‘My heart sank’: Woman loses almost $4,000 in minutes after selling preloved clothes online

By

Seia Ibanez

- Replies 8

Selling preloved clothes online can be a fantastic way to declutter, make extra cash, and contribute to a more sustainable fashion cycle.

However, as the unfortunate experience of Brianna Ireland, a 19-year-old Australian nursing student, demonstrates, it can also expose sellers to the risk of sophisticated online scams.

Brianna decided to use the fashion marketplace app Depop for the first time to sell her unwanted clothing items.

Within minutes of listing her clothes, she received messages from a potential buyer named 'Sarah’. This buyer requested Brianna's email address ‘for some reason’ at checkout, which seemed innocuous enough.

‘I was so excited to sell clothes, I just didn’t think anything of it...I was so caught up in the moment,’ Brianna said.

What followed was a harrowing sequence of events that led to Brianna losing over $4000. She received a confirmation email that appeared legitimate, asking her to click a link to verify the purchase.

The link took her to a website that requested her bank details and led her to sign into her bank account to 'confirm the payment’.

‘During this process, I didn’t even think to check my app to make sure the item was actually sold,’ Brianna said.

‘At this point, I didn’t know how the app worked because it was my first time using it. I thought, “This must be the process”.’

‘It was weird because I thought everything on Depop was through PayPal, but (I thought) maybe my PayPal account mustn’t have worked for whatever reason.’

A chatbot then appeared, and after several attempts to complete the process, Brianna realised something was amiss.

‘At this point, the website was taking ages to load and kept saying there was an error after entering the codes,’ she continued.

‘The chatbot then randomly appeared after my third attempt at putting in this code, and it asked if I had another bank to log into.’

‘By this point, I was extremely confused as to why it was asking me this, and then it hit me.’

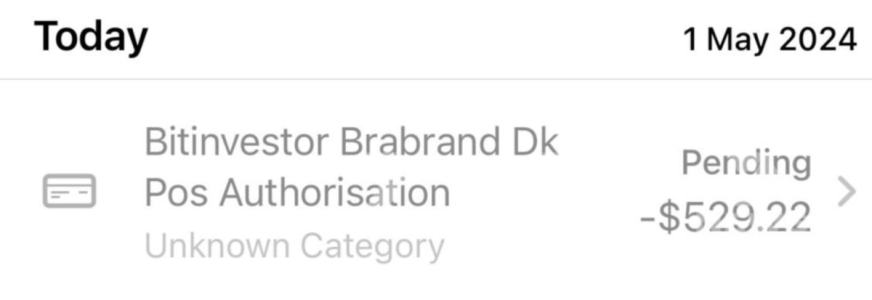

By the time she logged into her bank account, it was too late; a 'Bitcoin investor' from Peru had withdrawn $529.22, and an additional $3500 was in the process of being taken.

‘I had the worst heart palpitations, and my palms were sweating,’ Brianna said

‘I was in too much shock at this point to cry.’

‘My instinct was to call my bank immediately...but I was put on hold for about five minutes until I was able to get the bank employee to freeze my account.’

‘It wasn’t until I was talking to the worker that it hit me what had happened, and I started to bawl.’

The employee was able to prevent $3500 from transferring after freezing her bank account.

‘I’m just so grateful I called the bank when I did. Otherwise, the payment wouldn’t have bounced back into my account, and they definitely would have drained my entire bank account,’ she said.

‘This would have been so horrible, considering I am a full-time university student studying nursing, and I moved away from home to study, so I don’t have any financial support from my family.’

However, she was unable to recover the initial $530, as her bank stated she had 'verified' the payment.

A spokesperson for Depop responded to the incident, saying, ‘We’re sorry that Brianna had this experience.’

‘Depop has a wide range of protection measures in place to block scams and prevent users from falling victim to fraudulent behaviour.’

‘Our in-app payment systems are designed specifically to keep users safe, and legitimate payments on Depop will only ever be taken within the app or Depop.com.’

‘Unfortunately, as peer-to-peer marketplaces become more popular, scammers are using increasingly sophisticated methods to encourage consumers to pay outside of secure platforms —this is an industry-wide issue.’

Depop stated that it continuously updates its strategies for addressing fraudulent activities and invests in new technologies and tactics to safeguard users of its marketplace.

Depop’s Community Guidelines stated that external parties not affiliated with the app may attempt to gain access to your account through deceptive emails and websites that appear to come from a legitimate source, known as phishing.

‘We strongly recommend against sharing any personal information via Message,’ the company said on its website.

If you detect any suspicious activity or fraudulent behaviour, contact Depop directly.

Refrain from clicking on any links or opening attachments within the email.

Legitimate Depop emails always originate from an @depop.com email address, so double-check the sender's address to ensure its authenticity.

In a similar story, a mum and co-owner of a baby clothing brand suffered substantial financial losses due to a hacker draining thousands from her business account.

In a similar story, a mum and co-owner of a baby clothing brand suffered substantial financial losses due to a hacker draining thousands from her business account.

