Banks urged to take responsibility for protecting customers against scams

- Replies 4

Have you or someone you know fallen victim to a scam? If so, you're not alone. In recent years, scams have been on the rise, and they're becoming more sophisticated, which is making it harder for Australians, especially older adults, to protect themselves.

Scammers use advanced tactics, such as social engineering, phishing, and identity theft, to target their victims and take advantage of their lack of knowledge about the latest technology and online threats.

According to the Australian Competition and Consumer Commission (ACCC), scams cost Australian consumers and businesses over $2 billion in 2021 alone. Thankfully, financial institutions have been taking steps to prevent and recover losses from scams.

In 2021, they stopped or recovered nearly $341 million from scammers and refunded $103 million to customers who were victims of scams, up from $49 million in 2020. While these numbers are encouraging, there is still more work to be done to protect vulnerable populations.

Thankfully, consumer advocacy groups are working hard to protect us from such scams. That's why CHOICE – along with the Consumer Action Law Centre – is pressing banks to adopt better security measures and to reimburse victims of scams regardless of the customer's blame.

CHOICE's Head of Policy, Patrick Veyret, recently noted that 'Australia had fallen behind best practice' when it came to customer protection against scammers.

'Banks should be required to adopt Confirmation of Payee (CoP) technology', he said.

'They should also be required to reimburse their customers where they fail to stop scammers from obtaining customers' money via their payment platforms. This will create better incentives for banks to invest in the right systems and technology to protect consumers.'

If you're not familiar with it, the UK has a system called Confirmation of Payee (CoP), which is very helpful in fighting against financial fraud and deception.

Basically, it works by checking the account information against a database of verified identities. This ensures that the account holder's name matches their account number, making it much harder for scammers to use fake or stolen information to get access to other people's money.

Credit: Bottomline.

The Australian Competition and Consumer Commission (ACCC) has noticed the benefits of this system and suggested to the government that they introduce a similar process in Australia.

This would be a huge step towards protecting consumers (and their money) from scammers. It would provide a safer and more reliable way to check the identity of account holders, making it harder for scammers to take people's savings.

If Australia introduces the CoP system, it would make banking more secure and help reduce the number of fraud cases in the country.

Veyret's statement was in response to a recent push from the four big banks for customers to take more responsibility for keeping themselves safe. According to them, mandatory reimbursements could make it easier for scammers as it could be a potential 'honey pot'.

The Commonwealth Bank recently introduced NameCheck technology in an effort to put more control in the customer's hands. When used, the technology allows the bank to check the account details on all transactions and make sure they match up.

This tech has been successful in other countries such as the UK. The result? A 35% reduction in the total amount of money lost to misdirected payments.

And while it's positive that the Commonwealth Bank has taken the initiative (rolling out by late March), there is still more to be done.

The other banks have yet to announce any similar system, and for those like Bill Hall – a 76-year-old man who, after a scammer changed an invoice from his builder, lost $20,000 within minutes – this is deeply concerning.

Hall received an alert from a bank's fraud department eventually, noting that a different bank was concerned because the name for the account did not match the name on the fund's transfer. But, by then, it was too late.

Although the banks were able to recover a portion of his money, $6,000 was all they could get back, leaving Hall at a significant financial loss. To make matters worse, when he contacted the Financial Complaints Authority for assistance, they informed him that they couldn't investigate the matter because the transfer had taken place between different banks.

It's a stark reminder that despite efforts to protect customers from scams, there's still a long way to go in the fight against financial fraud.

The debate over mandatory reimbursements for scam victims continues, with Commonwealth Bank recently weighing in on the issue. When asked whether the bank would support such a policy, their response was in line with the government's position.

According to a spokesperson for the bank, they share the government's concerns about avoiding any measures that might inadvertently lead to 'more scam activity' in Australia. While this may seem like a reasonable stance, it's also a reminder that protecting the profits of financial institutions sometimes comes at the expense of their customers.

The other big banks – namely, Westpac and NAB – also argued that customers can protect themselves by being more vigilant and keeping a close watch on their personal information and accounts.

