Aussie government announces changes to the federal budget! How can seniors benefit from it?

By

Danielle F.

- Replies 91

The cost of living continues to be a contentious topic across the nation.

However, good news is on the horizon as the Australian government unveiled massive updates on the latest federal budget.

This multi-billion dollar relief package could ease the financial burden on Australians and stimulate the economy.

Here are some of the key points of the budget to help seniors understand how they can benefit from the new measures.

Healthcare: A boost for bulk-billing and cheaper medicines

Healthcare is a critical concern for many, especially for seniors who rely on regular GP visits.

The government announced an $8.5 billion boost for Medicare and aimed to deliver 18 million extra bulk-billed GP visits each year.

This expansion of bulk billing should save Australians a combined $859 million a year by 2030.

Starting 1 January 2026, the cost of the majority of medicines on the Pharmaceutical Benefits Scheme (PBS) could be reduced from $31.60 to $25.

This measure could save Australians $200 million a year.

Both policies have bipartisan support, ensuring its implementation regardless of the election outcome.

Energy bill relief: Keeping the lights on for less

With electricity bills set to rise by up to nine per cent starting July, the government has pledged further relief.

The government promised to reduce household bills thanks to a $150 relief from their power bill.

This initiative was on top of last year's $3.5 billion energy bill relief package.

The government aimed to alleviate the strain on family budgets by putting downward pressure on inflation.

The extension of energy bill rebates could cost taxpayers $1.8 billion over the forward estimates.

Support for Australian-made goods amidst global tariff tensions

In response to the global economic uncertainty and the impact of United States-imposed tariffs on Australian exports, the government signalled its support for local industries.

Prime Minister Albanese indicated that the budget would include additional support for the 'Buy Australian' campaign, as well as a 'spiced-up Made in Australia' plan that could bolster local manufacturers and counteract the potential influx of cheap international products.

Budget deficit and economic outlook

After two consecutive years of surpluses, the budget is set to return to a deficit in 2025.

The deficit is forecasted to be around $26.9 billion—a figure close to the one projected in December's Mid-year Economic and Fiscal Outlook (MYEFO).

The government has been taking a cautious approach to revenue and expenditure, with the Treasury not expecting significant changes from the MYEFO projections.

Education: A significant discount on student debt

The federal budget could bring welcome relief to the roughly three million Australians grappling with student debt.

Outstanding balances will be reduced by 20 per cent on 1 June, representing a $16 billion reduction in student debt.

This one-off discount could provide financial reprieve for former students.

This change in student debt was part of the government's election promises.

Childcare: Subsidies for families

Another election promise set to be fulfilled was the provision of three days a week of subsidised childcare for families.

This promise could apply to households with a combined income of less than $530,000 a year.

The activity test will be scrapped, making it easier for low-income parents to access affordable childcare.

This policy, recommended by the Productivity Commission, could cost $427 million over five years and is slated to begin on 1 January 2026.

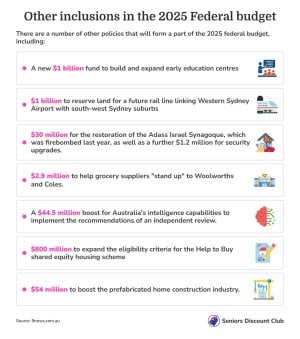

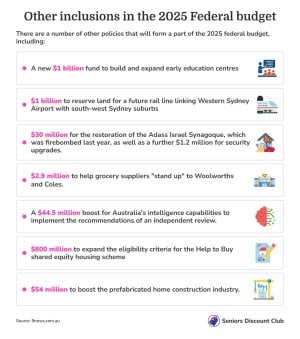

Here are other changes that the federal budget may bring:

As Aussies go through the changes in the federal budget, it's crucial to stay informed about how these changes could impact seniors' lives.

Some of these measures could mean more money in seniors' pockets, while others mean greater access to essential services.

What are your thoughts on the latest budget announcements? Can these measures provide the necessary relief for your household? Share your opinions and experiences in the comments below. Let's continue the conversation about government services and welfare in these challenging times.

However, good news is on the horizon as the Australian government unveiled massive updates on the latest federal budget.

This multi-billion dollar relief package could ease the financial burden on Australians and stimulate the economy.

Here are some of the key points of the budget to help seniors understand how they can benefit from the new measures.

Healthcare: A boost for bulk-billing and cheaper medicines

Healthcare is a critical concern for many, especially for seniors who rely on regular GP visits.

The government announced an $8.5 billion boost for Medicare and aimed to deliver 18 million extra bulk-billed GP visits each year.

These relief plans from the federal government may help Australians navigate the cost of living crisis. Image Credit: Freepik/K Studio

This expansion of bulk billing should save Australians a combined $859 million a year by 2030.

Starting 1 January 2026, the cost of the majority of medicines on the Pharmaceutical Benefits Scheme (PBS) could be reduced from $31.60 to $25.

This measure could save Australians $200 million a year.

Both policies have bipartisan support, ensuring its implementation regardless of the election outcome.

Energy bill relief: Keeping the lights on for less

With electricity bills set to rise by up to nine per cent starting July, the government has pledged further relief.

The government promised to reduce household bills thanks to a $150 relief from their power bill.

This initiative was on top of last year's $3.5 billion energy bill relief package.

The government aimed to alleviate the strain on family budgets by putting downward pressure on inflation.

The extension of energy bill rebates could cost taxpayers $1.8 billion over the forward estimates.

Support for Australian-made goods amidst global tariff tensions

In response to the global economic uncertainty and the impact of United States-imposed tariffs on Australian exports, the government signalled its support for local industries.

Prime Minister Albanese indicated that the budget would include additional support for the 'Buy Australian' campaign, as well as a 'spiced-up Made in Australia' plan that could bolster local manufacturers and counteract the potential influx of cheap international products.

Budget deficit and economic outlook

After two consecutive years of surpluses, the budget is set to return to a deficit in 2025.

The deficit is forecasted to be around $26.9 billion—a figure close to the one projected in December's Mid-year Economic and Fiscal Outlook (MYEFO).

The government has been taking a cautious approach to revenue and expenditure, with the Treasury not expecting significant changes from the MYEFO projections.

Education: A significant discount on student debt

The federal budget could bring welcome relief to the roughly three million Australians grappling with student debt.

Outstanding balances will be reduced by 20 per cent on 1 June, representing a $16 billion reduction in student debt.

This one-off discount could provide financial reprieve for former students.

This change in student debt was part of the government's election promises.

Childcare: Subsidies for families

Another election promise set to be fulfilled was the provision of three days a week of subsidised childcare for families.

This promise could apply to households with a combined income of less than $530,000 a year.

The activity test will be scrapped, making it easier for low-income parents to access affordable childcare.

This policy, recommended by the Productivity Commission, could cost $427 million over five years and is slated to begin on 1 January 2026.

Here are other changes that the federal budget may bring:

Source: 9news.com.au

As Aussies go through the changes in the federal budget, it's crucial to stay informed about how these changes could impact seniors' lives.

Some of these measures could mean more money in seniors' pockets, while others mean greater access to essential services.

Key Takeaways

- The Federal Budget is set to deliver cost-of-living relief with measures like a bulk-billing boost and cheaper PBS medicines.

- Substantial energy bill relief is also part of the plan, with an extension of rebates and promises to counteract rising electricity costs.

- Support for Australian-made products will be strengthened in response to international tariff challenges.

- The budget will return to deficit but includes significant investments such as a student debt discount and subsidised childcare, among others.