‘No second chances’: Avoiding retirement money mistakes you can’t undo

- Replies 0

Retirement is supposed to be the time to reap the rewards of decades of hard work. But for many older Australians, a single financial misstep in these golden years can lead to lasting regret – and unlike in your younger days, there may be no time to recover.

From costly Age Pension traps to spending blunders, it pays to be aware of the money mistakes you can’t undo.

The good news? With a bit of savvy planning (and a dash of caution), you can steer clear of these pitfalls and make the most of your retirement. In this editorial, we’ll look at some common scenarios – drawn from real-life cases – and practical strategies to avoid irreversible mistakes.

Settle in with a cuppa, and let’s chat about how to keep your finances on track in retirement.

One retiree couple – let’s call them John and Maya – learned this the hard way. They had about $380,000 in super and were eligible for the full Age Pension (as homeowner retirees, that amount was well below the ~$470,000 assets limit for a full pension). With roughly $45,000 a year coming in from the Age Pension plus their super drawdowns, they planned to live modestly and save their super for later. They stuck to only the minimum required withdrawals (around 5% of their super each year), thinking it would make their money last.

Unfortunately, life had other plans – John was diagnosed with a terminal illness, and suddenly their dreams of “one day” travelling together crumbled. The money they scrimped and saved can’t buy back the lost time and experiences.

The mistake: Treating the minimum super drawdown as a maximum, and deferring enjoyable spending “for later” without considering health or unforeseen events. In other words, being too frugal too early.

Financial experts observe this is a common issue – retirees often remain “savers” out of habit, even when they can afford to spend a bit more. As financial planner Charles Badenach noted, many people “are not taking enough income from their super pension,” and end up with “a lot of money left when they don’t need it.” The result: “They could have actually had a better quality of lifestyle earlier,” he told ABC Radio.

Is it reversible? Sadly, no – time wasted is gone forever. You generally can’t get a refund on experiences you never had. John and Maya’s unspent money can’t buy back his health or years of adventure. The lesson is not to rush out and blow your savings, but to find a balance.

You worked hard for your retirement funds and the Age Pension safety net – using them wisely to enjoy life (within your means) is part of what you’ve earned.

How to avoid being too frugal: Make a retirement spending plan that considers your likely lifespan and different phases of retirement. Many advisers break it down into the “go-go” years (your active 60s and early 70s), the “slow-go” years (mid-70s to 80s), and the “no-go” years (late 80s and beyond).

You’ll probably spend more on travel and leisure in the earlier phase and less as you slow down. Use budgeting tools (ASIC’s Moneysmart retirement planner or the Retirement Essentials forecaster) to model how increasing your annual withdrawals for travel or hobbies might affect your long-term finances.

Often, you’ll find you can afford that trip or new kitchen without jeopardising your future security. Remember, the government sets minimum drawdown rates for account-based pensions (e.g. 5% at age 65-74), but that’s just a floor – you can take more if needed. If you’re unsure how much is safe to spend, consider talking to a financial adviser about a sustainable withdrawal strategy.

The key is to use your money while it can do you good, rather than depriving yourself unnecessarily. As the old saying goes, “There are no pockets in a shroud.”

Consider the case of Manoj and Devi, a fictional couple that illustrates this predicament. Both in their early 60s, they took the plunge into retirement as soon as they were eligible – and promptly withdrew a combined $100,000 lump sum from super to splurge on home renovations and luxury entertainment. They also generously gifted money to their adult kids. In the next two years, they drew another $160,000 for living costs.

Suddenly, despite a similar starting balance to John and Maya, these two found themselves with a near-depleted super kitty – and neither of them even at Age Pension age yet. At their current burn rate, they’d hit age 67 with nothing left except the family home. It’s a classic “live fast, repent later” scenario.

The mistake: Failing to plan for a retirement that could last 20, 30, or even more years. Australian life expectancies at age 65 are around 20 years for men and 23 years for women on average – and many of us will live into our late 80s or 90s. Spending too much too soon can leave you relying only on the Age Pension for potentially decades.

While the Age Pension is a vital safety net, it provides a modest income (currently around $42,000–$45,000 a year for a couple on the full pension, or about $28,000 for a single). That’s roughly equivalent to a “modest” lifestyle by industry standards – comfortable enough for basics, but with little room for big trips or treats.

Manoj and Devi’s high living in their 60s may force them into a very pared-back lifestyle later on – a harsh trade-off if they end up watching every dollar in their 80s.

Is it reversible? Partially, but it’s tough. The sooner you catch an overspending issue, the more you can do to course-correct. In Manoj and Devi’s case, since they’re only in their 60s, they have a few options. They could rejoin the workforce (even part-time) to rebuild savings and delay drawing on the Pension. They also might take advantage of super contribution rules to keep boosting their nest egg while they still can.

Another strategy is to “practise” living on the full Age Pension amount (about $45k p.a. for a couple, or $1,730 a fortnight) – essentially test if they can adjust to that budget now. If it feels impossible to live on, that’s a red flag that changes are needed. Downsizing their home or tapping home equity is another avenue to free up funds, but that’s a big decision with its own pros and cons.

In short, they may have to tighten belts and make lifestyle changes immediately to avoid running completely dry. Not everyone will be able to go back to work or downsize, so the better path is not to get into this predicament in the first place.

