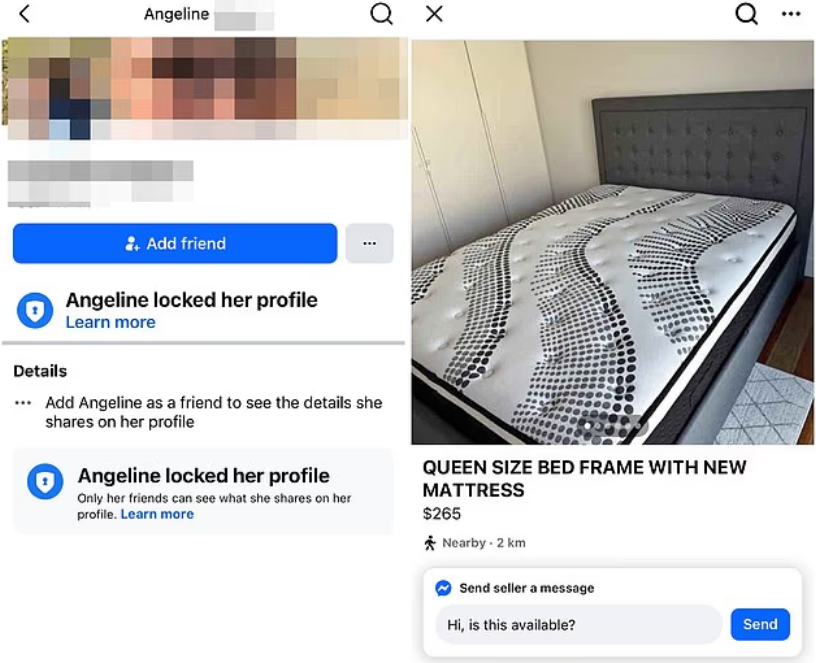

Young Brisbane woman Ash Bradford thought she'd found the perfect deal—a queen-size bed frame with a brand new mattress for just $260 on Facebook Marketplace.

What happened next is a cautionary tale that's becoming all too familiar for Australians, particularly those over 60 who are increasingly finding themselves in scammers' crosshairs.

Recent figures from Scamwatch show ACT residents alone lost nearly $326,000 to buying and selling scams in just the first five months of 2025, with 485 cases reported.

But Ash's experience reveals just how sophisticated these operations have become—and why they're so effective.

When a bargain becomes a trap

Having just moved from Sydney to Brisbane, 23-year-old Ash needed a bed urgently. The Facebook Marketplace listing appeared 30 minutes after being posted, and the price seemed almost too good to be true. That should have been her first warning sign.

After expressing interest, the seller 'Angeline' quickly provided an address and seemed genuine. But as Ash and her mum began their 20-minute drive to inspect the bed, the red flags started appearing fast and furious.

'The woman goes, "Oh, how long are you going to be?" I was like, "We're going to be 20 minutes." She goes, "I've actually got a lot of people asking me about this... So what can we do so you don't waste your time driving here?"' Ash recalled.

'Mum and I had alarm bells ringing the moment 'she' asked for a deposit on a mattress. Who even does that?'

Then came the crucial moment that transforms a legitimate sale into a scam: the demand for an upfront deposit. Angeline insisted on a $50 PayID transfer before Ash could even see the bed, claiming there was 'overwhelming response' from other buyers.

Why this scam is exploding across Australia

What happened to Ash isn't isolated. Research by TSB reveals that a staggering 73 per cent of purchase fraud cases are now linked to Facebook Marketplace, making it the most dangerous platform for buyers and sellers alike.

Even more concerning, fraud experts have discovered that about 34 per cent of Facebook Marketplace advertisements could be scam posts, with fraudsters posting an average of six fake ads every minute on the platform.

The numbers paint a stark picture for older Australians specifically. People over 65 were the only age group to experience increased scam losses in 2023, with those losses jumping 13.3 per cent to $120 million.

The psychology behind targeting seniors

Scammers deliberately exploit the trust and unfamiliarity with technology that some older adults may have, leading to financial loss and emotional distress.

Several factors make older Australians attractive targets: they've had more time to accumulate wealth, often invested in homes and retirement savings, and many grew up in a more trusting era.

One reason scammers target older adults is that they're less likely to report suspected fraud, allowing criminals to operate with reduced risk of detection.

