The largest telecommunications penalty in Australian history is currently before the Federal Court, and the details are both shocking and sobering.

As Justice Patrick O'Sullivan deliberates whether to approve Optus's agreed $100 million penalty for breaching the Australian Consumer Law, the case reveals a disturbing pattern of exploitation that should concern every Australian—particularly those who might be more vulnerable to high-pressure sales tactics.

This isn't just another corporate fine making headlines. It's a stark reminder that some of Australia's biggest companies have been systematically targeting our most vulnerable community members, and the practices exposed could affect any of us or our loved ones.

In this article

The Staggering Scale of Exploitation

The numbers alone tell a troubling story. Between August 2019 and July 2023, Optus sales staff at 16 retail stores pressured over 400 consumers into purchasing telecommunications products and services they did not want, need or could afford.

But this case becomes even more significant when compared to a similar scandal that rocked the industry just four years earlier.

This case follows similar ACCC action against Telstra, which was ordered in May 2021 to pay a $50 million penalty for engaging in unconscionable conduct involving 108 Indigenous consumers.

The Optus penalty—if approved—would be exactly double Telstra's record-breaking fine, reflecting both the increased scale of harm and the justice system's growing impatience with corporate misconduct.

'The conduct, which included selling inappropriate, unwanted or unaffordable mobiles and phone plans to people who are vulnerable or experiencing disadvantage is simply unacceptable'

The ABC reported that Justice O'Sullivan presided over the Adelaide hearing and said 'great weight should be given to the parties agreed range' in determining the $100m penalty. The hearing has been adjourned until a later date.

Who Were the Targets?

The victims weren't chosen randomly. Court documents reveal a systematic pattern of targeting people who staff knew would struggle to understand contracts or defend themselves.

Many of the affected consumers were vulnerable or experiencing disadvantage, such as living with a mental disability, or English not being a first language. Many of the consumers were First Nations Australians from regional, remote and very remote parts of Australia.

The Federal Court heard that people across Australia who were homeless, unemployed or on a disability pension were also sold products they could not afford or need.

The case studies presented to the Federal Court are heartbreaking. One woman with an intellectual disability was sold seven separate contracts despite having limited understanding of money and written documents.

Staff input false information on credit checks, and when her parents complained in 2021, they were told by Optus staff that 'there was nothing they could do' and their daughter 'had to pay her bills'.

The ABC transcript noted this woman amassed more than $6,000 in debts, which were later cleared. Counsel told the court: 'Optus now accepts the conduct in relation to consumer five was unconscionable and we say, obviously so.'

Another victim was a man who was deaf, mute, and had parts of his fingers and hand amputated.

Despite his obvious communication challenges and reliance on disability payments, staff sold him multiple phones, plans, and accessories totalling over $7,500 in contracts he couldn't possibly understand or use effectively.

The Unconscionable Methods

The sales tactics revealed in court documents should alarm anyone who's ever walked into a phone shop or taken a call from a telecommunications company.

Commission-based sales arrangements for Optus's sales staff had the potential to incentivise the inappropriate sales conduct, creating a system where vulnerable consumers became targets for financial gain.

The methods included:

- Pressuring customers into buying multiple products they didn't need

- Failing to explain relevant terms and conditions to vulnerable consumers in a manner they could understand

- Selling products to people in areas with no Optus coverage

- Misleading consumers to believe that goods were free or included as part of a bundle at no additional cost

- Manipulating credit assessments to approve customers who should have been declined

In Mount Isa, Queensland, the situation was even worse. The ACCC revealed that staff fraudulently completed 82 contracts with 42 customers without consumer knowledge, then pursued them for debt collection when they couldn't pay for services they never agreed to purchase.

Counsel said: 'In February 2020, Optus commenced debt collector activity against 42 consumers … [and] referred outstanding debt to third-party debt collection agencies. One of those consumers received more than 100 calls from a third-party debt collector.'

Red Flags: Warning Signs of Unconscionable Sales Practices

High-pressure tactics that make you feel rushed to sign immediately

Sales staff who seem more interested in signing you up than understanding your needs

Reluctance to explain contract terms clearly or give you time to read them

Offers that seem too good to be true or 'free' items with hidden ongoing costs

Staff who suggest increasing your income or changing personal details on applications

Being sold multiple products or services in one visit without clear explanations

The Human Cost

The financial damage was devastating. One consumer accumulated a debt of over $19,000, while others faced years of harassment from debt collectors. Many consumers experienced significant financial harm, accruing thousands of dollars of unexpected debt and being pursued by debt collectors, in some instances for years, causing significant emotional distress and fear.