How to avoid outliving your money: It sounds simple, but have a plan – preferably before you retire. Work out a sustainable annual withdrawal rate from your super and stick close to it, adjusting for inflation.

A common rule of thumb is the “4% rule” (withdrawing about 4% of your balance in the first year of retirement and adjusting thereafter), but the right number can vary depending on your age and market returns. Many super funds and tools (like Moneysmart’s retirement planner) can model different scenarios. Make sure to account for major one-off spends (a new car, home repairs, helping kids) in your budgeting.

If you want a spending spree to celebrate retirement – that’s okay, just build it into the plan (e.g. earmark a certain lump sum for fun, and know how that affects your later income).

Also, review your investments. If your super is all in ultra-conservative options earning very low returns, even moderate withdrawals could chew through it.

On the other hand, taking on too much risk chasing high returns can backfire too. It’s wise to revisit your asset allocation at retirement – often a balanced or diversified approach is recommended to sustain income for 20+ years. And keep an eye on fees; as one retiree quipped, an “irreversible mistake is to have your super in a poor performing fund” with high fees and low returns.

If unsure, getting professional financial advice can be well worth it.

Finally, don’t forget about inflation and rising costs. The current cost-of-living squeeze in Australia means expenses like groceries, utilities and healthcare can climb faster than expected. What felt like plenty of money now might not go as far in 10 years.

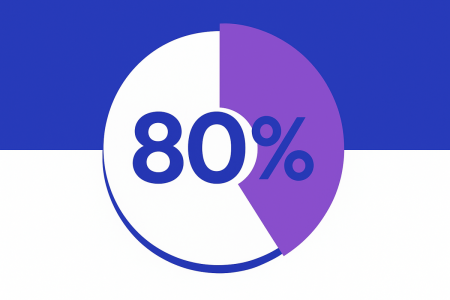

So, build a buffer in your projections – and consider the Age Pension your ally here. Even if you start retirement as a self-funded retiree, keep an eye on the means test thresholds. As your assets reduce over time (or if markets fall), you might become eligible for a part Age Pension sooner than you think. In fact, around seven in ten Australians over 67 receive some Age Pension, and by their 80s about 80% will be on it – a testament to how our savings tend to run down later in life.

The takeaway: plan for the long haul, because your retirement could last longer than your career did!

Meet Barry, a 72-year-old carpenter who prided himself on being financially independent. He kept working past pension age, thinking his assets were too high to bother with Centrelink. Four years went by until exhaustion (and maybe some prodding from mates) made him finally investigate. To his surprise, he would have been eligible for a part pension years earlier – he’d simply never kept up with the means test changes.

In those four years, Barry missed out on roughly $6,200 per year in payments – about $25,000 all up that he can never recoup. As he wryly noted, that money could have allowed him to cut back his work hours and avoid running himself ragged. On top of that, he could have had a Pensioner Concession Card, saving on medicines and bills.

The mistake: Assuming “I won’t get anything, so why apply?” or simply putting it in the “too hard basket”. In Barry’s case, asset thresholds for the pension creep up over time (they’re indexed in March, July, and September each year), and his assets in later retirement were lower than he thought. He left tens of thousands on the table.

Many self-funded retirees eventually become eligible as their super balance falls – but if you’re not paying attention, you might qualify later than necessary or not at all. Another error is not realising you can apply before you stop working or turn 67. Centrelink allows you to lodge a claim up to 13 weeks before reaching Age Pension age, so that you can start receiving payments as soon as you’re eligible.

If you wait until after your 67th birthday to even start paperwork, you’re leaving money on the table. Similarly, working part-time doesn’t automatically disqualify you – the income test has generous limits.

For example, a couple can earn around $100,000 a year combined and still potentially get a part pension, depending on assets. That’s because only relatively high incomes and assets cut you out – the system is meant to taper, not be all-or-nothing.

Is it reversible? Unfortunately, missed pension payments generally can’t be back-paid beyond a very short window. Centrelink will only backpay to your application date (or a maximum of a few weeks prior in some circumstances). Unless the department made an error, any money you could have received is gone.

In Barry’s scenario, he can start getting payments now, but those four years of forgone income are lost. The best he can do is chalk it up as a lesson and spread the word to others not to delay.

How to avoid missing out: Stay informed and be proactive. Even if you’re not eligible at 67, mark your calendar to check again every 6–12 months. Asset and income thresholds change, and your situation can change too. (Relying on what a friend or neighbour says can be misleading; always check based on your own numbers.)

You can use the online eligibility calculators – for instance, the Retirement Essentials website has one, or you can consult Centrelink’s Financial Information Service. Importantly, don’t wait until you “need” the money to apply. If you meet the criteria, even a part pension of $1 a fortnight qualifies you for the Pensioner Concession Card with all its discounts. That card alone can save you thousands on prescriptions, rates, utilities and more over time.

If you’re still working or have other income, familiarize yourself with the Work Bonus and income test rules. The Work Bonus, for example, lets age pensioners earn an extra amount from work ($300 a fortnight currently) without affecting their pension – a nice incentive if you want to ease into retirement with some part-time work.

And remember, apply early: you can submit the forms up to 3 months in advance of hitting Age Pension age. This way, you won’t miss a single pension payday once eligible. Yes, the paperwork can be a hassle (there’s a reason Centrelink gets a reputation), but the payoff is real money and benefits you’re entitled to. If in doubt, reach out to Services Australia or a retirement services provider for help with the application – there are even services that will do the Centrelink paperwork with you for a fee, which can be well worth avoiding frustration.

