty," Dr McDonald said.

Dr McDonald said stamp duty impacted poorer people more "because wealthier people can choose to pay a higher excess" rather than fork out for a large premium.

She said the double whammy of stamp duty and GST could make insurance unaffordable for some.

"Lower socio-economic groups are where we tend to see underinsurance," she said.

"We know household budgets continue to come under pressure, which is why since forming government, we've taken decisive and immediate action on meaningful and targeted cost-of-living relief for Queenslanders who need it most," Mr Janetzki said.

"We're investing in mitigation and resilience measures, while our comprehensive plan to deliver safety where you live also puts downward pressure on insurance premiums."

For her part, Ms Sharrocks thought as insurance prices got out of hand for many, both state and federal governments should consider ditching their taxes.

She called the $2 billion the state stands to make by 2027-28 "an awful lot of money", and said "anything that can reduce" her bill would go a long way to help.

"I can just about pay this. I do know a lot of people don't insure their houses. They've got to make it viable for people to insure," she said.

"They can't just keep bleeding us, and they are. Stamp duty, GST, it's just one after another."

By Julius Dennis

The price to insure her Middle Park home, in Brisbane's west, jumped by more than $1,000 just this year, bringing the annual premium to $10,847.

The rising premium means a rising stamp duty.

This year Ms Sharrocks paid $895 to the state government, part of the $1.6 billion it reaped during the 2024-25 financial year from the tax.

Additionally, she paid $904 in GST.

The house flooded in 2011, but the family's insurer did not pay out because it did not cover riverine flooding, Ms Sharocks said.

It has left her struggling to stay in the house she built with her late husband when they moved from England.

"I live on my own — my husband passed away five years ago in December — and we lost most of our money rebuilding the house, so I live off a state pension," Ms Sharrocks said.

Now she must pay $903 a month "before anything else", she said.

The price included a 30 per cent discount for never making a claim, Ms Sharrock said.

'Robbing people blind'

When in opposition, Premier David Crisafulli called the insurance industry "the milking cow" of governments, and called for a rethink of stamp duty that was "robbing people blind".Now in government, the LNP has not made changes to stamp duty on insurance premiums, which are projected to bring in more than $2 billion in the 2027-28 financial year.

The Insurance Council of Australia has consistently asked states to lessen stamp duty, which CEO Andrew Hall has called "lazy" and "punishing people for doing the right thing".

Associate Professor Kirsten McDonald from Griffith University said examples like Ms Sharrocks's are exactly why the state must look at stamp duty reform.

"It's certainly a prompt for the government to look at reform on stamp duty," Dr McDonald said.

The Australian Capital Territory is the only state or territory not to enforce stamp duty on insurance in Australia.Dr McDonald said stamp duty impacted poorer people more "because wealthier people can choose to pay a higher excess" rather than fork out for a large premium.

She said the double whammy of stamp duty and GST could make insurance unaffordable for some.

"Lower socio-economic groups are where we tend to see underinsurance," she said.

'They can't keep bleeding us'

When asked if the cost of stamp duty on Ms Sharrocks's insurance was fair, Queensland Treasurer David Janetzki pointed to the "targeted" cost-of-living measures the government had included in June's state budget."We know household budgets continue to come under pressure, which is why since forming government, we've taken decisive and immediate action on meaningful and targeted cost-of-living relief for Queenslanders who need it most," Mr Janetzki said.

"We're investing in mitigation and resilience measures, while our comprehensive plan to deliver safety where you live also puts downward pressure on insurance premiums."

For her part, Ms Sharrocks thought as insurance prices got out of hand for many, both state and federal governments should consider ditching their taxes.

"I can just about pay this. I do know a lot of people don't insure their houses. They've got to make it viable for people to insure," she said.

"They can't just keep bleeding us, and they are. Stamp duty, GST, it's just one after another."

By Julius Dennis