The fact that banks are hesitant to support mandatory reimbursements raises important questions about their priorities.

Are they more concerned about their bottom line than doing the right thing for their customers? And is the fear of increased scam activity a legitimate concern, or simply a convenient excuse to avoid taking responsibility?

As more and more Australians fall victim to scams, we must hold our banks accountable and demand a more proactive approach to protecting our financial well-being.

To keep our money safe, we must stay vigilant and ensure that our banks are doing their part in protecting us. It's essential to understand the various services and programs that your bank offers to make informed decisions and take proactive measures, especially when it comes to online banking.

Fraud and scams can still occur, even with the best security systems. It's crucial to know how to identify them and report them to the bank immediately. Also, it's important to keep our personal information confidential to prevent fraudsters from gaining access to our accounts.

By working together and being careful, we can safeguard our money from these cunning fraudsters.

We want to hear from you, dear members! What do you think about banks reimbursing scam victims?

Should financial institutions be held responsible for failing to protect their customers from scammers, or do you think that reimbursement will only encourage more fraudulent activity? Should it be up to the customer to take more responsibility for their own security?

Whatever your thoughts on the matter, we want to know! So, feel free to leave a comment and start a conversation.

Scammers use advanced tactics, such as social engineering, phishing, and identity theft, to target their victims and take advantage of their lack of knowledge about the latest technology and online threats.

According to the Australian Competition and Consumer Commission (ACCC), scams cost Australian consumers and businesses over $2 billion in 2021 alone. Thankfully, financial institutions have been taking steps to prevent and recover losses from scams.

In 2021, they stopped or recovered nearly $341 million from scammers and refunded $103 million to customers who were victims of scams, up from $49 million in 2020. While these numbers are encouraging, there is still more work to be done to protect vulnerable populations.

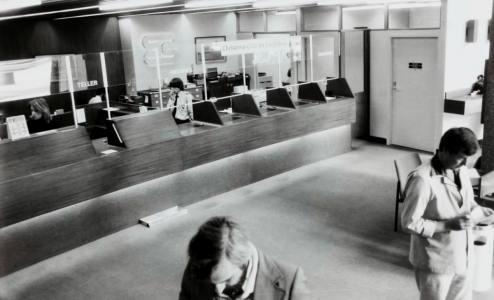

Advocacy groups are pressing banks to adopt better security measures and to reimburse victims of scams. Credit: Pexels/Monstera.

Thankfully, consumer advocacy groups are working hard to protect us from such scams. That's why CHOICE – along with the Consumer Action Law Centre – is pressing banks to adopt better security measures and to reimburse victims of scams regardless of the customer's blame.

CHOICE's Head of Policy, Patrick Veyret, recently noted that 'Australia had fallen behind best practice' when it came to customer protection against scammers.

'Banks should be required to adopt Confirmation of Payee (CoP) technology', he said.

'They should also be required to reimburse their customers where they fail to stop scammers from obtaining customers' money via their payment platforms. This will create better incentives for banks to invest in the right systems and technology to protect consumers.'

If you're not familiar with it, the UK has a system called Confirmation of Payee (CoP), which is very helpful in fighting against financial fraud and deception.

Basically, it works by checking the account information against a database of verified identities. This ensures that the account holder's name matches their account number, making it much harder for scammers to use fake or stolen information to get access to other people's money.

Credit: Bottomline.

The Australian Competition and Consumer Commission (ACCC) has noticed the benefits of this system and suggested to the government that they introduce a similar process in Australia.

This would be a huge step towards protecting consumers (and their money) from scammers. It would provide a safer and more reliable way to check the identity of account holders, making it harder for scammers to take people's savings.

If Australia introduces the CoP system, it would make banking more secure and help reduce the number of fraud cases in the country.

Veyret's statement was in response to a recent push from the four big banks for customers to take more responsibility for keeping themselves safe. According to them, mandatory reimbursements could make it easier for scammers as it could be a potential 'honey pot'.