Bottom line: Don’t be shy to claim what you’ve earned through a lifetime of paying taxes. As 80% of older Aussies will tell you, chances are you’ll need it eventually!

In plain English: Centrelink ignores the younger person’s super balance when assessing the older partner’s pension eligibility. Many couples mistakenly think all their assets are counted jointly once one of them is applying for the pension.

That’s exactly what happened to Henry and Angela, who assumed that because they had, say, $800k in combined assets, neither of them would get a pension. Henry (68) didn’t bother applying when he hit 67. In reality, because Angela was only 60 and her super was still in accumulation, Henry could have claimed a part pension using just his share of assets being assessed. By not knowing this, they effectively “left money on the table” for over a year – missing out on payments that won’t be backpaid.

The mistake: Not realising that some assets don’t count against the Age Pension in specific circumstances. Super is a big one – before pension age, your super isn’t counted at all. For couples with an age gap, this presents a legal and smart opportunity: you can rearrange ownership of assets to maximise pension eligibility.

As financial advisors point out, you can, for example, hold more investments in the younger spouse’s name or contribute extra into the younger spouse’s super (up to their contribution caps) while they’re under 67. Those assets then won’t reduce the older spouse’s pension entitlement. Charles Badenach gave an illustrative example: “If I’m 67 and my wife’s 60, I could put all of the assets in my wife’s name in superannuation (accumulation phase), and it won’t count under the assets test [for my pension].”

That might be an extreme case (and you’d need to trust your spouse, naturally!), but it underscores how powerful the younger spouse exemption can be.

Another related oversight is not realising the younger spouse can even “roll back” their own pension account to accumulation to regain the exemption if needed. Angela, in our story, could plan to shift her super to pension phase (tax-free earnings) when it suits them – but keep it in accumulation (taxed at 15% on earnings) until Henry is safely on the pension. It’s a bit of a dance between tax and Centrelink rules, but savvy retirees can make it work.

Is it reversible? In Henry and Angela’s case, the lost year of pension can’t be retrieved, but they corrected course: Henry put in his claim (and now gets a modest fortnightly payment), and Angela kept her super in accumulation to remain exempt. If you’ve missed this trick, you can fix it going forward – move eligible assets into the younger partner’s super ASAP, or adjust financial arrangements to take advantage of the exemption.

Be mindful of contribution limits and that any transfers should be above-board (selling assets or moving money into super where allowable). It often requires guidance, as there are taxation implications to consider (e.g. once the younger spouse eventually hits pension age, that money will come back into the means test). But for the interim, it can mean thousands of dollars in extra entitlements.

How to take advantage (the right way): First, get advice – either from Centrelink’s Financial Information Service or a licensed financial adviser – before moving large sums around. The principle is straightforward: maximize the assets held by the younger spouse (in super or in their name) and minimize the assets in the older spouse’s name that count towards the test. Some strategies include:

Julia found this out after receiving a $100k inheritance from her uncle. Worried that having that money would push her over the pension asset limit, she quickly gave $90,000 of it to her three adult children – thinking she’d solved the problem. Instead, her pension was abruptly reduced.

Why? Because under the rules, you can give away only up to $10,000 per financial year, with a maximum of $30,000 over a five-year period, without affecting your pension. Julia’s $90k gift exceeded those limits by a mile. Centrelink deemed the excess amount as a “deprived asset”, meaning they pretend she still has that money for the purpose of the assets and income test.

In her case, about $60,000 of that gift is still counted as her asset (earning deemed income as well) for five years from the date of gift. Ouch. Her good intentions – trying to help family and stay under the threshold – ended up temporarily cutting her pension more than if she had kept the money (since $90k in the bank would also affect the pension, but gifting it improperly gave her neither the money nor the full pension).

The mistake: Not understanding the gifting (or “deprivation”) rules. It’s not just cash gifts – selling an asset for less than it’s worth, or transferring an investment to someone for free, can also trigger it. The government set these rules to stop people from artificially impoverishing themselves to claim benefits. The limits – $10k a year, $30k over 5 years – haven’t changed in ages, so they’re well known to Centrelink staff even if not to all the public.

Exceeding these limits doesn’t incur a fine or anything; it just doesn’t work – the excess is still counted as yours for 5 years. In Julia’s case, she would have been better off keeping most of that inheritance and using it on allowable things (more on that in a moment). Instead, she unintentionally put herself in a worst-of-both-worlds situation.

Is it reversible? Largely, no. Once you’ve gifted above the limit, you can’t simply undo it with Centrelink. Even if Julia’s kids returned the money to her, Centrelink might still count it as deprived unless she proves the gift was reversed – a messy situation. And even then, regaining pension might require reapplication or reassessment.

Realistically, her best move is what she’s doing: talking to her children about possibly paying back some funds so she can use them in allowable ways. But there’s no guarantee that will fix her pension immediately – the deprived asset rule stays in effect for five years regardless.

So, unfortunately, she may have to live with a lower pension for a while. This is one of those mistakes that’s hard to unwind after the fact.