The anatomy of a marketplace deposit scam

When Ash and her mum arrived at the provided address, they discovered the sophisticated nature of modern scams. Despite texting 'Hey we're pulling up,' there was no response. Multiple knocks at the door went unanswered.

'Then she texts me, 'Have you paid your deposit?' I'm like, 'I'm at your house, I'm at your door.' She goes, 'Sorry I stand by what I said previously. I just need a deposit first',' Ash explained.

The realisation hit them: 'Mum and I are staring at each other, and we thought it's a scam and we're probably on a random person's porch right now... This is probably not her house.'

How the scam variations work

A particularly sophisticated variant involves scammers impersonating Australia Post. They pose as buyers interested in items, then offer to arrange fake payment methods involving Australia Post services.

Australia Post has confirmed they don't offer prepayment options for transactions on online marketplace platforms.

Another common variation exploits PayID, where scammers send fake emails claiming there are limits on non-business accounts, tricking sellers into transferring money to 'increase their PayID limit' before receiving payment.

What Ash's story teaches us

Despite the frustrating experience, there was a silver lining. After sharing her story on social media, Ash was overwhelmed by the community response. 'The community came through in the kindest way—I had people DMing me offering their spare beds, some even including free delivery.'

Her video has been viewed more than 150,000 times, with viewers sharing their own experiences:

'Someone put my trailer on Marketplace, and people rocked up at my house asking for MY trailer that they paid for online. I'm sorry WHAT,' one person revealed, highlighting how scammers even use real people's addresses and property.

Ash's golden rules for marketplace safety

- If you feel rushed, it's a scam

- If they ask for a deposit, it's a scam

- If they claim they've organised prepaid shipping, it's 100 per cent nonsense

- Never pay money without seeing the item first

- Trust your instincts when something feels off

Protecting yourself from marketplace scams

Here are five critical red flags that may indicate you're being targeted: the buyer or seller has a brand-new profile or missing photo, the price seems too good to be true, they want payment via gift card, there's urgency in their communications, and they want to move communication off the platform.

Safe payment practices:

Use payment options that provide protections, such as PayPal or credit cards. Never hand over money until you see the item and are confident it's legitimate and working.

Meeting safely:

Always arrange to meet in person and make payments after viewing the product. Choose public places for exchanges, and bring someone with you when possible.

Australian resources and reporting

If you suspect you've encountered a scam:

- Report immediately to ReportCyber or Scamwatch

- Contact your bank or financial institution to cancel affected cards and accounts

- Contact the National Elder Fraud Hotline at 833-372-8311 if you're a senior who's been targeted

The Be Connected initiative, supported by the Australian Government through eSafety and the Department of Social Services, specifically helps increase the confidence, skills and online safety of older Australians.

Support for scam victims

If you've shared personal information with scammers, IDCARE offers free support. As Australia's national identity and cyber support service, they can develop a specific response plan for your situation. Visit idcare.org or call 1800 595 160.

The broader implications

The ACCC's Scamwatch received over 11,500 reports of classified scams last year, while NAB noted that buying and selling scams online jumped by 78 per cent.

Protecting older Australians requires collective effort from families, carers, community organisations, and government agencies working together to create supportive environments where older adults feel safe and informed.

The sophistication of these scams continues to evolve. Financial scams surged by 340 per cent in Q2 2025, demonstrating that staying informed about current tactics is crucial for protection.

Moving forward safely

Ash's experience serves as a powerful reminder that anyone can be targeted by sophisticated scammers. The key is recognising the warning signs early and trusting your instincts when something feels wrong.

Remember the three-step approach: STOP—don't rush to act as scammers create urgency; THINK—ask yourself if you really know who you're communicating with; PROTECT—act quickly if something feels wrong, contacting your bank immediately if you've shared financial information.

What This Means For You

As our community becomes more digitally connected, sharing experiences like Ash's helps protect others from falling victim to similar schemes.

Have you encountered suspicious activity on Facebook Marketplace or other online platforms? What warning signs helped you identify potential scams? Share your experiences in the comments below—your story could help protect fellow community members from financial loss and emotional distress.

Original Article

https://www.dailymail.co.uk/femail/...ing-discovery-sellers-home-Im-sorry-what.html

Canberra residents face surge in Facebook Marketplace scams | The Canberra Times | Canberra, ACT

Cited text: ScamWatch statistics for 2025 until May show ACT residents have lost nearly $326,000 to buying and selling to scamsters with 485 cases reported so far...