Perhaps most disturbing, Optus engaged debt collectors to pursue some of these consumers after it had launched internal investigations into the sales conduct, meaning the company continued to chase vulnerable people for debts it knew were questionable.

Did you know?

Did you know?

The telecommunications industry has been under increasing scrutiny since 2016, when similar practices first came to light. Despite industry codes of conduct and regulatory oversight, these cases show that voluntary compliance isn't enough to protect vulnerable consumers from predatory sales practices.

A Pattern Across the Industry

This isn't an isolated case of a few rogue employees. The pattern is troubling when you consider both major cases:

Telstra (2016-2018): 108 Indigenous consumers who did not speak English as a first language, had difficulties with literacy and financial concepts, and/or were unemployed and relied on government benefits

Optus (2019-2023): Over 400 consumers across 16 retail stores, with similar targeting of vulnerable communities

The timeline is particularly concerning—Optus's misconduct began in 2019, just as the Telstra investigation was reaching its peak. This suggests the industry didn't learn from Telstra's mistakes but instead continued similar practices.

Financial Counselling Australia noted that the penalty sends a strong message to the telecommunications industry that mis-selling to vulnerable customers will not be tolerated, and that financial counsellors have been raising concerns about Optus' conduct for years.

Your Rights and Protections

While these cases are disturbing, it's important to know that you do have rights and protections. The Australian Consumer Law provides several safeguards that apply to all telecommunications purchases:

Consumers automatically receive consumer guarantees when they buy goods and services, and it is unlawful for businesses to mislead consumers about these rights.

Under the Telecommunications Consumer Protections Code

Under the 2012 Telecommunications Consumer Protections (TCP) Code and Australian Consumer Law (ACL), consumers have a bunch of rights, including:

- The right to clear, accurate information about products and services

- Protection from high-pressure sales tactics

- The right to cancel contracts in certain circumstances

- The ability to cancel your contract early without penalty under certain circumstances

- Protection from unconscionable conduct

Example Scenario

- Margaret, 72, visits a phone shop looking to upgrade her basic mobile. The salesperson immediately starts pushing expensive smartphones, multiple data plans, and accessories she doesn't understand. When Margaret says she needs time to think, the salesperson claims the 'special deal' expires today and starts filling out paperwork using her pension card details.

- This scenario contains multiple red flags: high-pressure tactics, complex products inappropriate for stated needs, artificial time pressure, and using financial information without clear consent. Margaret should leave immediately and consider reporting the behaviour.

What You Can Do If You've Been Affected

If you believe you or a family member has been the victim of unconscionable sales practices:

1. Contact the Company First: Impacted consumers can call an Optus specialist customer care team on 1300 082 820 for further information or support

2. Document Everything: Keep records of all contracts, bills, and communications

3. Seek Help: Contact:

- The Telecommunications Industry Ombudsman: 1800 062 058

- ACCC Consumer Rights hotline: 1300 302 502

- Financial Counselling Australia: 1800 007 007

4. Know Your Rights: You have the right to have your complaint resolved in a fair, efficient and courteous manner and at no cost

What Does This Mean For You?

If you're an Optus customer who feels you were pressured into contracts you didn't understand or couldn't afford, you may be entitled to compensation.

The company has committed to remediation programs and has already begun compensating affected consumers.

Even if you're not an Optus customer, these cases establish important precedents for consumer protection across the entire telecommunications industry.

Stronger Protections on the Horizon

The good news is that regulators are taking action. In February 2024, the ACMA made the Telecommunications (Financial Hardship) Industry Standard 2024, which commenced on 29 March 2024 and was developed to improve safeguards for telco customers having financial difficulties.

The planned Telecommunications Amendment (Enhancing Consumer Safeguards) Bill 2025 will further strengthen consumer and data protections, with fines for breaching industry codes, standards, and determinations increasing from $250,000 to around $10 million or 30 per cent of turnover.

These changes represent a significant escalation in the regulatory response to telecommunications misconduct, moving from voluntary industry codes to mandatory standards with substantial penalties.