How to help family without hurting yourself: There are a few strategies to consider:

That way, her Age Pension wouldn’t have been reduced at all. The moral: kindness is wonderful, but take care of your needs first and be mindful of the rules when sharing money. A surprise windfall or inheritance can be a blessing – just plan before you give it all away. Your future self (and even your family, who might otherwise end up supporting you more later) will thank you.

But by understanding the key trigger points in retirement – when to apply for pensions, how much to withdraw, when to spend or save, how rules work – you give yourself the best chance to make decisions you won’t lament later.

A few practical takeaways to wrap up:

Lastly, remember that retirement is about living your best life with the resources you have. Financial security is a means to that end, not an end in itself. Avoiding irreversible money mistakes helps protect that security.

But equally, don’t become so focused on never making a mistake that you end up with the biggest regret of all – not enjoying your retirement. As Charles Badenach reminded listeners, sometimes retirees need a mindset shift to “move to the spending phase psychologically”.

After all, you’ve spent decades accumulating this wealth – it’s okay to use it for you. The trick is doing it in a balanced, informed way.

Retirement rarely offers do-overs, so a bit of planning now can pay dividends (literally and figuratively) for years to come. Learn from those who came before – the ones who, with hindsight, wished they’d done things a little differently. By avoiding these common traps, you can retire with fewer regrets and more peace of mind.

And if you take nothing else from this discussion, let it be this piece of down-to-earth advice: When it comes to your money in retirement, measure twice and cut once. Think through the consequences before you act – whether it’s withdrawing a big lump sum, delaying a claim, or gifting away your nest egg. Your future self will thank you.

Now, over to you: Have you seen friends or family make any of these retirement mistakes, or nearly fallen into one yourself? What steps are you taking to ensure your “second act” is financially secure and fulfilling?

Read More: DIY Super in Retirement: Golden Opportunity or Stressful Burden?

From costly Age Pension traps to spending blunders, it pays to be aware of the money mistakes you can’t undo.

The good news? With a bit of savvy planning (and a dash of caution), you can steer clear of these pitfalls and make the most of your retirement. In this editorial, we’ll look at some common scenarios – drawn from real-life cases – and practical strategies to avoid irreversible mistakes.

Settle in with a cuppa, and let’s chat about how to keep your finances on track in retirement.

Living Too Frugally – “You Can’t Take It With You”

Many of us have spent our working lives saving diligently, so it’s only natural to enter retirement with a cautious mindset. But there’s a difference between being careful and being so frugal that you miss out on life.One retiree couple – let’s call them John and Maya – learned this the hard way. They had about $380,000 in super and were eligible for the full Age Pension (as homeowner retirees, that amount was well below the ~$470,000 assets limit for a full pension). With roughly $45,000 a year coming in from the Age Pension plus their super drawdowns, they planned to live modestly and save their super for later. They stuck to only the minimum required withdrawals (around 5% of their super each year), thinking it would make their money last.

Unfortunately, life had other plans – John was diagnosed with a terminal illness, and suddenly their dreams of “one day” travelling together crumbled. The money they scrimped and saved can’t buy back the lost time and experiences.

The mistake: Treating the minimum super drawdown as a maximum, and deferring enjoyable spending “for later” without considering health or unforeseen events. In other words, being too frugal too early.

Financial experts observe this is a common issue – retirees often remain “savers” out of habit, even when they can afford to spend a bit more. As financial planner Charles Badenach noted, many people “are not taking enough income from their super pension,” and end up with “a lot of money left when they don’t need it.” The result: “They could have actually had a better quality of lifestyle earlier,” he told ABC Radio.

Is it reversible? Sadly, no – time wasted is gone forever. You generally can’t get a refund on experiences you never had. John and Maya’s unspent money can’t buy back his health or years of adventure. The lesson is not to rush out and blow your savings, but to find a balance.

You worked hard for your retirement funds and the Age Pension safety net – using them wisely to enjoy life (within your means) is part of what you’ve earned.

How to avoid being too frugal: Make a retirement spending plan that considers your likely lifespan and different phases of retirement. Many advisers break it down into the “go-go” years (your active 60s and early 70s), the “slow-go” years (mid-70s to 80s), and the “no-go” years (late 80s and beyond).

You’ll probably spend more on travel and leisure in the earlier phase and less as you slow down. Use budgeting tools (ASIC’s Moneysmart retirement planner or the Retirement Essentials forecaster) to model how increasing your annual withdrawals for travel or hobbies might affect your long-term finances.

Often, you’ll find you can afford that trip or new kitchen without jeopardising your future security. Remember, the government sets minimum drawdown rates for account-based pensions (e.g. 5% at age 65-74), but that’s just a floor – you can take more if needed. If you’re unsure how much is safe to spend, consider talking to a financial adviser about a sustainable withdrawal strategy.

The key is to use your money while it can do you good, rather than depriving yourself unnecessarily. As the old saying goes, “There are no pockets in a shroud.”

Burning Through Savings Too Fast – Mind the Long Game

On the flip side, some of us finally reach retirement and think “YOLO – you only live once, let’s enjoy it all now!” There’s nothing wrong with celebrating the start of your retirement, but overspending in the early years can come back to bite you.Consider the case of Manoj and Devi, a fictional couple that illustrates this predicament. Both in their early 60s, they took the plunge into retirement as soon as they were eligible – and promptly withdrew a combined $100,000 lump sum from super to splurge on home renovations and luxury entertainment. They also generously gifted money to their adult kids. In the next two years, they drew another $160,000 for living costs.

