‘A substantial markup’: Why a top online store is facing court over customer charges

By

Maan

- Replies 0

Concerns have arisen over the practices of a major online retailer, sparking questions about fairness and transparency in consumer transactions.

What seemed like a straightforward way to buy everyday essentials has come under intense scrutiny.

Now, regulators are taking serious action that could have wide-reaching implications for shoppers.

A major Australian online retailer faced federal court action after being accused of misleading more than 40,000 customers into paying inflated prices for electronics and household goods.

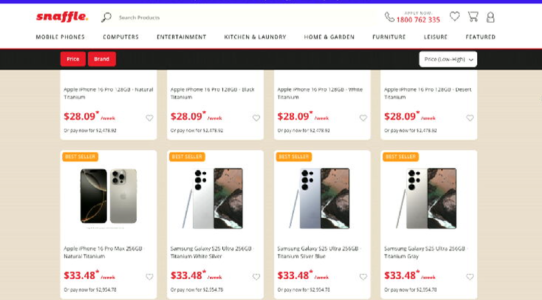

Snaffle, the retailer in question, offered customers the option to purchase items like washing machines, fridges and mobile phones through weekly installments spread over several years.

However, the Australian Securities & Investments Commission (ASIC) alleged that the company not only marked up product prices but also overcharged on interest payments.

In one example cited by ASIC, a customer was charged over $4000 across three years for a mobile phone that originally retailed for less than $1500.

Another case involved Snaffle charging $835 more than the correct amount for a 35L fridge.

Australian regulations capped the interest on credit contracts at 48 per cent.

ASIC claimed that Snaffle had ignored this limit, applying interest rates between 60 and 103 per cent, resulting in hundreds of dollars extra costs for customers.

Instead of calculating interest on the decreasing unpaid balance—which depreciates over time—ASIC said up to 40,430 customers were charged a flat interest rate on the full purchase price throughout the contract period.

ASIC Deputy Chair Sarah Court explained the regulator’s stance: 'ASIC alleges Snaffle charged customers a substantial markup on products, as well as a delivery fee they did not incur, operating costs, a profit margin and additional adjustments – all before significant interest was applied, resulting in an unlawful credit contract.'

She added: 'We're especially concerned about the impact on particularly vulnerable people and we think a significant penalty will clearly send that message.'

Stephanie Tonkin, chief executive of the Consumer Action Law Centre, urged consumers to consider alternatives.

'There are far better products out there than Snaffle and other consumer lease products,' Tonkin said.

'There's a no-interest scheme to help you access a fridge, or other white-goods, or other essential items.'

In a previous story, concerns were raised about customers being charged unfairly in essential services.

This issue of overcharging continues to affect many, including patients caught in complex billing systems.

Read on to learn more about how a Medicare loophole is impacting people’s wallets.

With reports of widespread overcharging in installment plans, how do you think retailers should be held accountable? Share your thoughts in the comments.

What seemed like a straightforward way to buy everyday essentials has come under intense scrutiny.

Now, regulators are taking serious action that could have wide-reaching implications for shoppers.

A major Australian online retailer faced federal court action after being accused of misleading more than 40,000 customers into paying inflated prices for electronics and household goods.

Snaffle, the retailer in question, offered customers the option to purchase items like washing machines, fridges and mobile phones through weekly installments spread over several years.

However, the Australian Securities & Investments Commission (ASIC) alleged that the company not only marked up product prices but also overcharged on interest payments.

In one example cited by ASIC, a customer was charged over $4000 across three years for a mobile phone that originally retailed for less than $1500.

Another case involved Snaffle charging $835 more than the correct amount for a 35L fridge.

Australian regulations capped the interest on credit contracts at 48 per cent.

ASIC claimed that Snaffle had ignored this limit, applying interest rates between 60 and 103 per cent, resulting in hundreds of dollars extra costs for customers.

Instead of calculating interest on the decreasing unpaid balance—which depreciates over time—ASIC said up to 40,430 customers were charged a flat interest rate on the full purchase price throughout the contract period.

ASIC Deputy Chair Sarah Court explained the regulator’s stance: 'ASIC alleges Snaffle charged customers a substantial markup on products, as well as a delivery fee they did not incur, operating costs, a profit margin and additional adjustments – all before significant interest was applied, resulting in an unlawful credit contract.'

She added: 'We're especially concerned about the impact on particularly vulnerable people and we think a significant penalty will clearly send that message.'

Stephanie Tonkin, chief executive of the Consumer Action Law Centre, urged consumers to consider alternatives.

'There are far better products out there than Snaffle and other consumer lease products,' Tonkin said.

'There's a no-interest scheme to help you access a fridge, or other white-goods, or other essential items.'

This issue of overcharging continues to affect many, including patients caught in complex billing systems.

Read on to learn more about how a Medicare loophole is impacting people’s wallets.

Key Takeaways

- A major online retailer allegedly misled over 40,000 customers by inflating prices and overcharging interest.

- ASIC claimed the company charged unlawful interest rates up to 103 per cent, exceeding the 48 per cent legal limit.

- Customers were charged flat interest on the full purchase price rather than on the reducing balance.

- Consumer advocates advised customers to explore better, no-interest alternatives for essential goods.

With reports of widespread overcharging in installment plans, how do you think retailers should be held accountable? Share your thoughts in the comments.