Aussie mum’s terrifying ordeal reveals shocking insurance gap

By

Gian T

- Replies 3

In a land where natural beauty often comes with unpredictable challenges, one resident’s experience reflects a growing worry shared by many.

Living in a regional town, she has faced repeated destruction by severe weather over the years.

Her story highlights a broader issue now affecting more people: rising concerns about the accessibility and cost of protecting homes as environmental risks intensify.

Chay Khamsone's dilemma is far from unique. According to the Climate Council's alarming new analysis, over 2 million properties across Australia are now challenging to insure due to their vulnerability to extreme weather.

Of these, 652,000 properties are at high risk, while 1.55 million are at moderate risk. This data paints a stark picture of a nation grappling with the tangible impacts of a warming planet.

The Climate Council's 'At the Front Door' report identifies 86 suburbs as critical climate risk zones, where the majority of properties are highly likely to be affected by climate-related disasters.

This report, coupled with the suburb analysis tool updated by Climate Valuation, underscores the immediacy of the threat to Australian households.

For Chay, the reality of climate change is not an abstract concept but a disruptive and costly force that has left her local council still reeling from the cleanup after the 2021 floods.

Despite the risks, Chay is determined to stay in Pappinbarra, hoping her children can continue living there.

However, she harbors reservations about them following in her footsteps as a firefighter, a sentiment shared by many volunteers who fear for the safety of the next generation facing potentially 'unfightable' fires.

The economic strain on the nation mirrors the personal toll on families like Chay's.

Nicki Hutley, the Climate Council's chief economist, emphasises that the escalating frequency of disasters in Australia is driving insurance costs sky-high.

The stark reality is that insurance cannot be the sole solution to this crisis.

Karl Mallon, an insurance industry expert and founder of Climate Valuation, echoes this sentiment.

He urges governments to clarify their plans to protect communities and mitigate the impacts of natural disasters.

His company's data, which encompasses 15 million commercial and residential properties, reveals that climate change is not a distant threat but a present danger to communities across Australia.

The Bureau of Meteorology's findings that Australian temperatures have risen by over 1.5 degrees since 1910 only add to the urgency.

With pollution from fossil fuels on the rise, the frequency and severity of extreme weather events are expected to increase, leaving more Australians like Chay in precarious situations.

As the nation approaches an election, Chay focuses on the political parties' stances on climate change and their commitment to safeguarding communities.

She believes that a vote for a safer climate would demonstrate Australians' support for firefighters and those on the front lines of these disasters.

Chay's story is a clarion call for action. It reminds us that climate change is not just a topic for scientific debate but a real and present danger that affects the lives and livelihoods of everyday Australians.

It calls on all of us to consider the implications of our votes, policies, and actions on the environment and our collective future.

This issue may hit close to home for our readers at the Seniors Discount Club.

Many of you have lived in your communities for decades, witnessing the changes in the landscape and weather patterns.

It's crucial to stay informed about your property's risks and advocate for policies protecting your home and your legacy for future generations.

Have you faced similar challenges to Chay? What measures should be taken to address this growing insurance gap? Join the conversation and let us know your thoughts in the comments below.

Have you faced similar challenges to Chay? What measures should be taken to address this growing insurance gap? Join the conversation and let us know your thoughts in the comments below.

Living in a regional town, she has faced repeated destruction by severe weather over the years.

Her story highlights a broader issue now affecting more people: rising concerns about the accessibility and cost of protecting homes as environmental risks intensify.

Chay Khamsone's dilemma is far from unique. According to the Climate Council's alarming new analysis, over 2 million properties across Australia are now challenging to insure due to their vulnerability to extreme weather.

Of these, 652,000 properties are at high risk, while 1.55 million are at moderate risk. This data paints a stark picture of a nation grappling with the tangible impacts of a warming planet.

The Climate Council's 'At the Front Door' report identifies 86 suburbs as critical climate risk zones, where the majority of properties are highly likely to be affected by climate-related disasters.

This report, coupled with the suburb analysis tool updated by Climate Valuation, underscores the immediacy of the threat to Australian households.

For Chay, the reality of climate change is not an abstract concept but a disruptive and costly force that has left her local council still reeling from the cleanup after the 2021 floods.

Despite the risks, Chay is determined to stay in Pappinbarra, hoping her children can continue living there.

However, she harbors reservations about them following in her footsteps as a firefighter, a sentiment shared by many volunteers who fear for the safety of the next generation facing potentially 'unfightable' fires.

The economic strain on the nation mirrors the personal toll on families like Chay's.

Nicki Hutley, the Climate Council's chief economist, emphasises that the escalating frequency of disasters in Australia is driving insurance costs sky-high.

The stark reality is that insurance cannot be the sole solution to this crisis.

Karl Mallon, an insurance industry expert and founder of Climate Valuation, echoes this sentiment.

He urges governments to clarify their plans to protect communities and mitigate the impacts of natural disasters.

His company's data, which encompasses 15 million commercial and residential properties, reveals that climate change is not a distant threat but a present danger to communities across Australia.

The Bureau of Meteorology's findings that Australian temperatures have risen by over 1.5 degrees since 1910 only add to the urgency.

With pollution from fossil fuels on the rise, the frequency and severity of extreme weather events are expected to increase, leaving more Australians like Chay in precarious situations.

As the nation approaches an election, Chay focuses on the political parties' stances on climate change and their commitment to safeguarding communities.

She believes that a vote for a safer climate would demonstrate Australians' support for firefighters and those on the front lines of these disasters.

Chay's story is a clarion call for action. It reminds us that climate change is not just a topic for scientific debate but a real and present danger that affects the lives and livelihoods of everyday Australians.

It calls on all of us to consider the implications of our votes, policies, and actions on the environment and our collective future.

This issue may hit close to home for our readers at the Seniors Discount Club.

Many of you have lived in your communities for decades, witnessing the changes in the landscape and weather patterns.

It's crucial to stay informed about your property's risks and advocate for policies protecting your home and your legacy for future generations.

Key Takeaways

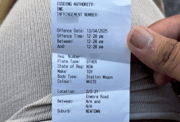

- An Australian mother from Pappinbarra, NSW, is struggling to obtain affordable home insurance following extreme weather events in her area.

- Over 2 million Australian properties are now considered challenging to insure due to the risk of extreme weather, with more than 652,000 considered at high risk.

- The Climate Council's new report identifies 86 suburbs as critical climate risk zones, with a significant percentage of properties facing high risk.

- Insurance industry experts and climate advocates are urging governments to provide clear strategies to keep communities safe and mitigate the impacts of natural disasters.