Suddenly, despite a similar starting balance to John and Maya, these two found themselves with a near-depleted super kitty – and neither of them even at Age Pension age yet. At their current burn rate, they’d hit age 67 with nothing left except the family home. It’s a classic “live fast, repent later” scenario.

The mistake: Failing to plan for a retirement that could last 20, 30, or even more years. Australian life expectancies at age 65 are around 20 years for men and 23 years for women on average – and many of us will live into our late 80s or 90s. Spending too much too soon can leave you relying only on the Age Pension for potentially decades.

While the Age Pension is a vital safety net, it provides a modest income (currently around $42,000–$45,000 a year for a couple on the full pension, or about $28,000 for a single). That’s roughly equivalent to a “modest” lifestyle by industry standards – comfortable enough for basics, but with little room for big trips or treats.

Manoj and Devi’s high living in their 60s may force them into a very pared-back lifestyle later on – a harsh trade-off if they end up watching every dollar in their 80s.

Is it reversible? Partially, but it’s tough. The sooner you catch an overspending issue, the more you can do to course-correct. In Manoj and Devi’s case, since they’re only in their 60s, they have a few options. They could rejoin the workforce (even part-time) to rebuild savings and delay drawing on the Pension. They also might take advantage of super contribution rules to keep boosting their nest egg while they still can.

Another strategy is to “practise” living on the full Age Pension amount (about $45k p.a. for a couple, or $1,730 a fortnight) – essentially test if they can adjust to that budget now. If it feels impossible to live on, that’s a red flag that changes are needed. Downsizing their home or tapping home equity is another avenue to free up funds, but that’s a big decision with its own pros and cons.

In short, they may have to tighten belts and make lifestyle changes immediately to avoid running completely dry. Not everyone will be able to go back to work or downsize, so the better path is not to get into this predicament in the first place.

How to avoid outliving your money: It sounds simple, but have a plan – preferably before you retire. Work out a sustainable annual withdrawal rate from your super and stick close to it, adjusting for inflation.

A common rule of thumb is the “4% rule” (withdrawing about 4% of your balance in the first year of retirement and adjusting thereafter), but the right number can vary depending on your age and market returns. Many super funds and tools (like Moneysmart’s retirement planner) can model different scenarios. Make sure to account for major one-off spends (a new car, home repairs, helping kids) in your budgeting.

If you want a spending spree to celebrate retirement – that’s okay, just build it into the plan (e.g. earmark a certain lump sum for fun, and know how that affects your later income).

Also, review your investments. If your super is all in ultra-conservative options earning very low returns, even moderate withdrawals could chew through it.

On the other hand, taking on too much risk chasing high returns can backfire too. It’s wise to revisit your asset allocation at retirement – often a balanced or diversified approach is recommended to sustain income for 20+ years. And keep an eye on fees; as one retiree quipped, an “irreversible mistake is to have your super in a poor performing fund” with high fees and low returns.

If unsure, getting professional financial advice can be well worth it.

Finally, don’t forget about inflation and rising costs. The current cost-of-living squeeze in Australia means expenses like groceries, utilities and healthcare can climb faster than expected. What felt like plenty of money now might not go as far in 10 years.

So, build a buffer in your projections – and consider the Age Pension your ally here. Even if you start retirement as a self-funded retiree, keep an eye on the means test thresholds. As your assets reduce over time (or if markets fall), you might become eligible for a part Age Pension sooner than you think. In fact, around seven in ten Australians over 67 receive some Age Pension, and by their 80s about 80% will be on it – a testament to how our savings tend to run down later in life.

The takeaway: plan for the long haul, because your retirement could last longer than your career did!

Procrastinating on Your Age Pension – Claim What’s Yours

One costly mistake we see far too often is waiting too long to apply for the Age Pension – or not checking your eligibility because you assume you won’t qualify. Unlike a fine wine, Age Pension entitlements don’t get better with age if left on the shelf; in fact, you can lose payments forever if you delay too much.Meet Barry, a 72-year-old carpenter who prided himself on being financially independent. He kept working past pension age, thinking his assets were too high to bother with Centrelink. Four years went by until exhaustion (and maybe some prodding from mates) made him finally investigate. To his surprise, he would have been eligible for a part pension years earlier – he’d simply never kept up with the means test changes.

In those four years, Barry missed out on roughly $6,200 per year in payments – about $25,000 all up that he can never recoup. As he wryly noted, that money could have allowed him to cut back his work hours and avoid running himself ragged. On top of that, he could have had a Pensioner Concession Card, saving on medicines and bills.

The mistake: Assuming “I won’t get anything, so why apply?” or simply putting it in the “too hard basket”. In Barry’s case, asset thresholds for the pension creep up over time (they’re indexed in March, July, and September each year), and his assets in later retirement were lower than he thought. He left tens of thousands on the table.

Many self-funded retirees eventually become eligible as their super balance falls – but if you’re not paying attention, you might qualify later than necessary or not at all. Another error is not realising you can apply before you stop working or turn 67. Centrelink allows you to lodge a claim up to 13 weeks before reaching Age Pension age, so that you can start receiving payments as soon as you’re eligible.

If you wait until after your 67th birthday to even start paperwork, you’re leaving money on the table. Similarly, working part-time doesn’t automatically disqualify you – the income test has generous limits.