Protecting Yourself and Your Family

The best defence against unconscionable sales practices is knowledge and preparation. Here are practical steps to protect yourself:

Before You Shop

- Research plans online before visiting stores

- Bring a trusted friend or family member for support

- Set a clear budget and stick to it

- Understand your current usage patterns

During Sales Interactions

- Never let anyone pressure you into signing immediately

- Ask for all offers in writing

- Request the Critical Information Summary (CIS) for any plan

- Verify coverage at your address before committing

- Walk away if you feel pressured or confused

After Signing

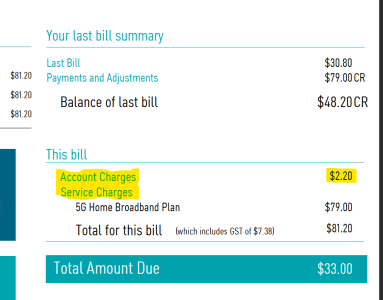

- Read your first bill carefully

- Monitor your usage and charges

- Contact your provider immediately if anything seems wrong

- Keep all documentation

Protecting Yourself from Telecommunications Exploitation

- Never sign contracts under pressure or without understanding terms

- Be especially cautious if English isn't your first language or you have difficulties with complex documents

- Bring a trusted advocate when dealing with telecommunications companies

- Know that you have legal rights and protections under Australian Consumer Law

- Report suspicious practices to the ACCC or Telecommunications Industry Ombudsman

- Remember: if an offer sounds too good to be true, it probably is

The Broader Message

The penalty sends a strong message to the telecommunications industry: mis-selling to vulnerable customers will not be tolerated. But the real test will be whether this record-breaking fine actually changes industry culture or simply becomes another cost of doing business.

Financial Counselling Australia argues that self-regulation via the current Telecommunications Consumer Protections Code is clearly not working, and that rules need to be tightened, oversight improved, and enforcement strengthened to ensure that all consumers are properly protected.

The cases also highlight the crucial role that community advocates, financial counsellors, and consumer protection agencies play in holding big corporations accountable. The ACCC acknowledged being 'grateful to the many advocates, financial counsellors and carers who assisted the impacted individuals'.

Moving Forward Together

As Justice O'Sullivan considers whether to approve this historic penalty, it's worth remembering that behind every statistic is a real person who was taken advantage of when they were vulnerable. The woman with intellectual disability who accumulated $6,000 in debt. The deaf man who couldn't understand what he was signing. The remote community members who were sold phones that couldn't work where they lived.

This case isn't just about corporate accountability—it's about protecting the fundamental right to be treated fairly in the marketplace, regardless of your circumstances, background, or level of understanding.

The telecommunications industry provides essential services that connect us to family, friends, emergency services, and the broader world. We shouldn't have to navigate a minefield of predatory practices to access these vital services.

While we wait for Justice O'Sullivan's decision and for stronger regulatory reforms to take effect, the best protection we have is awareness, vigilance, and looking out for each other. If you see a family member or neighbour struggling with telecommunications issues, consider offering to help them understand their options or accompany them to resolve problems.

What This Means For You

After all, in a fair and decent society, no one should face exploitation simply because they need help understanding a phone contract.

Have you or someone you know encountered high-pressure sales tactics from telecommunications companies? What warning signs do you think other readers should know about? Share your experiences in the comments below—your story could help protect others from similar exploitation.

Original Article

https://www.abc.net.au/news/2025-09...-against-optus-vulnerable-customers/105724206

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: As part of an agreement announced today, the ACCC and Optus will jointly ask the Federal Court to impose a total penalty of $100 million on Optus for ...

Excerpt: $100 million penalty for breaching the Australian Consumer Law

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct

From sales to sanctions: Optus faces $100 million penalty for unconscionable sales practices—Bird & Bird

Cited text: Between August 2019 and July 2023, Optus sales staff at 16 retail stores pressured over 400 consumers into purchasing telecommunications products and ...

Excerpt: Between August 2019 and July 2023, Optus sales staff at 16 retail stores pressured over 400 consumers into purchasing telecommunications products and services they did not want, need or could afford

https://www.twobirds.com/en/insight...on-penalty-for-unconscionable-sales-practices

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: This case follows similar ACCC action against Telstra, which was ordered in May 2021 to pay a $50 million penalty for engaging in unconscionable condu...

Excerpt: This case follows similar ACCC action against Telstra, which was ordered in May 2021 to pay a $50 million penalty for engaging in unconscionable conduct

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct

Telstra to pay $50m penalty for unconscionable sales to Indigenous consumers | ACCC

Cited text: The Federal Court today ordered that Telstra pay $50 million in penalties for engaging in unconscionable conduct when it sold mobile contracts to more...