Excerpt: ACT residents lost $326,000 to buying/selling scams in first 5 months of 2025

https://www.canberratimes.com.au/st...nts-face-surge-in-facebook-marketplace-scams/

Facebook Marketplace and Shops Statistics By Country, Seller, Demographics And Market Share (2025)

Cited text: TSB revealed that 73 per cent of purchase fraud cases were tied to Marketplace.

Excerpt: 73 per cent of purchase fraud cases linked to Facebook Marketplace according to TSB

https://electroiq.com/stats/facebook-marketplace-and-shops-statistics/

Seniors top scammers’ hit list—National Seniors Australia

Cited text: The ACCC found that people over 65 were the only age group to experience an increase in reported losses. In 2023, those losses increased by 13.3 per cent to $...

Excerpt: People over 65 were only age group with increased scam losses—up 13.3 per cent to $120 million in 2023

https://nationalseniors.com.au/news/latest-news/seniors-top-scammers-hit-list

Seniors top scammers’ hit list—National Seniors Australia

Cited text: Losses for people over the age of 65 increased by 13.3 per cent in 2023 to $120 million.

Excerpt: People over 65 were only age group with increased scam losses—up 13.3 per cent to $120 million in 2023

https://nationalseniors.com.au/news/latest-news/seniors-top-scammers-hit-list

37+ Facebook Marketplace Statistics Every Marketer Should Know in 2025

Cited text: After assessing the ads posted on the platform, TSB fraud experts discovered that about 34 per cent of Facebook Marketplace adverts could be scam posts.

Excerpt: 34 per cent of Facebook Marketplace ads could be scam posts

https://cropink.com/fb-marketplace-statistics

37+ Facebook Marketplace Statistics Every Marketer Should Know in 2025

Cited text: Additionally, another study revealed that fraudsters post an average of six fake ads every minute on Facebook Marketplace.

Excerpt: fraudsters posting an average of six fake ads every minute on the platform

https://cropink.com/fb-marketplace-statistics

37+ Facebook Marketplace Statistics Every Marketer Should Know in 2025

Cited text: Additionally, another study revealed that fraudsters post an average of six fake ads every minute on Facebook Marketplace.

Excerpt: fraudsters posting an average of six fake ads every minute on the platform

https://cropink.com/fb-marketplace-statistics

Top Tips for Keeping Seniors Safe from Common Scams

Cited text: Scammers exploit the trust and unfamiliarity with technology that some older adults may have, leading to financial loss, emotional distress, and, in s...

Excerpt: Scammers deliberately exploit the trust and unfamiliarity with technology that some older adults may have

https://www.focusconnect.org.au/a-guide-to-keeping-seniors-safe-from-scams

10 Tips to Protect Seniors from Being Scammed | Hebrew SeniorLife

Cited text: Older Americans have had more time to accumulate wealth, which is often invested in their homes and retirement savings.

Excerpt: Several factors make older Australians attractive targets: they

https://www.hebrewseniorlife.org/blog/10-tips-to-protect-seniors-from-being-scammed

10 Tips to Protect Seniors from Being Scammed | Hebrew SeniorLife

Cited text: Today’s older adults also grew up in a more trusting time.

Excerpt: Several factors make older Australians attractive targets: they

https://www.hebrewseniorlife.org/blog/10-tips-to-protect-seniors-from-being-scammed

Beware of Scams Targeting Older Adults | National Institute on Aging

Cited text: One reason that scammers target older adults is that they are less likely to report suspected fraud.

Excerpt: One reason scammers target older adults is that they

https://www.nia.nih.gov/health/safety/beware-scams-targeting-older-adults

Facebook Marketplace Scam Alert—Australian Business Journal

Cited text: Scammers are increasingly impersonating potential buyers and falsely using the name of Australia Post to trick sellers. This latest wave of fraud invo...

Excerpt: A particularly sophisticated variant involves scammers impersonating Australia Post.

https://theabj.com.au/2025/01/19/facebook-marketplace-scam-alert/

Facebook Marketplace Scam Alert—Australian Business Journal

Cited text: Australia Post does not offer prepayment options for transactions on online marketplace platforms.

Excerpt: Australia Post has confirmed they don

https://theabj.com.au/2025/01/19/facebook-marketplace-scam-alert/

How to avoid Facebook scams | P&N Bank

Cited text: This type of scam has become more common as the use of PayID has grown. In case you’re not sure of what it is; PayID is a payment method that uses a m...