For example, a couple can earn around $100,000 a year combined and still potentially get a part pension, depending on assets. That’s because only relatively high incomes and assets cut you out – the system is meant to taper, not be all-or-nothing.

Is it reversible? Unfortunately, missed pension payments generally can’t be back-paid beyond a very short window. Centrelink will only backpay to your application date (or a maximum of a few weeks prior in some circumstances). Unless the department made an error, any money you could have received is gone.

In Barry’s scenario, he can start getting payments now, but those four years of forgone income are lost. The best he can do is chalk it up as a lesson and spread the word to others not to delay.

How to avoid missing out: Stay informed and be proactive. Even if you’re not eligible at 67, mark your calendar to check again every 6–12 months. Asset and income thresholds change, and your situation can change too. (Relying on what a friend or neighbour says can be misleading; always check based on your own numbers.)

You can use the online eligibility calculators – for instance, the Retirement Essentials website has one, or you can consult Centrelink’s Financial Information Service. Importantly, don’t wait until you “need” the money to apply. If you meet the criteria, even a part pension of $1 a fortnight qualifies you for the Pensioner Concession Card with all its discounts. That card alone can save you thousands on prescriptions, rates, utilities and more over time.

If you’re still working or have other income, familiarize yourself with the Work Bonus and income test rules. The Work Bonus, for example, lets age pensioners earn an extra amount from work ($300 a fortnight currently) without affecting their pension – a nice incentive if you want to ease into retirement with some part-time work.

And remember, apply early: you can submit the forms up to 3 months in advance of hitting Age Pension age. This way, you won’t miss a single pension payday once eligible. Yes, the paperwork can be a hassle (there’s a reason Centrelink gets a reputation), but the payoff is real money and benefits you’re entitled to. If in doubt, reach out to Services Australia or a retirement services provider for help with the application – there are even services that will do the Centrelink paperwork with you for a fee, which can be well worth avoiding frustration.

Bottom line: Don’t be shy to claim what you’ve earned through a lifetime of paying taxes. As 80% of older Aussies will tell you, chances are you’ll need it eventually!

Not Knowing the “Younger Spouse” Loophole

Retirement finances can be a team game for couples, and understanding how the rules differ when one partner is younger can make a huge difference. A commonly overlooked strategy involves “younger spouse” superannuation. Here’s what that means: If you have a husband, wife, or partner who hasn’t reached Age Pension age yet, any super they have in accumulation phase (i.e. not yet converted into a pension income stream) is completely exempt from the Age Pension means test.In plain English: Centrelink ignores the younger person’s super balance when assessing the older partner’s pension eligibility. Many couples mistakenly think all their assets are counted jointly once one of them is applying for the pension.

That’s exactly what happened to Henry and Angela, who assumed that because they had, say, $800k in combined assets, neither of them would get a pension. Henry (68) didn’t bother applying when he hit 67. In reality, because Angela was only 60 and her super was still in accumulation, Henry could have claimed a part pension using just his share of assets being assessed. By not knowing this, they effectively “left money on the table” for over a year – missing out on payments that won’t be backpaid.

The mistake: Not realising that some assets don’t count against the Age Pension in specific circumstances. Super is a big one – before pension age, your super isn’t counted at all. For couples with an age gap, this presents a legal and smart opportunity: you can rearrange ownership of assets to maximise pension eligibility.

As financial advisors point out, you can, for example, hold more investments in the younger spouse’s name or contribute extra into the younger spouse’s super (up to their contribution caps) while they’re under 67. Those assets then won’t reduce the older spouse’s pension entitlement. Charles Badenach gave an illustrative example: “If I’m 67 and my wife’s 60, I could put all of the assets in my wife’s name in superannuation (accumulation phase), and it won’t count under the assets test [for my pension].”

That might be an extreme case (and you’d need to trust your spouse, naturally!), but it underscores how powerful the younger spouse exemption can be.

Another related oversight is not realising the younger spouse can even “roll back” their own pension account to accumulation to regain the exemption if needed. Angela, in our story, could plan to shift her super to pension phase (tax-free earnings) when it suits them – but keep it in accumulation (taxed at 15% on earnings) until Henry is safely on the pension. It’s a bit of a dance between tax and Centrelink rules, but savvy retirees can make it work.

Is it reversible? In Henry and Angela’s case, the lost year of pension can’t be retrieved, but they corrected course: Henry put in his claim (and now gets a modest fortnightly payment), and Angela kept her super in accumulation to remain exempt. If you’ve missed this trick, you can fix it going forward – move eligible assets into the younger partner’s super ASAP, or adjust financial arrangements to take advantage of the exemption.

Be mindful of contribution limits and that any transfers should be above-board (selling assets or moving money into super where allowable). It often requires guidance, as there are taxation implications to consider (e.g. once the younger spouse eventually hits pension age, that money will come back into the means test). But for the interim, it can mean thousands of dollars in extra entitlements.

How to take advantage (the right way): First, get advice – either from Centrelink’s Financial Information Service or a licensed financial adviser – before moving large sums around. The principle is straightforward: maximize the assets held by the younger spouse (in super or in their name) and minimize the assets in the older spouse’s name that count towards the test. Some strategies include:

- Super contributions: If one partner is <67 (or <75 and still meeting work test conditions), consider contributing extra into their super. This might mean using after-tax (non-concessional) contributions or even withdrawing from the older spouse’s super (once they’re retired and over preservation age) and re-contributing it to the younger spouse’s super. Note: There are caps (currently $110k a year non-concessional, or more with bring-forward rules) and potential tax on pulling money out if under 60, etc. So definitely check the rules or get professional help.