The Commonwealth Bank recently introduced NameCheck technology in an effort to put more control in the customer's hands. When used, the technology allows the bank to check the account details on all transactions and make sure they match up.

This tech has been successful in other countries such as the UK. The result? A 35% reduction in the total amount of money lost to misdirected payments.

And while it's positive that the Commonwealth Bank has taken the initiative (rolling out by late March), there is still more to be done.

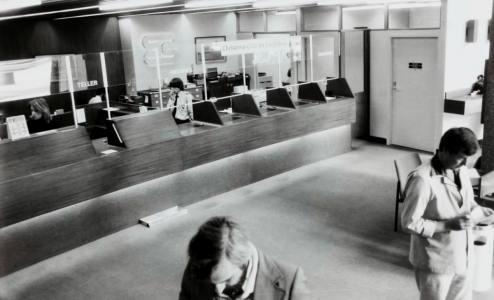

Australia's big banks have taken a strong stance against mandatory reimbursements, claiming it could inadvertently lead to increases in scam activities. Credit: Unsplash/Museums Victoria.

The other banks have yet to announce any similar system, and for those like Bill Hall – a 76-year-old man who, after a scammer changed an invoice from his builder, lost $20,000 within minutes – this is deeply concerning.

Hall received an alert from a bank's fraud department eventually, noting that a different bank was concerned because the name for the account did not match the name on the fund's transfer. But, by then, it was too late.

Although the banks were able to recover a portion of his money, $6,000 was all they could get back, leaving Hall at a significant financial loss. To make matters worse, when he contacted the Financial Complaints Authority for assistance, they informed him that they couldn't investigate the matter because the transfer had taken place between different banks.

It's a stark reminder that despite efforts to protect customers from scams, there's still a long way to go in the fight against financial fraud.

The debate over mandatory reimbursements for scam victims continues, with Commonwealth Bank recently weighing in on the issue. When asked whether the bank would support such a policy, their response was in line with the government's position.

According to a spokesperson for the bank, they share the government's concerns about avoiding any measures that might inadvertently lead to 'more scam activity' in Australia. While this may seem like a reasonable stance, it's also a reminder that protecting the profits of financial institutions sometimes comes at the expense of their customers.

The other big banks – namely, Westpac and NAB – also argued that customers can protect themselves by being more vigilant and keeping a close watch on their personal information and accounts.

Key Takeaways

- Consumer rights advocates are also advocating for the government to force banks to offer reimbursements – as they do in the UK.

- The Commonwealth Bank has announced NameCheck technology to reduce false billing scams as well as mistaken payments.

- Banks have encouraged customers to play an important role in protecting themselves from scams, whilst the banks argue that mandatory reimbursements could 'inadvertently lead to increases in scam activity'.

Are they more concerned about their bottom line than doing the right thing for their customers? And is the fear of increased scam activity a legitimate concern, or simply a convenient excuse to avoid taking responsibility?

As more and more Australians fall victim to scams, we must hold our banks accountable and demand a more proactive approach to protecting our financial well-being.

Even with the best security systems, it's still important to be aware of how to detect fraud and scams. Credit: Unsplash/Towfiqu barbhuiya.

To keep our money safe, we must stay vigilant and ensure that our banks are doing their part in protecting us. It's essential to understand the various services and programs that your bank offers to make informed decisions and take proactive measures, especially when it comes to online banking.

Fraud and scams can still occur, even with the best security systems. It's crucial to know how to identify them and report them to the bank immediately. Also, it's important to keep our personal information confidential to prevent fraudsters from gaining access to our accounts.

By working together and being careful, we can safeguard our money from these cunning fraudsters.

We want to hear from you, dear members! What do you think about banks reimbursing scam victims?

Should financial institutions be held responsible for failing to protect their customers from scammers, or do you think that reimbursement will only encourage more fraudulent activity? Should it be up to the customer to take more responsibility for their own security?

Whatever your thoughts on the matter, we want to know! So, feel free to leave a comment and start a conversation.