Excerpt: 108 Indigenous consumers

https://www.accc.gov.au/media-relea...-unconscionable-sales-to-indigenous-consumers

Telstra resolves sales practices investigation for 108 vulnerable Indigenous customers

Cited text: Telstra today reached a settlement with the ACCC, including a proposed penalty of $50 million, in relation to unconscionable conduct involving five Te...

Excerpt: 108 Indigenous consumers

https://www.telstra.com.au/aboutus/...ation-for-108-vulnerable-indigenous-customers

Optus faces $100 millon fine over unlawful sales to vulnerable First Nations customers | SBS NITV

Cited text: The Australian Competition and Consumer Commission (ACCC) said many of the affected consumers were vulnerable or experiencing disadvantage, such as li...

Excerpt: Many of the affected consumers were vulnerable or experiencing disadvantage, such as living with a mental disability, or English not being a first language

https://www.sbs.com.au/nitv/article...-vulnerable-first-nations-customers/eo0vbl5kl

Optus faces $100M penalty over ‘unconscionable conduct’

Cited text: Many of those affected were vulnerable or experiencing disadvantage, the ACCC said, such as living with a mental disability, diminished cognitive capa...

Excerpt: Many of the affected consumers were vulnerable or experiencing disadvantage, such as living with a mental disability, or English not being a first language

https://www.arnnet.com.au/article/4008635/optus-faces-100m-penalty-over-unconscionable-conduct.html

Optus faces $100 millon fine over unlawful sales to vulnerable First Nations customers | SBS NITV

Cited text: Many of the consumers were First Nations Australians from regional, remote and very remote parts of Australia.

Excerpt: Many of the consumers were First Nations Australians from regional, remote and very remote parts of Australia

https://www.sbs.com.au/nitv/article...-vulnerable-first-nations-customers/eo0vbl5kl

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: failing to explain relevant terms and conditions to vulnerable consumers in a manner they could understand, resulting in them not understanding their ...

Excerpt: Staff input false information on credit checks

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: Commission-based sales arrangements for Optus’s sales staff had the potential to incentivise the inappropriate sales conduct, despite the Telecommunic...

Excerpt: Commission-based sales arrangements for Optus's sales staff had the potential to incentivise the inappropriate sales conduct

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct

Unconscionable Conduct—Optus agrees to $100m penalty—Piper Alderman

Cited text: Allegations included that Optus put undue pressure on some consumers to purchase the goods or services and that debt collectors were engaged to pursue...

Excerpt: staff fraudulently completed 82 contracts with 42 customers without consumer knowledge

https://piperalderman.com.au/insight/unconscionable-conduct-optus-agrees-to-100m-penalty/

Telstra faces $50m penalty for 'unconscionable conduct' - Telco/ISP—iTnews

Cited text: “For example, one consumer had a debt of over $19,000; another experienced extreme anxiety worrying they would go to jail if they didn’t pay; and yet ...

Excerpt: One consumer accumulated a debt of over $19,000

https://www.itnews.com.au/news/telstra-faces-50m-penalty-for-unconscionable-conduct-558266

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: They accrued thousands of dollars of unexpected debt and some were pursued by debt collectors, in some instances for years,” Ms Lowe said. “It is not ...

Excerpt: Many consumers experienced significant financial harm, accruing thousands of dollars of unexpected debt and being pursued by debt collectors, in some instances for years, causing significant emotional distress and fear

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: “It is not surprising, and indeed could and should have been anticipated, that this conduct caused many of these people significant emotional distress...

Excerpt: Optus engaged debt collectors to pursue some of these consumers after it had launched internal investigations into the sales conduct

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct

CN11—Unconscionable conduct case results in 50 million penalty under Australian Consumer Law

Cited text: From January 2016 to August 2018, staff at five Branded Stores sold Telstra post-paid mobile contracts to 108 Indigenous consumers who did not speak E...

Excerpt: 108 Indigenous consumers who did not speak English as a first language, had difficulties with literacy and financial concepts, and/or were unemployed and relied on government benefits

https://www.ashurst.com/en/insights...illion-penalty-under-australian-consumer-law/

Record penalty against Optus sends clear message to telco sector—Financial Counselling Australia

Cited text: The penalty sends a strong message to the telecommunications industry: mis-selling to vulnerable customers will not be tolerated. For some time, finan...

Excerpt: Financial Counselling Australia noted that the penalty sends a strong message to the telecommunications industry that mis-selling to vulnerable customers will not be tolerated, and that financial counsellors have been raising concerns…

https://www.financialcounsellingaus...st-optus-sends-clear-message-to-telco-sector/

Consumer rights and guarantees | ACCC

Cited text: Consumers automatically receive these consumer guarantees when they buy goods and services.