- Asset ownership tweaks: Some assets like shares or bank accounts could be held in the younger person’s name alone. The Centrelink assets test will count jointly owned assets in proportion, so shifting more into one name could change the assessed total for the older person. Just be careful – simply transferring assets between spouses is allowed and not treated as a gift by Centrelink (spouses are basically one financial unit), but there may be legal or tax reasons to formalize it. Again, advice helps.

- Timing the pension phase: When the younger spouse does approach Age Pension age, plan the timing of converting their super to an income stream. Keeping it in accumulation up to that point maximises pension for the older partner; afterwards, you might both go into pension phase for tax-free earnings. It’s a bit technical, but the goal is to not inadvertently start an account-based pension for the younger spouse too early (since once it’s paying an income stream to someone over pension age, it becomes assessable). Angela in our story was surprised to learn she could even reverse a conversion if needed – something to keep in mind if you’ve already moved to pension phase but haven’t reached Age Pension age yourself.

Gifting Gone Wrong – Beware “Deprivation” Rules

Many Aussie retirees love to share the wealth with family – helping the kids with a house deposit, paying grandkids’ school fees, or giving an early inheritance. It’s generous and can be immensely rewarding to see your money making a difference. However, if you’re on (or planning to get) the Age Pension, you must tread carefully: Centrelink has strict gifting limits, and breaking those rules can backfire spectacularly.Julia found this out after receiving a $100k inheritance from her uncle. Worried that having that money would push her over the pension asset limit, she quickly gave $90,000 of it to her three adult children – thinking she’d solved the problem. Instead, her pension was abruptly reduced.

Why? Because under the rules, you can give away only up to $10,000 per financial year, with a maximum of $30,000 over a five-year period, without affecting your pension. Julia’s $90k gift exceeded those limits by a mile. Centrelink deemed the excess amount as a “deprived asset”, meaning they pretend she still has that money for the purpose of the assets and income test.

In her case, about $60,000 of that gift is still counted as her asset (earning deemed income as well) for five years from the date of gift. Ouch. Her good intentions – trying to help family and stay under the threshold – ended up temporarily cutting her pension more than if she had kept the money (since $90k in the bank would also affect the pension, but gifting it improperly gave her neither the money nor the full pension).

The mistake: Not understanding the gifting (or “deprivation”) rules. It’s not just cash gifts – selling an asset for less than it’s worth, or transferring an investment to someone for free, can also trigger it. The government set these rules to stop people from artificially impoverishing themselves to claim benefits. The limits – $10k a year, $30k over 5 years – haven’t changed in ages, so they’re well known to Centrelink staff even if not to all the public.

Exceeding these limits doesn’t incur a fine or anything; it just doesn’t work – the excess is still counted as yours for 5 years. In Julia’s case, she would have been better off keeping most of that inheritance and using it on allowable things (more on that in a moment). Instead, she unintentionally put herself in a worst-of-both-worlds situation.

Is it reversible? Largely, no. Once you’ve gifted above the limit, you can’t simply undo it with Centrelink. Even if Julia’s kids returned the money to her, Centrelink might still count it as deprived unless she proves the gift was reversed – a messy situation. And even then, regaining pension might require reapplication or reassessment.

Realistically, her best move is what she’s doing: talking to her children about possibly paying back some funds so she can use them in allowable ways. But there’s no guarantee that will fix her pension immediately – the deprived asset rule stays in effect for five years regardless.

So, unfortunately, she may have to live with a lower pension for a while. This is one of those mistakes that’s hard to unwind after the fact.

How to help family without hurting yourself: There are a few strategies to consider:

- Stay within the gifting free limits. You are allowed to be generous up to $10k each year (1 July–30 June), with a total of $30k over 5 years. If you want to give a big amount, you might split it into chunks over several years. For example, gift $10k this year, another next year, etc. It requires patience (and who knows if you’ll be around in 5+ years – a valid concern), but it keeps your pension safe.

- Use your money on you (in exempt ways). Centrelink doesn’t count certain expenditures as “gifts”. Notably, money you spend on home improvements, repairs, or renovations for your own home is not counted – your principal residence is an exempt asset. Julia could have used part of that $90k to upgrade her home or even prepay some home maintenance, thereby improving her quality of life and staying under asset limits. Similarly, spending on travel or a car is generally just considered normal spending, not gifting – as long as you’re receiving fair value (a holiday in exchange for your money is fine, giving money away for nothing is not). In other words, “spending” is not “gifting” when you get something of equal value in return. Planning purposeful expenses that both improve your life and reduce your assessable assets is a win-win. Need a new roof? Always wanted to visit the grandkids in London? These are legitimate uses of your savings that won’t count against your pension – whereas handing cash to the kids does. In fact, financial advisers often counsel pensioners to use their allowable spending before gifting. As one retirement guide notes, “you wouldn’t be viewed as gifting when you pay for a holiday or renovations” – those are normal costs.

