ATO warns Aussies risking tax refund with this simple mistake

By

Gian T

- Replies 0

Tax season has rolled around again, and while many are eager to lodge early in hopes of a quick refund, there’s a fresh warning that shouldn’t be ignored.

With more people turning to modern tools for quick answers, relying on tech for money matters is becoming common. But authorities are now urging caution—using these tools for tax advice might lead to unexpected trouble.

The ATO has made it clear—while new technologies can make life easier, they can also introduce new risks.

Many of these AI platforms are not based in Australia and may not be up to date with our ever-changing tax laws.

That means the advice you get could be inaccurate, incomplete, or just plain wrong.

An ATO spokesperson told SkyNews.com.au: ‘The ATO is warning people to be careful when seeking tax advice on Australian tax law using new technologies. While new technologies can help improve our lives, there may be risks associated with a number of new platforms offering inaccurate tax advice.’

And here’s the kicker: even if you get your advice from a chatbot, you’re still responsible for the information you submit to the ATO.

If you make a mistake, it’s your name on the dotted line—not the AI’s.

Mark Chapman, Director of Tax Communications at H&R Block, says there’s a growing trend of self-lodgers turning to AI for help with deductions and other tax questions.

But he warns that this shortcut could be a costly one.

‘There is a growing use of AI in tax return preparation, particularly amongst self-lodgers… however, this is potentially dangerous,’ Chapman said.

‘Self-preparers are particularly prone to using these open-source AI programs and I would recommend using them with caution or not at all.’

He adds that while AI use is increasing every year, nothing beats the accuracy and peace of mind you get from a real, human tax expert.

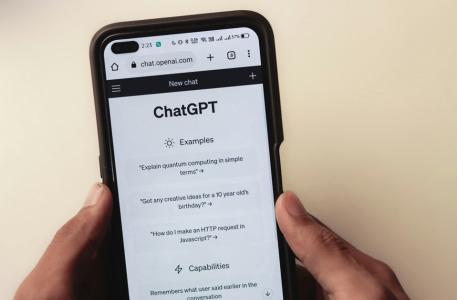

To put these warnings to the test, SkyNews.com.au asked ChatGPT and Meta AI for help with lodging an Australian tax return.

Both platforms offered general advice and even pointed to the ATO’s myDeductions tool (which, ironically, is powered by AI itself).

But when asked about maximising deductions, the advice was generic and not always tailored to Australian rules.

Worse still, when the country wasn’t specified, the advice became even less relevant—sometimes referencing US tax law or other international systems.

That’s a recipe for confusion, and potentially, for making mistakes on your return.

Most of the big-name AI platforms are based overseas, mainly in the United States.

Their databases and training materials may not include the latest updates from the ATO, and they might not understand the finer points of Australian tax law, like what counts as a work-related deduction or the rules around superannuation and pension income.

And while some AI tools, like the ATO’s own myDeductions, are explicitly designed for Aussies, the open-source chatbots you find online are not.

That means you could be getting advice that’s not just unhelpful, but downright risky.

To keep your tax return accurate, the ATO recommends using official sources like its website, myTax, or calling directly, and if you're unsure, it’s best to consult a registered tax agent.

Remember, if you make a mistake on your return—even if it’s because you followed dodgy AI advice—you could face penalties, delays, or even an audit. It’s just not worth the risk.

We know that tax time can be stressful, and it’s tempting to look for shortcuts. But when it comes to your hard-earned money, it pays to be cautious.

AI is a fantastic tool for many things, but for something as important as your tax return, it’s best to trust the experts.

Have you ever used AI or online tools for tax advice? Did it help, or did you run into trouble? Share your experiences in the comments below—we’d love to hear your stories and tips for making tax time a little less taxing.

Have you ever used AI or online tools for tax advice? Did it help, or did you run into trouble? Share your experiences in the comments below—we’d love to hear your stories and tips for making tax time a little less taxing.

With more people turning to modern tools for quick answers, relying on tech for money matters is becoming common. But authorities are now urging caution—using these tools for tax advice might lead to unexpected trouble.

The ATO has made it clear—while new technologies can make life easier, they can also introduce new risks.

Many of these AI platforms are not based in Australia and may not be up to date with our ever-changing tax laws.

That means the advice you get could be inaccurate, incomplete, or just plain wrong.

An ATO spokesperson told SkyNews.com.au: ‘The ATO is warning people to be careful when seeking tax advice on Australian tax law using new technologies. While new technologies can help improve our lives, there may be risks associated with a number of new platforms offering inaccurate tax advice.’

And here’s the kicker: even if you get your advice from a chatbot, you’re still responsible for the information you submit to the ATO.

If you make a mistake, it’s your name on the dotted line—not the AI’s.

Mark Chapman, Director of Tax Communications at H&R Block, says there’s a growing trend of self-lodgers turning to AI for help with deductions and other tax questions.

But he warns that this shortcut could be a costly one.

‘There is a growing use of AI in tax return preparation, particularly amongst self-lodgers… however, this is potentially dangerous,’ Chapman said.

‘Self-preparers are particularly prone to using these open-source AI programs and I would recommend using them with caution or not at all.’

He adds that while AI use is increasing every year, nothing beats the accuracy and peace of mind you get from a real, human tax expert.

To put these warnings to the test, SkyNews.com.au asked ChatGPT and Meta AI for help with lodging an Australian tax return.

Both platforms offered general advice and even pointed to the ATO’s myDeductions tool (which, ironically, is powered by AI itself).

But when asked about maximising deductions, the advice was generic and not always tailored to Australian rules.

Worse still, when the country wasn’t specified, the advice became even less relevant—sometimes referencing US tax law or other international systems.

That’s a recipe for confusion, and potentially, for making mistakes on your return.

Most of the big-name AI platforms are based overseas, mainly in the United States.

Their databases and training materials may not include the latest updates from the ATO, and they might not understand the finer points of Australian tax law, like what counts as a work-related deduction or the rules around superannuation and pension income.

And while some AI tools, like the ATO’s own myDeductions, are explicitly designed for Aussies, the open-source chatbots you find online are not.

That means you could be getting advice that’s not just unhelpful, but downright risky.

To keep your tax return accurate, the ATO recommends using official sources like its website, myTax, or calling directly, and if you're unsure, it’s best to consult a registered tax agent.

Remember, if you make a mistake on your return—even if it’s because you followed dodgy AI advice—you could face penalties, delays, or even an audit. It’s just not worth the risk.

We know that tax time can be stressful, and it’s tempting to look for shortcuts. But when it comes to your hard-earned money, it pays to be cautious.

AI is a fantastic tool for many things, but for something as important as your tax return, it’s best to trust the experts.

Key Takeaways

- The Australian Taxation Office (ATO) has warned Australians not to rely on artificial intelligence platforms like ChatGPT and Meta AI for tax advice, as these may provide inaccurate or misleading information.

- Many AI platforms used for financial advice are not based in Australia and may not provide information that’s relevant to Australian tax law.

- The ATO recommends Australians seek advice directly from official ATO sources or registered tax professionals and to use tools like myTax or the official ATO website for their tax returns.

- Experts warn that while AI use is increasing every year among self-lodgers, nothing beats getting tax advice from a qualified human expert, and self-preparers should be particularly cautious.