A Record Number of Aussie Small Businesses Are Bleeding Money—Here's Why It Matters to You!

- Replies 19

In a startling revelation that has sent ripples through the Australian business community, a recent survey has uncovered that an unprecedented 38% of small businesses reported financial losses* in the last fiscal year. This figure, sourced from a survey conducted by Thriday, a financial management platform*, paints a grim picture of the economic landscape for Australia's small businesses, which are often considered the backbone of the nation's economy.The survey, which included 200 small businesses*, indicates that these enterprises are not just struggling to stay afloat but are actively haemorrhaging money amidst a storm of economic challenges. Stagnant growth, rising inflation, and mounting cost pressures have created a perfect storm that has left many small business owners reeling.

So why does this matter to you, especially if you’re retired or close to retiring? Small businesses are integral to the Australian economy, providing employment, fostering community spirit, and contributing significantly to local economies. When they suffer, it can lead to a domino effect* of unemployment, reduced consumer spending, and a general economic downturn that can affect everyone, including retirees on the pension and those planning for retirement.

Small businesses are often owned and operated by families, including many who are in their later working years or who have turned to entrepreneurship* as a post-retirement venture*.

According to the Australian Small Business and Family Enterprise Ombudsman, 'More than one in five small business owners (22 per cent) are aged 60 and over.' In some industries, the number of small business owners aged over 50 is over 50 per cent.

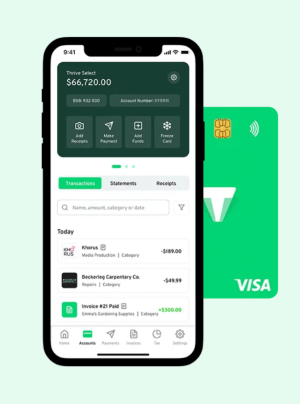

In response to this dire situation, Thriday* has implemented an innovative solution: an automated system called Profit First*.

This system is a radical departure from traditional accounting methods, which typically consider profit as what remains after all expenses have been paid. Instead, the Profit First method flips this concept on its head by prioritising profit above all else*.

Here's how it works: from every dollar earned*, a predetermined percentage is immediately allocated to profit. This profit is untouchable, set aside before any other expenses are considered. The remaining funds are then used to cover taxes, owner's pay, and operating expenses. This disciplined approach* ensures that profit is not an afterthought but a guaranteed outcome, encouraging businesses to operate within their means and make strategic decisions that promote financial health*.

Thriday's integration of the aptly named Profit First method* into its platform is a game-changer for small businesses. It simplifies the process of allocating funds, making it user-friendly and automated. This means that even those who may not be as tech-savvy or who are new to the world of digital finance can easily adopt this method to improve their financial standing.

The CEO and co-founder of Thriday*, Michael Nuciforo, emphasised the transformative potential of this collaboration with Profit First*. He believes that by empowering small businesses to prioritise profitability*, they can not only survive but thrive, even in challenging economic conditions.

Nuciforo shared*: ‘Our platform is designed to be a catalyst for positive change for small businesses. Thriday's seamless integration of banking, accounting, and tax automation is complemented by the introduction of Profit First*, providing businesses with a comprehensive solution to reduce the challenges of turning a profit in today's economic climate.’

Customer feedback has been overwhelmingly positive*, with many business owners reporting that the clarity and strategic focus provided by the Profit First method* have been instrumental in turning their financial situations around.

Customer Wendy B. said*, ‘Super well-constructed business tool. Easy to navigate even if you’re not super PC savvy.’

Another customer said*, ‘I was weighing the options between a few places for opening a business banking account and Thriday had the convenience of doing it online, as opposed to traditional institutions, and all the features included in the one platform made everything much easier!’

While a third added*, ‘I am a new customer to Thriday and just getting my small business started. I really like the way it makes following the Profit First method so clear and easy. Anything that eases bookkeeping stress and simplifies financial processes gets my tick of approval.’

Looking to the future, Thriday and Profit First are committed to launching additional features* to give small businesses even more control over their finances. The goal is to continue developing innovative solutions beyond traditional financial management, ensuring that small businesses have the tools they need to achieve sustainable profitability*.

Key Takeaways

- A record number of Australian small businesses reported losses in the last financial year, according to a survey by Thriday*.

- Thriday has introduced an automated Profit First system* to aid small businesses in improving their financial health.

- Profit First* encourages businesses to allocate income to profit, taxes, owner's pay, and expenses from the start, fostering disciplined spending and strategic decision-making.

- Thriday's partnership with Profit First* aims to provide small businesses with a comprehensive suite of services to achieve sustainable profitability, reinforced by positive customer feedback.

For the over-60s community, this development is particularly significant. Whether you're a small business owner*, a consumer, or simply someone concerned about the economic health of your community, the success* of small businesses affects us all. Thriday's partnership with Profit First* offers a practical solution that could help many small businesses reverse their financial losses and contribute positively to the broader Australian economy.

For more information on how Thriday's Automated Profit First Allocations* can help small businesses or to explore the platform's capabilities, visit www.thriday.com.au*. With the right tools and support, the tide can turn for small businesses, ensuring they remain a thriving and vital part of our communities for years to come.

*Please note, members, that this is a sponsored article. All content of ours that has an asterisk next to it means we may get a commission when you click on a link – at no cost to you! We do this to assist with the costs of running the SDC. Thank you!