Excerpt: Consumers automatically receive consumer guarantees when they buy goods and services

https://www.accc.gov.au/consumers/buying-products-and-services/consumer-rights-and-guarantees

Consumer rights and guarantees | ACCC

Cited text: It is unlawful for businesses to mislead consumers about these rights.

Excerpt: it is unlawful for businesses to mislead consumers about these rights

https://www.accc.gov.au/consumers/buying-products-and-services/consumer-rights-and-guarantees

Mobile phone rights for consumers—phones | CHOICE

Cited text: In fact, under the 2012 Telecommunications Consumer Protections (TCP) Code and Australian Consumer Law (ACL), consumers have a bunch of them.

Excerpt: Under the 2012 Telecommunications Consumer Protections (TCP) Code and Australian Consumer Law (ACL), consumers have a bunch of rights

https://www.choice.com.au/electroni...es/mobile-phones/articles/mobile-phone-rights

Mobile phone rights for consumers—phones | CHOICE

Cited text: Read smartphones review · While telcos are allowed to charge you if you terminate your contract early, under the ACL you can cancel your contract earl...

Excerpt: The ability to cancel your contract early without penalty under certain circumstances

https://www.choice.com.au/electroni...es/mobile-phones/articles/mobile-phone-rights

Optus faces $100m penalty in sales tactics case—iTnews

Cited text: Impacted consumers can call an Optus specialist customer care team on 1300 082 820 for further information or support.

Excerpt: Impacted consumers can call an Optus specialist customer care team on 1300 082 820 for further information or support

https://www.itnews.com.au/news/optus-faces-100m-penalty-in-sales-tactics-case-617937

Mobile phone rights for consumers—phones | CHOICE

Cited text: You have the right to have your complaint resolved in a fair, efficient and courteous manner and at no cost (except for in select circumstances).

Excerpt: You have the right to have your complaint resolved in a fair, efficient and courteous manner and at no cost

https://www.choice.com.au/electroni...es/mobile-phones/articles/mobile-phone-rights

Action on telco consumer protections: January to March 2024 | ACMA

Cited text: On 1 February 2024, we made the Telecommunications (Financial Hardship) Industry Standard 2024. The standard commenced on 29 March 2024. The standard ...

Excerpt: In February 2024, the ACMA made the Telecommunications (Financial Hardship) Industry Standard 2024, which commenced on 29 March 2024 and was developed to improve safeguards for telco customers having financial difficulties

https://www.acma.gov.au/publication...telco-consumer-protections-january-march-2024

Optus cops $100m fine for ‘unconscionable’ acts | Information Age | ACS

Cited text: The planned Telecommunications Amendment (Enhancing Consumer Safeguards) Bill 2025 will further strengthen consumer and data protections, with fines f...

Excerpt: The planned Telecommunications Amendment (Enhancing Consumer Safeguards) Bill 2025 will further strengthen consumer and data protections, with fines for breaching industry codes, standards, and determinations increasing from $250,000 to…

https://ia.acs.org.au/article/2025/optus-cops--100m-fine-for--unconscionable--acts.html

Record penalty against Optus sends clear message to telco sector—Financial Counselling Australia

Cited text: The penalty sends a strong message to the telecommunications industry: mis-selling to vulnerable customers will not be tolerated.

Excerpt: The penalty sends a strong message to the telecommunications industry: mis-selling to vulnerable customers will not be tolerated

https://www.financialcounsellingaus...st-optus-sends-clear-message-to-telco-sector/

Record penalty against Optus sends clear message to telco sector—Financial Counselling Australia

Cited text: Self-regulation via the current Telecommunications Consumer Protections Code is clearly not working. The rules need to be tightened, oversight improve...

Excerpt: Financial Counselling Australia argues that self-regulation via the current Telecommunications Consumer Protections Code is clearly not working, and that rules need to be tightened, oversight improved, and enforcement strengthened to…

https://www.financialcounsellingaus...st-optus-sends-clear-message-to-telco-sector/

Optus agrees to $100m penalty, subject to court approval, for unconscionable conduct | ACCC

Cited text: It has begun compensating affected consumers.” · “We are grateful to the many advocates, financial counsellors and carers who assisted the impacted in...

Excerpt: The ACCC acknowledged being 'grateful to the many advocates, financial counsellors and carers who assisted the impacted individuals'

https://www.accc.gov.au/media-relea...-to-court-approval-for-unconscionable-conduct