The hacker gained access to her debit card, leaving a balance of only $1.71 in the company’s bank account. You can read more about the story here.

Have you had any experiences with online selling or buying that you'd like to share? Let us know in the comments below.

However, as the unfortunate experience of Brianna Ireland, a 19-year-old Australian nursing student, demonstrates, it can also expose sellers to the risk of sophisticated online scams.

Brianna decided to use the fashion marketplace app Depop for the first time to sell her unwanted clothing items.

Within minutes of listing her clothes, she received messages from a potential buyer named 'Sarah’. This buyer requested Brianna's email address ‘for some reason’ at checkout, which seemed innocuous enough.

Brianna sold her preloved clothes at Depop, but unfortunately, it took a wrong turn for her. Credit: Shutterstock

‘I was so excited to sell clothes, I just didn’t think anything of it...I was so caught up in the moment,’ Brianna said.

What followed was a harrowing sequence of events that led to Brianna losing over $4000. She received a confirmation email that appeared legitimate, asking her to click a link to verify the purchase.

The link took her to a website that requested her bank details and led her to sign into her bank account to 'confirm the payment’.

‘During this process, I didn’t even think to check my app to make sure the item was actually sold,’ Brianna said.

‘At this point, I didn’t know how the app worked because it was my first time using it. I thought, “This must be the process”.’

‘It was weird because I thought everything on Depop was through PayPal, but (I thought) maybe my PayPal account mustn’t have worked for whatever reason.’

A chatbot then appeared, and after several attempts to complete the process, Brianna realised something was amiss.

‘At this point, the website was taking ages to load and kept saying there was an error after entering the codes,’ she continued.

‘The chatbot then randomly appeared after my third attempt at putting in this code, and it asked if I had another bank to log into.’

‘By this point, I was extremely confused as to why it was asking me this, and then it hit me.’

By the time she logged into her bank account, it was too late; a 'Bitcoin investor' from Peru had withdrawn $529.22, and an additional $3500 was in the process of being taken.

‘I had the worst heart palpitations, and my palms were sweating,’ Brianna said

‘I was in too much shock at this point to cry.’

‘My instinct was to call my bank immediately...but I was put on hold for about five minutes until I was able to get the bank employee to freeze my account.’

‘It wasn’t until I was talking to the worker that it hit me what had happened, and I started to bawl.’

The employee was able to prevent $3500 from transferring after freezing her bank account.

‘I’m just so grateful I called the bank when I did. Otherwise, the payment wouldn’t have bounced back into my account, and they definitely would have drained my entire bank account,’ she said.

‘This would have been so horrible, considering I am a full-time university student studying nursing, and I moved away from home to study, so I don’t have any financial support from my family.’

However, she was unable to recover the initial $530, as her bank stated she had 'verified' the payment.

A spokesperson for Depop responded to the incident, saying, ‘We’re sorry that Brianna had this experience.’

‘Depop has a wide range of protection measures in place to block scams and prevent users from falling victim to fraudulent behaviour.’

‘Our in-app payment systems are designed specifically to keep users safe, and legitimate payments on Depop will only ever be taken within the app or Depop.com.’

‘Unfortunately, as peer-to-peer marketplaces become more popular, scammers are using increasingly sophisticated methods to encourage consumers to pay outside of secure platforms —this is an industry-wide issue.’

Depop stated that it continuously updates its strategies for addressing fraudulent activities and invests in new technologies and tactics to safeguard users of its marketplace.

Depop’s Community Guidelines stated that external parties not affiliated with the app may attempt to gain access to your account through deceptive emails and websites that appear to come from a legitimate source, known as phishing.

‘We strongly recommend against sharing any personal information via Message,’ the company said on its website.

If you detect any suspicious activity or fraudulent behaviour, contact Depop directly.

Refrain from clicking on any links or opening attachments within the email.

Legitimate Depop emails always originate from an @depop.com email address, so double-check the sender's address to ensure its authenticity.

Tip

Members, if you or someone else was scammed, notify your bank immediately. You can also report the scam to Scamwatch here.

You can also visit our Scam Watch forum to stay updated with the latest tricks scammers use to deceive people out of their money and sensitive details.

You can also visit our Scam Watch forum to stay updated with the latest tricks scammers use to deceive people out of their money and sensitive details.

The hacker gained access to her debit card, leaving a balance of only $1.71 in the company’s bank account. You can read more about the story here.

Key Takeaways

- Nursing student Brianna Ireland lost over $4000 due to a sophisticated scam on the fashion marketplace app Depop after attempting to sell her preloved clothes.

- The scammer, posing as a buyer named 'Sarah,' used a hacked Depop account to gain Brianna's trust and requested her email for a payment never made through the legitimate app system.

- Brianna was tricked into entering her bank details on a fake site which resulted in immediate financial loss, but timely action prevented a larger sum from being withdrawn by the scammer.

- The incident serves as a reminder and wake-up call for all Australians to be vigilant, sceptical, and always double-check the legitimacy of online transactions and communication to avoid falling victim to similar scams..