- Consider a granny flat arrangement if you want to give a big sum to family: The so-called “granny flat interest” is an exception in Centrelink’s rules that can work for some. Essentially, it’s when you give money or assets to someone in exchange for a lifelong right to live in their property (often, parents giving equity to children to build a granny flat or extension, hence the name). If structured correctly, the money or house you transfer for a granny flat interest is exempt from the assets test – it’s not treated as a gift (or rather, it’s a gift that’s allowed). Centrelink uses a “reasonableness test” to assess if the amount you handed over is reasonable for the housing you’re getting. If it passes, you could, for example, give $200,000 or more to a child to build a granny flat and not have that count against your pension. But – and it’s a big but – if the amount is excessive or no formal life accommodation interest is established, they will treat the extra as deprivation. The current reasonableness test thresholds often allow quite large sums (potentially well over $800k for an older person in exchange for housing), but it’s complex. Use this only with professional legal and financial advice, and have a written agreement. It can be a brilliant way to give an early inheritance (and maybe live with or near family) without losing pension, as some retirees have done – just know it’s technical territory.

- Think twice before “gifting” assets like property or shares. Those count too. For instance, if you sign over a second property to your son for free or cheap, Centrelink will assess the difference between market value and what you got as a gift. If that difference is above the $10k/$30k limit, guess what – you’re deemed to still have that amount. One advisor noted seeing cases of people transferring a share of the family holiday house to the kids and inadvertently harming their pension for years. Better to wait, or sell it properly and distribute money within limits (or again, do a granny flat right-to-live approach for a home).

That way, her Age Pension wouldn’t have been reduced at all. The moral: kindness is wonderful, but take care of your needs first and be mindful of the rules when sharing money. A surprise windfall or inheritance can be a blessing – just plan before you give it all away. Your future self (and even your family, who might otherwise end up supporting you more later) will thank you.

The Bottom Line – Plan, Prepare, and Live Your Retirement

We’ve walked through some pretty heavy examples of “retirement regrets”. If there’s a silver lining, it’s that all of these mistakes were avoidable with a bit of foresight and knowledge. None of us has a crystal ball, and life will throw curveballs (illness, market crashes, family needs).But by understanding the key trigger points in retirement – when to apply for pensions, how much to withdraw, when to spend or save, how rules work – you give yourself the best chance to make decisions you won’t lament later.

A few practical takeaways to wrap up:

- Check your entitlements regularly: Even if you start out not needing the Age Pension, things change. Keep tabs on eligibility thresholds. Don’t be like Barry and let years slip by – apply on time and claim those concessions.

- Use your money wisely (neither hoard it nor squander it): There’s a happy medium between John and Maya’s over-cautious approach and Manoj and Devi’s early splurge. Plan for fun early retirement activities while also budgeting for a long life. If you have more than enough, enjoy it! If you’re borderline, adjust accordingly – maybe that means a cheaper version of the dream trip or spacing out big expenses.

- Maximise what you can control: Take advantage of legal strategies – from contribution tactics with a younger spouse, to spending to just under a threshold, to utilizing exemptions like your home (need a new hot water system? Now might be the time). These can significantly boost your retirement income and security. For instance, one couple found that by spending about $90k on things they truly wanted (home upgrades, travel, modest gifts within limits), they turned on an extra $60k+ of Age Pension over the next decade, plus got concession discounts – with very little impact on their long-term finances. Smart, targeted spending can pay off.

- When in doubt, get advice: This might sound self-serving coming from a financial services perspective, but even Services Australia encourages people to talk to their Financial Information Service officers or professional advisers for complex decisions. The system is complicated. The cost of bad decisions is often far greater than the cost of good advice. Whether it’s a one-off consultation to sanity-check your plan or ongoing financial planning, it can be a worthwhile investment to avoid costly blunders.

- Keep an eye on policy changes: Pension rules aren’t set in stone. Governments adjust rates, thresholds and legislation (for example, new downsizer super contributions rules, or changes to deeming rates). A change in the assets test or a new scheme might create opportunities or new risks. Stay informed through reputable sources – the government websites, trusted news outlets, or organizations like National Seniors and ASIC’s Moneysmart. Being forewarned is forearmed.

Lastly, remember that retirement is about living your best life with the resources you have. Financial security is a means to that end, not an end in itself. Avoiding irreversible money mistakes helps protect that security.

But equally, don’t become so focused on never making a mistake that you end up with the biggest regret of all – not enjoying your retirement. As Charles Badenach reminded listeners, sometimes retirees need a mindset shift to “move to the spending phase psychologically”.

After all, you’ve spent decades accumulating this wealth – it’s okay to use it for you. The trick is doing it in a balanced, informed way.

Retirement rarely offers do-overs, so a bit of planning now can pay dividends (literally and figuratively) for years to come. Learn from those who came before – the ones who, with hindsight, wished they’d done things a little differently. By avoiding these common traps, you can retire with fewer regrets and more peace of mind.

And if you take nothing else from this discussion, let it be this piece of down-to-earth advice: When it comes to your money in retirement, measure twice and cut once. Think through the consequences before you act – whether it’s withdrawing a big lump sum, delaying a claim, or gifting away your nest egg. Your future self will thank you.

Now, over to you: Have you seen friends or family make any of these retirement mistakes, or nearly fallen into one yourself? What steps are you taking to ensure your “second act” is financially secure and fulfilling?

Read More: DIY Super in Retirement: Golden Opportunity or Stressful Burden?