Got Health insurance? Your Premiums Are Going Up Yet Again

Over 65? You could be paying a whopping $194 more* for the same health cover this year.

A health insurance rate rise of 2.90% is what Aussies are being slapped with during a cost-of-living crisis. We’ve seen mortgage rates increase, grocery prices spike, petrol prices peak, and now our health insurance premiums will be increasing by an average of 2.90%*.

From 1 April 2023, Australians over the age of 65 could be paying up to $167^ more per year for their health insurance and that’s just for those of you who are not with one of the ‘Big Five’ health insurers – think BUPA, Medibank, HCF, nib and HBF – if you are with one of the ‘Big Five’ you could be paying up to $194^ per year for the exact same cover you currently have.

But what if we told you that over the past 4 years we know 44,197 Australians over the age of 50 who have managed to save an average of $259.50 on their health insurance, just by comparing and switching their cover?^^

Here’s How You Do It:

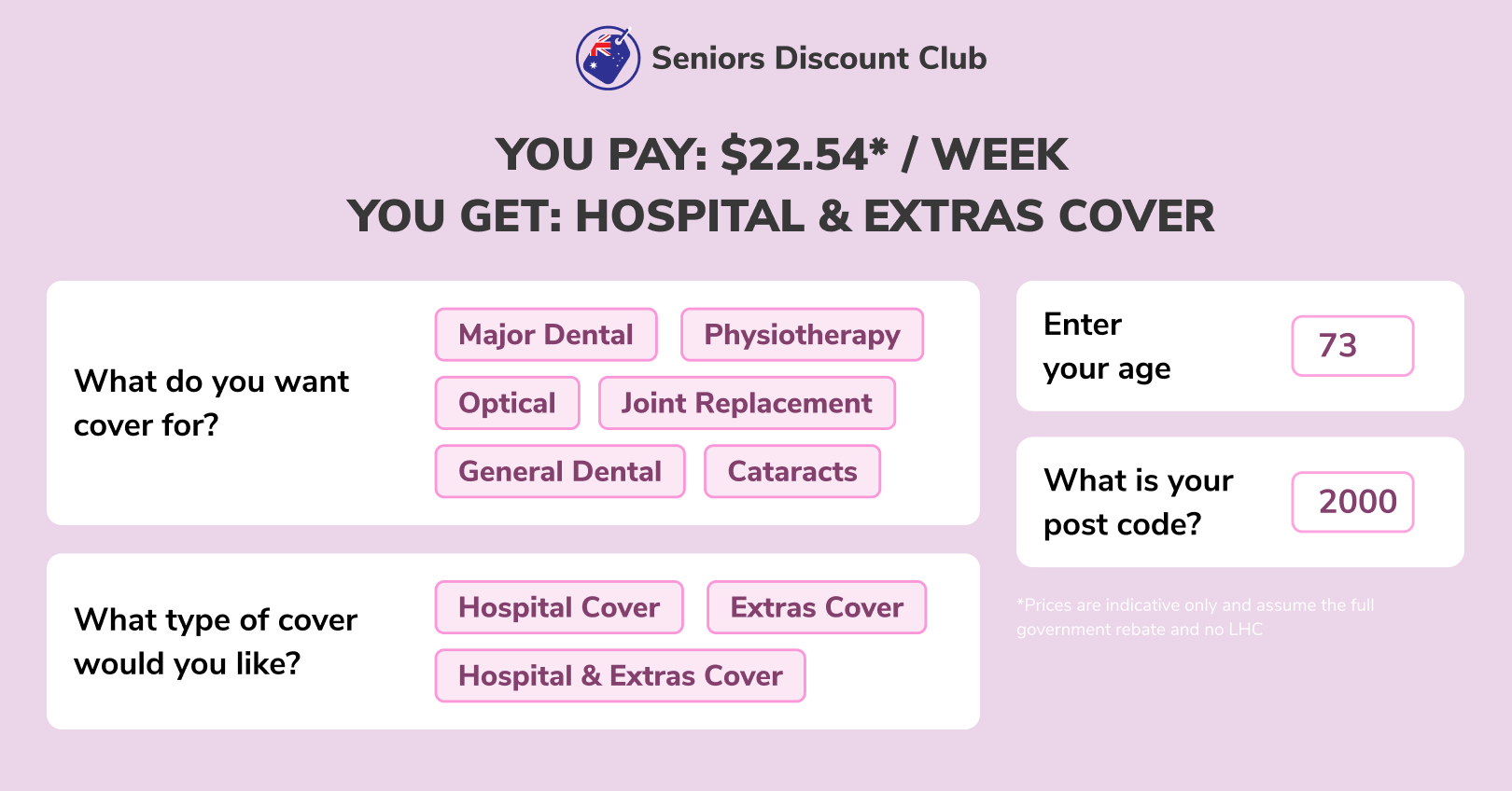

Step 1: Select your current life stage below.

Step 2: Once you select your preferred coverage options, you will have the opportunity to compare quotes from multiple health funds.

That’s right! 44,197 Australian’s over the age of 50 have managed to save $259.50^^ with our friends over at Compare Club. How? Well, Compare Club is helping Aussies find health insurance that is not only more affordable, but better suited to their needs. Aussies over the age of 60 are often left to fend for themselves unknowingly paying for cover they will never be able to use. We’ve seen Aussies in their 60s, 70s and even 80s paying for pregnancy and IVF cover, without even knowing it, and this should never be the case.

That’s one of the main reasons we’ve partnered with Compare Club. They can help older Aussies compare multiple health insurance brands, cover options and pricing all in one place. Their service can save you time, but the biggest benefit for most is how much money you can save off your yearly premiums, especially when health insurance premiums aren’t the only thing increasing in cost!

Get Started Now:

Step 1: Select your state below.

Step 2: After answering a few questions, you will have the opportunity to compare quotes in your area and could be eligible for significant savings.

When you work with our teams, you get the peace of mind that comes with working with trusted-professionals who have the years of experience needed to navigate the complicated health insurance system and keep you from any further confusion. For example, a lot of older Aussies worry about not being with ‘one of the big five’, when the reality is, there is no such thing as a ‘dodgy’ health fund in Australia, as the industry is heavily governed.

Our teams will make sure you have the health cover you need, while paying a price you’re comfortable with. We know there is more affordable health insurance on the market and our mission is to help as many Australians as possible get health insurance that is not only more affordable, but is better suited to their needs.

*2.90% is the official average annual premium increase across all Australian health insurers as announced by the Australian Government.

^Based on the average premium increase of 2.90% for an Australian couple aged over 65, and based on the average premium increase for the big 5 health funds of 3.38% for an Australian couple aged over 65.

^^Based on 44,197 Compare Club customers over the age of 50 who have compared and switched their health insurance over the past 4 years.