Excerpt: Another common variation exploits PayID, where scammers send fake emails claiming there are limits on non-business accounts, tricking sellers into transferring money to

https://www.pnbank.com.au/blog/four-common-facebook-marketplace-scams-and-how-to-avoid-them/

How to avoid Facebook scams | P&N Bank

Cited text: Well, here are five red flags that may indicate you are being targeted by a scam. The buyer or seller has a brand-new profile or is missing a profile ...

Excerpt: Here are five critical red flags that may indicate you

https://www.pnbank.com.au/blog/four-common-facebook-marketplace-scams-and-how-to-avoid-them/

How to avoid Facebook scams | P&N Bank

Cited text: Use payment options that provide protections, such as PayPal.

Excerpt: Use payment options that provide protections, such as PayPal or credit cards

https://www.pnbank.com.au/blog/four-common-facebook-marketplace-scams-and-how-to-avoid-them/

Facebook Marketplace scam: Common trick used to ...

Cited text: The ACCC says to use PayPal or credit cards.

Excerpt: Use payment options that provide protections, such as PayPal or credit cards

https://www.sbs.com.au/news/article...lace-scam-heres-how-she-foiled-them/sxu6h23r1

How to avoid Facebook scams | P&N Bank

Cited text: Never hand over money until you see the item that’s being sold and are confident it’s legitimate and in working order.

Excerpt: Never hand over money until you see the item and are confident it

https://www.pnbank.com.au/blog/four-common-facebook-marketplace-scams-and-how-to-avoid-them/

Facebook Marketplace Scams | Learn To Spot Them & Get Help | Netsafe

Cited text: Meet in public places: Arrange to meet in person and make payments after viewing the product.

Excerpt: Always arrange to meet in person and make payments after viewing the product

https://netsafe.org.nz/scams/facebook-marketplace-scams

Scams Awareness—National Seniors Australia

Cited text: If you think you’ve been scammed: - immediately stop any contact with the scammer—report the scam to ReportCyber or Scamwatch as soon as you can—c...

Excerpt: Report immediately to ReportCyber or Scamwatch

https://nationalseniors.com.au/resources/technology-hub/scams-awareness

Beware of Scams Targeting Older Adults | National Institute on Aging

Cited text: If you think that you or someone in your life has been the target of a scam, contact the National Elder Fraud Hotline at 833—372—8311.

Excerpt: Contact the National Elder Fraud Hotline at 833-372-8311 if you

https://www.nia.nih.gov/health/safety/beware-scams-targeting-older-adults

Keep Scam SAFE—National Seniors Australia

Cited text: The Be Connected initiative is dedicated to enhancing the confidence, digital literacy, and online safety of older Australians. Whether you're lo...

Excerpt: The Be Connected initiative, supported by the Australian Government through eSafety and the Department of Social Services, specifically helps increase the confidence, skills and online safety of older Australians

https://nationalseniors.com.au/resources/keep-scam-safe

I got scammed on Facebook Marketplace. This is what happened next. | YourLifeChoices

Cited text: The ACCC’s Scamwatch received over 11,500 reports of classified scams on sites like Marketplace last year, while NAB noted at the back end of last yea...

Excerpt: The ACCC

https://www.yourlifechoices.com.au/...ebook-marketplace-this-is-what-happened-next/

Top Tips for Keeping Seniors Safe from Common Scams

Cited text: Protecting older Australians from scams is a shared responsibility. Families, carers, community organisations, and government agencies must work toget...

Excerpt: Protecting older Australians requires collective effort from families, carers, community organisations, and government agencies working together to create supportive environments where older adults feel safe and informed

https://www.focusconnect.org.au/a-guide-to-keeping-seniors-safe-from-scams

Facebook Marketplace Statistics 2025: Growth Insights • SQ Magazine

Cited text: Financial scams surged by 340 per cent in Q2 2025, a dramatic spike in fraud activity.

Excerpt: Financial scams surged by 340 per cent in Q2 2025

https://sqmagazine.co.uk/facebook-marketplace-statistics/

Seniors top scammers’ hit list—National Seniors Australia

Cited text: STOP. Don’t rush to act. Scammers will create a sense of urgency. · THINK. Ask yourself if you really know who you are communicating with. Scammers c...

Excerpt: Remember the three-step approach: STOP—don

https://nationalseniors.com.au/news/latest-news/seniors-top-scammers-hit-list